Forex Analysis & Reviews: Nvidia is a new player in the Dow: what will it affect and what should investors expect?

Wall Street Rebounds: Amazon Lifts Indices Amid Weak Jobs Data The major Wall Street indices closed higher on Friday, recovering from the previous day's sell-off as Amazon's strong earnings offset significant concerns over October's U.S. job growth slowdown. Amazon's Success Inspires the Market Amazon.com (AMZN.O) shares jumped 6.2% after the company reported strong retail sales and profits exceeding Wall Street forecasts. This growth provided a major boost for investors, easing the overall negative sentiment in the market. Apple Loses Ground Meanwhile, Apple (AAPL.O) slipped 1.2%, with investors worried about the company's declining sales in China in the last quarter. The dip in sales in its largest Asian market caused concern among shareholders, slightly dampening the market's overall enthusiasm. The "Magnificent Seven" and AI Infrastructure Impact Stocks of other members of the "Magnificent Seven" — like Meta Platforms and Microsoft (MSFT.O) — also came under pressure after the companies reported high expenses on artificial intelligence infrastructure. These costs negatively impacted the Nasdaq (.IXIC) index on Thursday, leading to a short-term dip. New Month, New Optimism "The start of a new month often brings fresh optimism among investors, especially after yesterday's drop and strong reports from Apple and Amazon," said Sam Stovall, Chief Investment Strategist at CFRA Research. This optimism appears to have helped the market overcome temporary slumps. Weak Employment Data Doesn't Alarm Investors Despite weak employment data, which showed only 12,000 jobs added in October (well below the forecast of 113,000), the market did not take this as a reason for panic. Market participants attribute the weak numbers to temporary factors, such as hurricanes and strikes, and remain confident in labor market stability, with the unemployment rate holding steady at 4.1%. Confidence in Rate Cuts: Investors Continue Betting on Fed's Move Published employment data did not dampen optimism, and investors remain confident that the Federal Reserve will lower interest rates by 25 basis points in November. This move is seen as a likely catalyst for maintaining positive market momentum. Q3 Prospects and Elections as Market Drivers "Key factors in the near term will be quarterly earnings, interest rates, and upcoming elections," noted Sam Stovall, CFRA Research's Chief Investment Strategist. In his view, these events will have a decisive impact on investor sentiment and index movement in the coming weeks. Indices End the Day Up, But the Week Was Rough Friday's trading showed a confident rise on Wall Street: the Dow Jones Industrial Average (.DJI) added 288.73 points, or 0.69%, closing at 42,052.19. The S&P 500 (.SPX) rose 23.35 points (0.41%) to 5,728.80, while the Nasdaq Composite (.IXIC) grew by 144.77 points, or 0.80%, reaching 18,239.92. However, the weekly results were less encouraging: the S&P 500 lost 1.38%, Nasdaq fell 1.51%, and the Dow declined 0.16%. U.S. Elections: Awaiting the Unknown The upcoming U.S. elections are drawing increasing attention from investors, who predict a tight presidential race. Uncertainty surrounding the possible outcome is adding further fluctuations to the market, especially considering that the Fed's meeting is scheduled for the day after the vote. This combination of political and economic factors raises pressing questions for market participants. Amazon and Intel's Success: Consumer Sector Hits a Peak Amazon's strong results boosted the consumer goods sector (.SPLRCD), which rose 2.4%, reaching a two-year high. Alongside Amazon, Intel (INTC.O) shares surged by 7.8% due to a better-than-expected revenue forecast. This led the semiconductor index (.SOX) up by 1%, signaling a stable interest in technology despite overall volatility. Chevron on the Rise: Profits and Production Lift Shares Chevron (CVX.N) shares rose 2.8% following the release of its quarterly report, which exceeded analyst expectations due to increased oil production volumes. The data showed strong company growth amid a volatile market, boosting investor interest in the energy sector.

News are provided by InstaForex.

Read more: https://ifxpr.com/4f9D3oh

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD and GBP/USD on November 5 – Technical Analysis

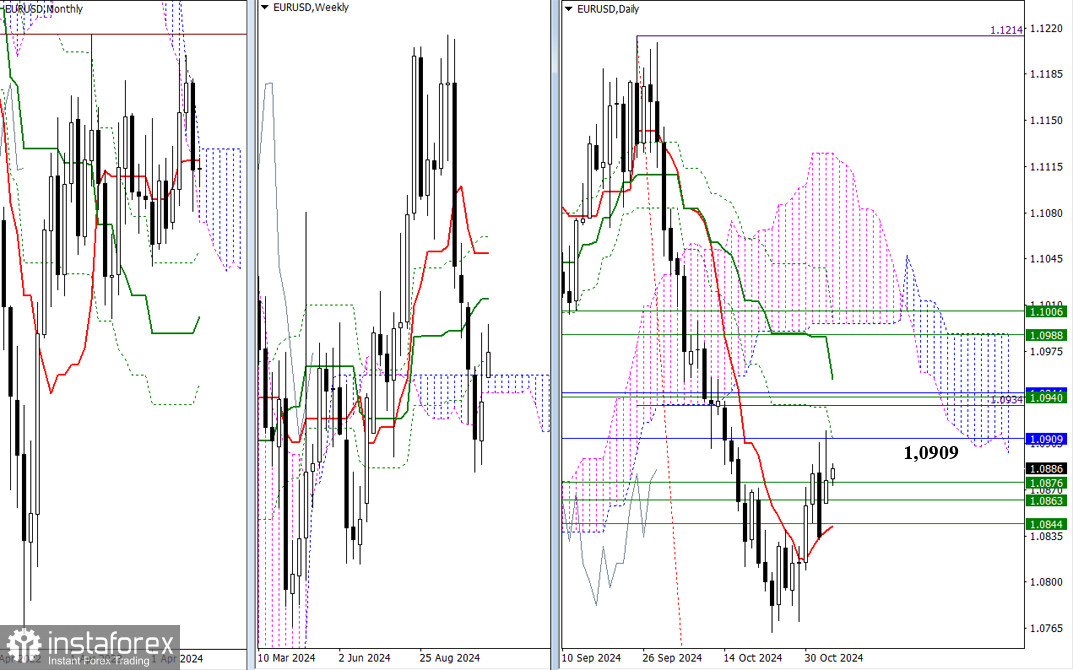

Higher Time Frames Yesterday, the monthly short-term trend resistance (1.0909) was tested. Despite the significant upward gap at the opening and the bulls' persistence, the outcome is recorded as a long upper shadow on the daily candle. It may take considerable effort from the bulls to overcome this monthly resistance (1.0909) and push into the bullish zone relative to the bearish monthly Ichimoku cloud (1.0943). The cluster of weekly levels (1.0876, 1.0863, 1.0844) and the daily short-term trend (1.0842) maintain a gravitational pull on the current development, providing some support for the bulls. For bears to assert their stance, they must break free from this zone and move significantly lower.

H4 – H1 The pair is in a corrective zone on the lower time frames, staying above the weekly long-term trend (1.0858), giving bulls the main advantage. Today's upward targets within the day are the classic Pivot resistance levels (1.0908, 1.0939, 1.0963) and the target for breaking through the H4 cloud (1.0921, 1.0939). Breaking and reversing the trend (1.0858) would create conditions to shift the current balance of power. The downward targets within the day are the classic Pivot support levels (1.0853, 1.0829, 1.0798).

GBP/USD

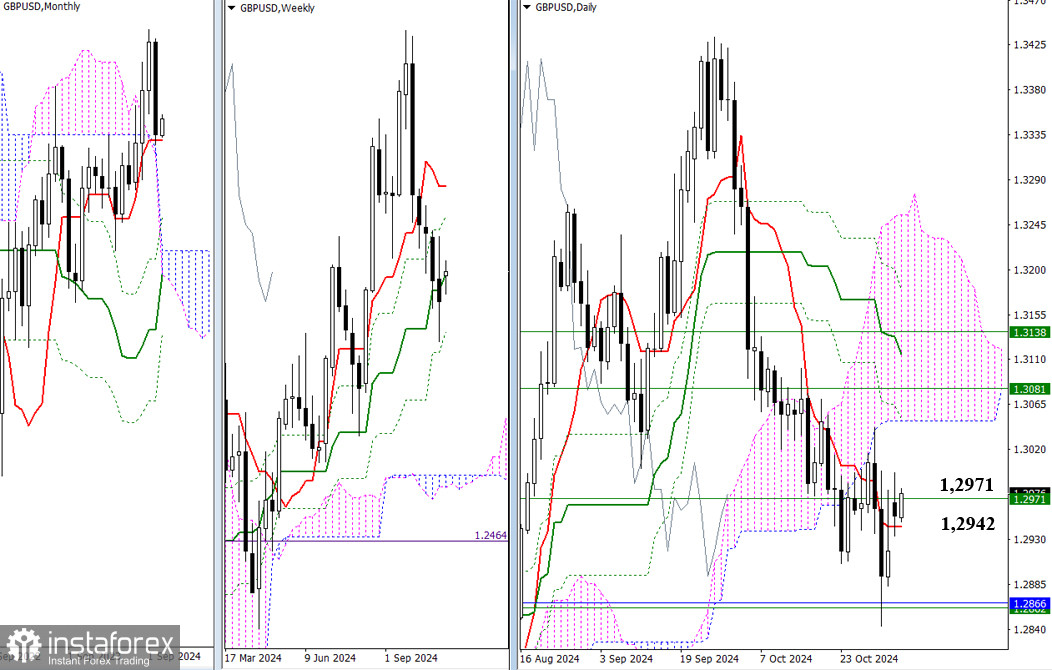

Higher Time Frames The upward gap pushed the pair into the influence of two key levels. The bulls found support from the daily short-term trend (1.2942), preventing the gap from closing, while the bears relied on the weekly medium-term trend resistance (1.2971), which halted the bulls from achieving higher targets. Today's development still depends on these two levels; whoever breaks through the opposing level will likely dictate the direction.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3NUkp83

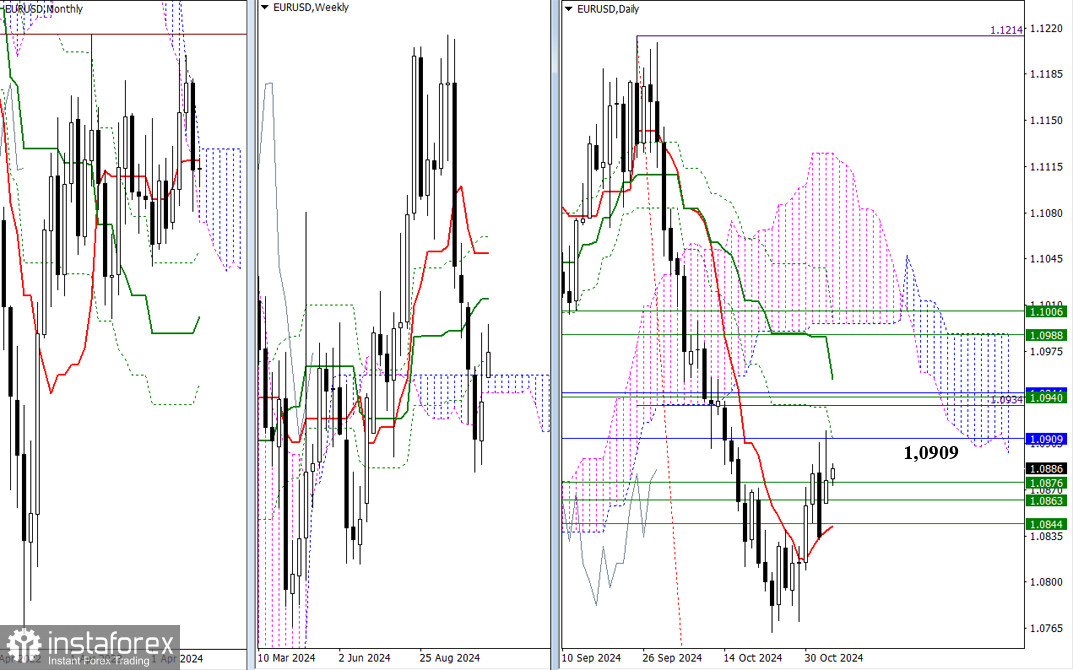

Higher Time Frames Yesterday, the monthly short-term trend resistance (1.0909) was tested. Despite the significant upward gap at the opening and the bulls' persistence, the outcome is recorded as a long upper shadow on the daily candle. It may take considerable effort from the bulls to overcome this monthly resistance (1.0909) and push into the bullish zone relative to the bearish monthly Ichimoku cloud (1.0943). The cluster of weekly levels (1.0876, 1.0863, 1.0844) and the daily short-term trend (1.0842) maintain a gravitational pull on the current development, providing some support for the bulls. For bears to assert their stance, they must break free from this zone and move significantly lower.

H4 – H1 The pair is in a corrective zone on the lower time frames, staying above the weekly long-term trend (1.0858), giving bulls the main advantage. Today's upward targets within the day are the classic Pivot resistance levels (1.0908, 1.0939, 1.0963) and the target for breaking through the H4 cloud (1.0921, 1.0939). Breaking and reversing the trend (1.0858) would create conditions to shift the current balance of power. The downward targets within the day are the classic Pivot support levels (1.0853, 1.0829, 1.0798).

GBP/USD

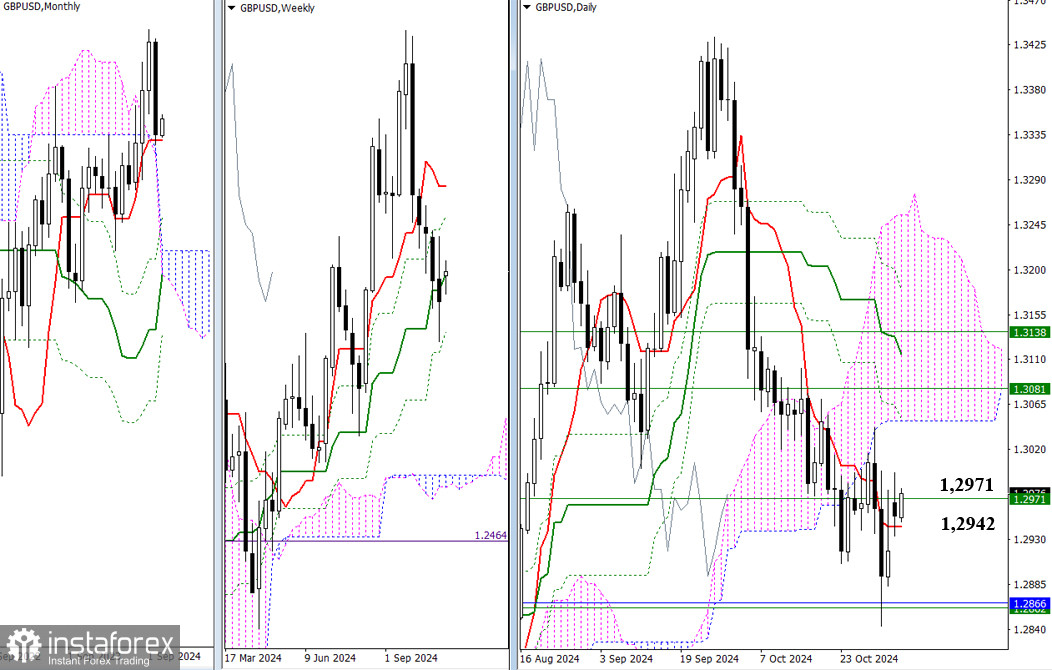

Higher Time Frames The upward gap pushed the pair into the influence of two key levels. The bulls found support from the daily short-term trend (1.2942), preventing the gap from closing, while the bears relied on the weekly medium-term trend resistance (1.2971), which halted the bulls from achieving higher targets. Today's development still depends on these two levels; whoever breaks through the opposing level will likely dictate the direction.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3NUkp83

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Markets in election grip: Dow, S&P fall, Nvidia climbs steadily

U.S. Stock Market Wrap-Up: Election Anticipation and Investor Anxiety U.S. stocks ended slightly down on Monday after a volatile trading session, with investors bracing for a decisive week as the nation prepares to choose its next president and the Federal Reserve gets set to release a key policy statement. Final Push: Trump vs. Harris In the final hours of the presidential race, candidates Donald Trump and Kamala Harris pulled out all the stops in an effort to secure crucial votes. Polls show a close race, and it may take several days to determine the winner. Trump Trades Lose Steam Some of the so-called "Trump trades" faced declines after recent polling showed Harris, a Democratic vice president, leading in Iowa. This led to a dip in the U.S. dollar, Treasury yields, and Bitcoin. Meanwhile, Trump Media & Technology Group (DJT.O) ended up with a 12.37% gain, recovering from early losses of nearly 6%. Harris's Odds Rise in Betting Markets Following the Iowa poll, Harris's odds against the former Republican president increased on several betting sites, which many market participants view as a predictor of election outcomes. "We'll need until at least Thursday to determine who won, so unfortunately, this week will likely be quite volatile," said Sam Stovall, chief investment strategist at CFRA Research in New York. "Earnings are doing well, the Fed will likely lower interest rates, and the only true uncertainty is the election. Hopefully, it will be resolved sooner rather than later, so investors can get back to business as usual," Stovall added. Wall Street Indices Struggle Amid Uncertainty On Monday, major U.S. stock indexes slid into the red. The Dow Jones Industrial Average (.DJI) fell by 257.59 points, or 0.61%, closing at 41,794.60. The S&P 500 (.SPX) also declined, losing 16.11 points, or 0.28%, to settle at 5,712.69. The Nasdaq Composite (.IXIC) joined the downtrend, shedding 59.93 points, or 0.33%, and ending at 18,179.98.

News are provided by InstaForex.

Read more: https://ifxpr.com/4fenLPa

U.S. Stock Market Wrap-Up: Election Anticipation and Investor Anxiety U.S. stocks ended slightly down on Monday after a volatile trading session, with investors bracing for a decisive week as the nation prepares to choose its next president and the Federal Reserve gets set to release a key policy statement. Final Push: Trump vs. Harris In the final hours of the presidential race, candidates Donald Trump and Kamala Harris pulled out all the stops in an effort to secure crucial votes. Polls show a close race, and it may take several days to determine the winner. Trump Trades Lose Steam Some of the so-called "Trump trades" faced declines after recent polling showed Harris, a Democratic vice president, leading in Iowa. This led to a dip in the U.S. dollar, Treasury yields, and Bitcoin. Meanwhile, Trump Media & Technology Group (DJT.O) ended up with a 12.37% gain, recovering from early losses of nearly 6%. Harris's Odds Rise in Betting Markets Following the Iowa poll, Harris's odds against the former Republican president increased on several betting sites, which many market participants view as a predictor of election outcomes. "We'll need until at least Thursday to determine who won, so unfortunately, this week will likely be quite volatile," said Sam Stovall, chief investment strategist at CFRA Research in New York. "Earnings are doing well, the Fed will likely lower interest rates, and the only true uncertainty is the election. Hopefully, it will be resolved sooner rather than later, so investors can get back to business as usual," Stovall added. Wall Street Indices Struggle Amid Uncertainty On Monday, major U.S. stock indexes slid into the red. The Dow Jones Industrial Average (.DJI) fell by 257.59 points, or 0.61%, closing at 41,794.60. The S&P 500 (.SPX) also declined, losing 16.11 points, or 0.28%, to settle at 5,712.69. The Nasdaq Composite (.IXIC) joined the downtrend, shedding 59.93 points, or 0.33%, and ending at 18,179.98.

News are provided by InstaForex.

Read more: https://ifxpr.com/4fenLPa

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: AUD/USD: What Does Trump's Victory Mean for the Australian Dollar?

Today, the AUD/USD pair dropped to a multi-month low amid a rally in the US dollar triggered by Trump's victory.

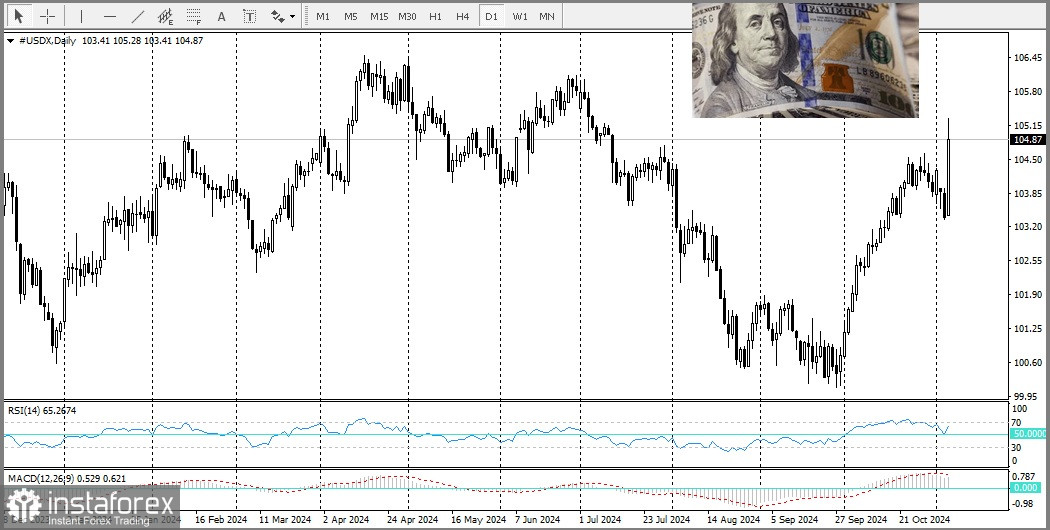

The sharp intraday decline of over 130 points was driven by strong demand for the US dollar. The USD index surged to a four-month high after exit polls from the US presidential election indicated that Republican candidate Donald Trump was leading the race. Additionally, Republicans are expected to secure a majority in the House of Representatives. In addition to these factors, Trump's presidency raises concerns about the introduction of new tariffs and a potential trade war with China, further pressuring the Australian dollar. Concerns about deficit spending and expectations of less aggressive Federal Reserve rate cuts are driving US Treasury yields higher. This has strengthened the US dollar and added further pressure on the AUD/USD pair. However, the risk-on sentiment, as evidenced by the sharp rise in US stock futures, has led to some profit-taking on the US dollar. Furthermore, the hawkish stance of the Reserve Bank of Australia (RBA) and signs that China's large-scale stimulus measures are boosting business activity are limiting losses for the Australian dollar, prompting intraday short-covering in the AUD/USD pair. Still, there is no certainty that current spot prices can build momentum or that the attempted recovery will be seen as more than a selling opportunity, given the prevailing bullish sentiment for the US dollar. Therefore, it would be prudent to wait for strong follow-through buying before confirming that the AUD/USD pair has formed a short-term bottom. This cautious outlook is supported by daily chart oscillators, which remain in negative territory, reinforcing the bearish forecast for now.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4fButP2

Today, the AUD/USD pair dropped to a multi-month low amid a rally in the US dollar triggered by Trump's victory.

The sharp intraday decline of over 130 points was driven by strong demand for the US dollar. The USD index surged to a four-month high after exit polls from the US presidential election indicated that Republican candidate Donald Trump was leading the race. Additionally, Republicans are expected to secure a majority in the House of Representatives. In addition to these factors, Trump's presidency raises concerns about the introduction of new tariffs and a potential trade war with China, further pressuring the Australian dollar. Concerns about deficit spending and expectations of less aggressive Federal Reserve rate cuts are driving US Treasury yields higher. This has strengthened the US dollar and added further pressure on the AUD/USD pair. However, the risk-on sentiment, as evidenced by the sharp rise in US stock futures, has led to some profit-taking on the US dollar. Furthermore, the hawkish stance of the Reserve Bank of Australia (RBA) and signs that China's large-scale stimulus measures are boosting business activity are limiting losses for the Australian dollar, prompting intraday short-covering in the AUD/USD pair. Still, there is no certainty that current spot prices can build momentum or that the attempted recovery will be seen as more than a selling opportunity, given the prevailing bullish sentiment for the US dollar. Therefore, it would be prudent to wait for strong follow-through buying before confirming that the AUD/USD pair has formed a short-term bottom. This cautious outlook is supported by daily chart oscillators, which remain in negative territory, reinforcing the bearish forecast for now.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4fButP2

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Election Day Markets: Trump Bets, Palantir Rise Add Intrigue

U.S. Stocks Soar: Economy Shows Strength Amid Pre-Election Frenzy U.S. stock markets showed a strong upward trend on Tuesday, propelled by a widespread rally following data indicating steady economic health. Investors, however, are preparing for possible fluctuations this week as the heated presidential election in the U.S. gets underway and results remain uncertain. Service Sector Exceeds Expectations According to a report from the Institute for Supply Management, the U.S. services sector PMI rose to 56.0 in October, marking its highest level since August 2022. This was an increase from 54.9 the previous month and exceeded economists' forecast of 53.8. These figures have bolstered investor confidence that the economy can withstand challenges despite the uncertainty. Rising Odds in the Presidential Race The intense race between former president Donald Trump and Democrat Kamala Harris remains highly contested. Polls indicate the outcome is still too close to predict with certainty. Betting markets, however, saw Trump's odds improve slightly, a trend many investors see as a possible pre-election indicator. Congress in Focus for Investors "The market is carefully evaluating possible election scenarios," commented Rob Haworth, senior investment strategist at U.S. Bank Wealth Management. He emphasized that both stock and bond markets are closely watching the outcome of congressional races. The prevailing forecast leans toward a divided government, but with such a close election, the outcome could go any way. With such unpredictable prospects, the coming week promises to be one of the most volatile for the market this year. U.S. Indices Hit New Highs: Markets on the Rise, but Volatility Ahead Indices on Wall Street continued their upward trend, reaching new highs on Tuesday. The S&P 500 gained 70.42 points (+1.23%), closing at 5,783.11. Tech-heavy Nasdaq Composite climbed by 259.19 points (+1.43%) to 18,439.17, while the Dow Jones ended the session with an increase of 431.42 points (+1.04%), reaching 42,227.74.

News are provided by InstaForex.

Read more: https://ifxpr.com/3NVhbRK

U.S. Stocks Soar: Economy Shows Strength Amid Pre-Election Frenzy U.S. stock markets showed a strong upward trend on Tuesday, propelled by a widespread rally following data indicating steady economic health. Investors, however, are preparing for possible fluctuations this week as the heated presidential election in the U.S. gets underway and results remain uncertain. Service Sector Exceeds Expectations According to a report from the Institute for Supply Management, the U.S. services sector PMI rose to 56.0 in October, marking its highest level since August 2022. This was an increase from 54.9 the previous month and exceeded economists' forecast of 53.8. These figures have bolstered investor confidence that the economy can withstand challenges despite the uncertainty. Rising Odds in the Presidential Race The intense race between former president Donald Trump and Democrat Kamala Harris remains highly contested. Polls indicate the outcome is still too close to predict with certainty. Betting markets, however, saw Trump's odds improve slightly, a trend many investors see as a possible pre-election indicator. Congress in Focus for Investors "The market is carefully evaluating possible election scenarios," commented Rob Haworth, senior investment strategist at U.S. Bank Wealth Management. He emphasized that both stock and bond markets are closely watching the outcome of congressional races. The prevailing forecast leans toward a divided government, but with such a close election, the outcome could go any way. With such unpredictable prospects, the coming week promises to be one of the most volatile for the market this year. U.S. Indices Hit New Highs: Markets on the Rise, but Volatility Ahead Indices on Wall Street continued their upward trend, reaching new highs on Tuesday. The S&P 500 gained 70.42 points (+1.23%), closing at 5,783.11. Tech-heavy Nasdaq Composite climbed by 259.19 points (+1.43%) to 18,439.17, while the Dow Jones ended the session with an increase of 431.42 points (+1.04%), reaching 42,227.74.

News are provided by InstaForex.

Read more: https://ifxpr.com/3NVhbRK

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on November 7, 2024

Donald Trump achieved such a decisive victory that this time, the election avoided the scandals that marred the vote four years ago. Additionally, Republicans secured a majority in the Senate. While vote counting for the House of Representatives continues, they are also clearly leading there. It seems that the Republican Party will gain control of the White House and both chambers of Congress. This translates to higher tariffs, increased U.S. protectionism, and more aggressive demands for higher defense spending for Europe. Given the fragile state of the eurozone economy, these developments could exacerbate its problems. Moreover, the situation worsened because of the collapse of the ruling coalition in Germany, prompting Olaf Scholz to discuss early elections. Currently, opposition parties are highly skeptical of the European Union, and NATO may not achieve a majority in the Bundestag, but they are likely to strengthen their positions. The future government will have to take their stance into account. All these factors contribute to a lack of optimism for the euro, which will likely remain under pressure. For now, political factors are expected to outweigh economic ones.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3AyHt9p

Donald Trump achieved such a decisive victory that this time, the election avoided the scandals that marred the vote four years ago. Additionally, Republicans secured a majority in the Senate. While vote counting for the House of Representatives continues, they are also clearly leading there. It seems that the Republican Party will gain control of the White House and both chambers of Congress. This translates to higher tariffs, increased U.S. protectionism, and more aggressive demands for higher defense spending for Europe. Given the fragile state of the eurozone economy, these developments could exacerbate its problems. Moreover, the situation worsened because of the collapse of the ruling coalition in Germany, prompting Olaf Scholz to discuss early elections. Currently, opposition parties are highly skeptical of the European Union, and NATO may not achieve a majority in the Bundestag, but they are likely to strengthen their positions. The future government will have to take their stance into account. All these factors contribute to a lack of optimism for the euro, which will likely remain under pressure. For now, political factors are expected to outweigh economic ones.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3AyHt9p

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Trump 2.0 - Markets Explode: Dow, S&P, Nasdaq Hit Record Highs!

Trump Back in the White House: Record Growth on Wall Street On Wednesday, U.S. stock indexes showed a sharp rise, reaching record levels, after Donald Trump won the 2024 U.S. presidential election in a sensational victory. Four years after leaving the political arena, he returned, surprising many analysts and investors. Strong Start: Dow, S&P 500, and Nasdaq Reach New Highs The Dow Jones, S&P 500, and Nasdaq Composite indices ended the day at historic highs. Investors responded enthusiastically to the prospect of tax cuts and possible deregulation, anticipating that the new president will continue to express his views on a wide range of issues, from the dollar's exchange rate to the state of the stock market. However, increases in import tariffs, which Trump may initiate, raise concerns about inflation and budget deficits. "Trump Trades" in Action: Bond Yields and Record Bitcoin Investor optimism led to higher yields on U.S. government bonds, with the base yield on 10-year treasury bonds reaching a four-month high at 4.479%. Bitcoin also saw record highs, exceeding the $76,000 mark. The dollar also showed significant growth, recording its largest single-day percentage gain since September 2022. Investors' Forecasts and Expectations "Investors seem to have been adjusting their portfolios to capture some of the risk exposure in anticipation of an outcome that seemed unlikely," said Mark Luschini, Chief Investment Strategist at Janney Montgomery Scott in Philadelphia.

News are provided by InstaForex.

Read more: https://ifxpr.com/40BeV9P

Trump Back in the White House: Record Growth on Wall Street On Wednesday, U.S. stock indexes showed a sharp rise, reaching record levels, after Donald Trump won the 2024 U.S. presidential election in a sensational victory. Four years after leaving the political arena, he returned, surprising many analysts and investors. Strong Start: Dow, S&P 500, and Nasdaq Reach New Highs The Dow Jones, S&P 500, and Nasdaq Composite indices ended the day at historic highs. Investors responded enthusiastically to the prospect of tax cuts and possible deregulation, anticipating that the new president will continue to express his views on a wide range of issues, from the dollar's exchange rate to the state of the stock market. However, increases in import tariffs, which Trump may initiate, raise concerns about inflation and budget deficits. "Trump Trades" in Action: Bond Yields and Record Bitcoin Investor optimism led to higher yields on U.S. government bonds, with the base yield on 10-year treasury bonds reaching a four-month high at 4.479%. Bitcoin also saw record highs, exceeding the $76,000 mark. The dollar also showed significant growth, recording its largest single-day percentage gain since September 2022. Investors' Forecasts and Expectations "Investors seem to have been adjusting their portfolios to capture some of the risk exposure in anticipation of an outcome that seemed unlikely," said Mark Luschini, Chief Investment Strategist at Janney Montgomery Scott in Philadelphia.

News are provided by InstaForex.

Read more: https://ifxpr.com/40BeV9P

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on November 8, 2024

It can be confidently stated that the Federal Reserve's decision to lower its refinancing rate from 5.00% to 4.75% contributed to the weakening of the U.S. dollar. However, this was likely just a trigger for a rebound following the dollar's significant surge, driven by the results of the U.S. elections. The market was already anticipating such a decision from the Federal Open Market Committee (FOMC). What carries more weight is the subsequent press conference, during which Fed Chair Jerome Powell hinted at the possibility of maintaining interest rates at their current level in December. The prevailing expectation had been that rates would be reduced again this year, bringing them down to 4.50%. However, Powell's comments suggest that this outlook could change depending on labor market dynamics. While there are concerns about the labor market, the Fed may still need to continue easing its monetary policy. Nevertheless, the mere possibility of a pause in rate cuts was not previously considered. Thus, the outcomes of yesterday's meeting have added another factor supporting the dollar's long-term strength. In other words, yesterday's dollar's weakness should be considered a temporary rebound.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/48H6uvG

It can be confidently stated that the Federal Reserve's decision to lower its refinancing rate from 5.00% to 4.75% contributed to the weakening of the U.S. dollar. However, this was likely just a trigger for a rebound following the dollar's significant surge, driven by the results of the U.S. elections. The market was already anticipating such a decision from the Federal Open Market Committee (FOMC). What carries more weight is the subsequent press conference, during which Fed Chair Jerome Powell hinted at the possibility of maintaining interest rates at their current level in December. The prevailing expectation had been that rates would be reduced again this year, bringing them down to 4.50%. However, Powell's comments suggest that this outlook could change depending on labor market dynamics. While there are concerns about the labor market, the Fed may still need to continue easing its monetary policy. Nevertheless, the mere possibility of a pause in rate cuts was not previously considered. Thus, the outcomes of yesterday's meeting have added another factor supporting the dollar's long-term strength. In other words, yesterday's dollar's weakness should be considered a temporary rebound.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/48H6uvG

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Political instability, rate cuts and Nvidia's record: what's happening in the market?

US markets end the day higher amid Fed rate cuts US stock markets ended trading on Thursday with a confident rise, helped by the Federal Reserve's decision to cut interest rates by a quarter of a percentage point (25 bps). This development strengthened the positive trend that began after Donald Trump returned to the US presidency. Fed Cuts Rate as Labor Market Weakens, Inflation Nears Target The Federal Reserve has decided to cut rates by 0.25%, citing signs of weakness in the labor market and a gradual move in inflation toward the central bank's 2% target. Markets had largely expected the move, almost entirely factoring the rate cut into their forecasts for the November meeting. Investors are now watching closely for any follow-up comments from Fed officials that could shed light on the future direction of monetary policy. Hopes for Economic Growth Push Indexes Higher Expectations of a return to corporate tax cuts and Trump-led regulatory easing have fueled investor optimism, sending key stock indexes higher. The Dow Industrials and S&P 500 posted their biggest one-day gains in two years last trading session, while the Nasdaq was not far behind, continuing to move in the green. Expert Comment: "Rate Cut Keeps Caps Level, But Eases Them" "The Fed has kept the drama out of this eventful period," said Brian Jacobsen, chief economist at Annex Wealth Management in Wisconsin. "A quarter-percentage point cut leaves the federal funds rate still in cap territory, but it's not as tight as it used to be." He said Trump's return to the presidency could bring a modest improvement in growth, but it would also likely lead to higher inflation. "The Fed will likely have to cut rates at a more cautious pace," Jacobsen concluded.

News are provided by InstaForex.

Read more: https://ifxpr.com/3YIogtM

US markets end the day higher amid Fed rate cuts US stock markets ended trading on Thursday with a confident rise, helped by the Federal Reserve's decision to cut interest rates by a quarter of a percentage point (25 bps). This development strengthened the positive trend that began after Donald Trump returned to the US presidency. Fed Cuts Rate as Labor Market Weakens, Inflation Nears Target The Federal Reserve has decided to cut rates by 0.25%, citing signs of weakness in the labor market and a gradual move in inflation toward the central bank's 2% target. Markets had largely expected the move, almost entirely factoring the rate cut into their forecasts for the November meeting. Investors are now watching closely for any follow-up comments from Fed officials that could shed light on the future direction of monetary policy. Hopes for Economic Growth Push Indexes Higher Expectations of a return to corporate tax cuts and Trump-led regulatory easing have fueled investor optimism, sending key stock indexes higher. The Dow Industrials and S&P 500 posted their biggest one-day gains in two years last trading session, while the Nasdaq was not far behind, continuing to move in the green. Expert Comment: "Rate Cut Keeps Caps Level, But Eases Them" "The Fed has kept the drama out of this eventful period," said Brian Jacobsen, chief economist at Annex Wealth Management in Wisconsin. "A quarter-percentage point cut leaves the federal funds rate still in cap territory, but it's not as tight as it used to be." He said Trump's return to the presidency could bring a modest improvement in growth, but it would also likely lead to higher inflation. "The Fed will likely have to cut rates at a more cautious pace," Jacobsen concluded.

News are provided by InstaForex.

Read more: https://ifxpr.com/3YIogtM

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on November 11, 2024

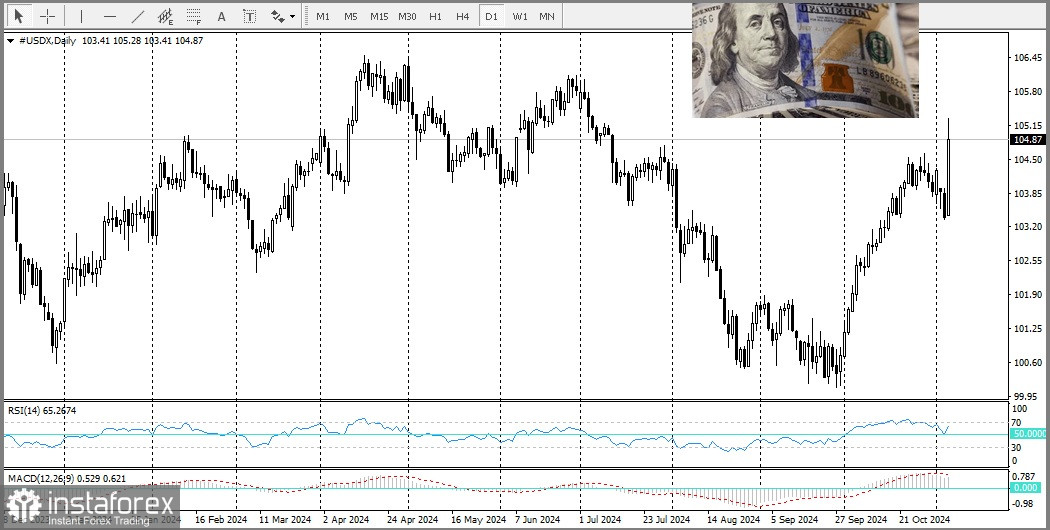

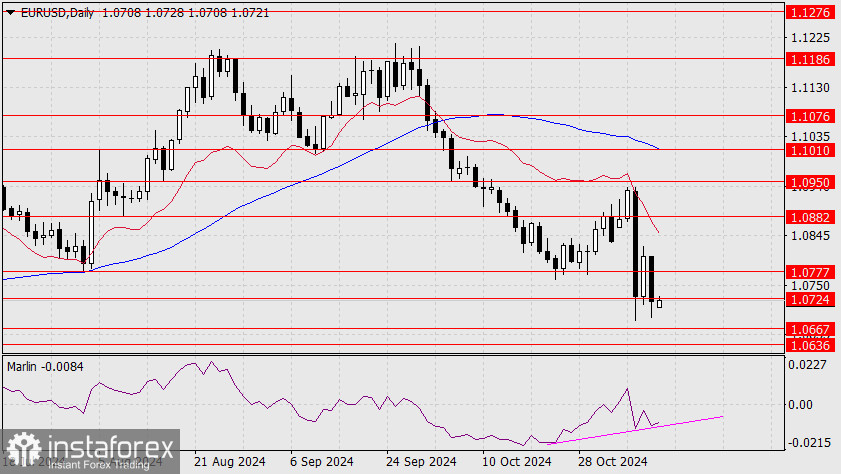

The price has repeatedly pierced the 1.0724 support level on the daily chart but has failed to consolidate below it. A divergence has formed with the Marlin oscillator in its attempts to reach the target level of 1.0667

The price might rise above the 1.0777 level again, even if the upward momentum does not fully develop. Overall, the trend remains bearish, as price movement is occurring below the indicator lines, and Marlin is still undecided about crossing into positive territory.

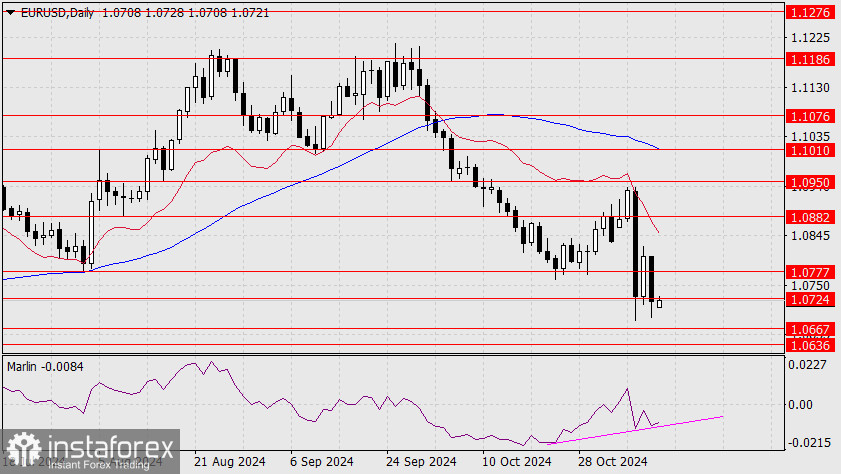

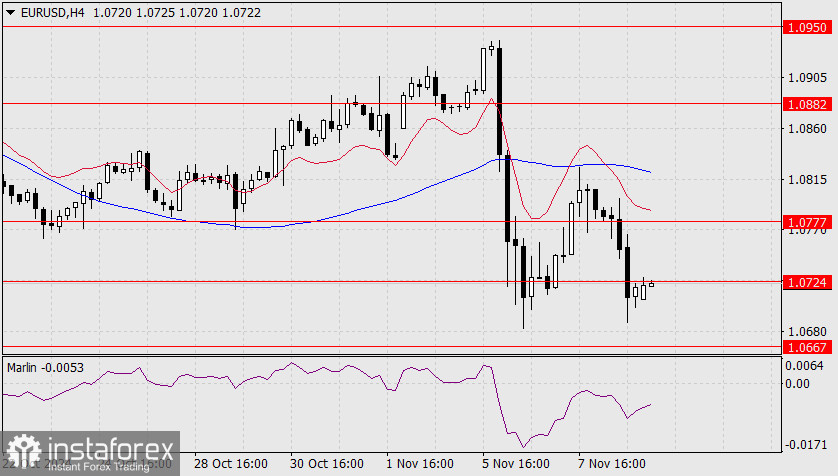

On the four-hour chart, the price has successfully consolidated below 1.0724. Now, it remains to be seen whether the price will reclaim this level and attempt to rise toward 1.0777. If the price shows no such intention, the target support at 1.0667 will likely be reached. The next target would be 1.0636, the May 31, 2023 low.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4fJ7d1U

The price has repeatedly pierced the 1.0724 support level on the daily chart but has failed to consolidate below it. A divergence has formed with the Marlin oscillator in its attempts to reach the target level of 1.0667

The price might rise above the 1.0777 level again, even if the upward momentum does not fully develop. Overall, the trend remains bearish, as price movement is occurring below the indicator lines, and Marlin is still undecided about crossing into positive territory.

On the four-hour chart, the price has successfully consolidated below 1.0724. Now, it remains to be seen whether the price will reclaim this level and attempt to rise toward 1.0777. If the price shows no such intention, the target support at 1.0667 will likely be reached. The next target would be 1.0636, the May 31, 2023 low.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4fJ7d1U

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am