Forex Analysis & Reviews: Hot Forecast for EUR/USD on 10.10.2024

The dollar continues its triumphant march, even amid talks that the Federal Reserve might lower interest rates by fifty basis points again. Today's release of inflation data in the United States fueled these discussions. The growth rate of consumer prices will likely slow from 2.5% to 2.3%, bringing it closer to the target level of 2.0%. However, despite the confident slowdown in inflation, it is doubtful that the Federal Open Market Committee (FOMC) will lower the refinancing rate by fifty basis points at its next meeting. After all, inflation is just one of the key indicators. Another is the labor market. Based on recent data, unemployment has once again declined, which supports the case for maintaining higher interest rates. It's clear that the U.S. central bank won't tighten its monetary policy further, but a large-scale easing is also not on the table. Nonetheless, the dollar is overbought, and the market needs at least a local correction. Thus, a slowdown in inflation could be an excellent reason for a correction.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3YjjwvY

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: Alphabet Slips, Boeing Loses Heights: Indexes Ignore Crisis

Wall Street Rises: S&P 500 and Dow Set New Records US stock indexes showed solid gains on Wednesday, with the S&P 500 and Dow Jones hitting new all-time highs. The market was positively influenced by the minutes of the latest US Federal Reserve meeting, as well as expectations for September inflation data and the upcoming earnings season of large corporations. Google under pressure as lawsuits continue Investor interest focused on shares of tech giant Alphabet, Google's parent company, which showed volatility during the day. The company's shares ended trading down 1.5% after the US Department of Justice announced that it might require the business to be broken up. The agency is considering filing a lawsuit to force the sale of some Google assets, such as the Chrome web browser and the Android operating system, in order to reduce the company's monopoly in the online search industry. The Fed remained cautiously optimistic The published minutes of the Fed's September meeting shed light on the discussions among regulators. Most members of the committee supported the idea of cutting the interest rate by 0.5%. However, it was ultimately agreed that such a decision would not mean a commitment to any specific pace of further rate cuts. Market expectations: rate cut or maintaining current conditions? According to the FedWatch analytical platform from CME Group, traders currently estimate the probability of a 25 basis point rate cut at 79%. At the same time, the probability that the Fed will decide to keep the current rate level is 21%. This scenario confirms the cautious mood of investors and their expectations regarding the regulator's future actions. "The minutes confirmed our expectations and calmed the markets. There was discussion of a more aggressive rate cut of 50 basis points, but apparently there was no consensus, and the Fed did not take such a step," commented Lindsay Bell, chief strategist at the investment company 248 Ventures in Charlotte, North Carolina.

News are provided by InstaForex.

Read more: https://ifxpr.com/4extBuK

Wall Street Rises: S&P 500 and Dow Set New Records US stock indexes showed solid gains on Wednesday, with the S&P 500 and Dow Jones hitting new all-time highs. The market was positively influenced by the minutes of the latest US Federal Reserve meeting, as well as expectations for September inflation data and the upcoming earnings season of large corporations. Google under pressure as lawsuits continue Investor interest focused on shares of tech giant Alphabet, Google's parent company, which showed volatility during the day. The company's shares ended trading down 1.5% after the US Department of Justice announced that it might require the business to be broken up. The agency is considering filing a lawsuit to force the sale of some Google assets, such as the Chrome web browser and the Android operating system, in order to reduce the company's monopoly in the online search industry. The Fed remained cautiously optimistic The published minutes of the Fed's September meeting shed light on the discussions among regulators. Most members of the committee supported the idea of cutting the interest rate by 0.5%. However, it was ultimately agreed that such a decision would not mean a commitment to any specific pace of further rate cuts. Market expectations: rate cut or maintaining current conditions? According to the FedWatch analytical platform from CME Group, traders currently estimate the probability of a 25 basis point rate cut at 79%. At the same time, the probability that the Fed will decide to keep the current rate level is 21%. This scenario confirms the cautious mood of investors and their expectations regarding the regulator's future actions. "The minutes confirmed our expectations and calmed the markets. There was discussion of a more aggressive rate cut of 50 basis points, but apparently there was no consensus, and the Fed did not take such a step," commented Lindsay Bell, chief strategist at the investment company 248 Ventures in Charlotte, North Carolina.

News are provided by InstaForex.

Read more: https://ifxpr.com/4extBuK

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on October 11, 2024

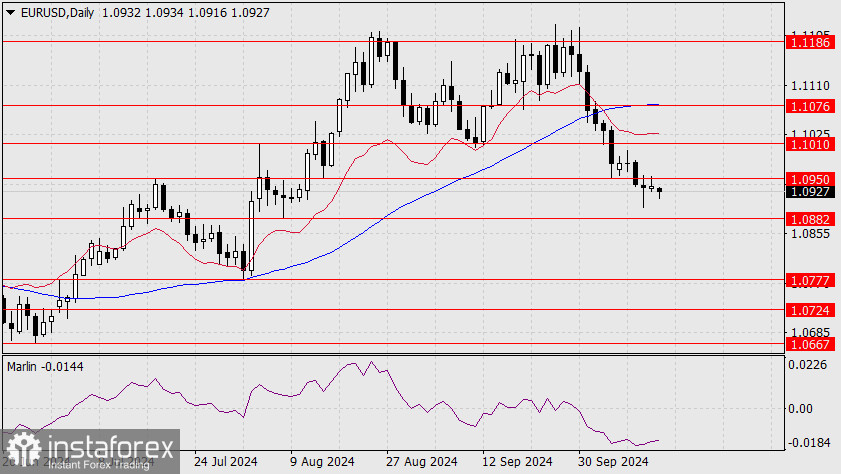

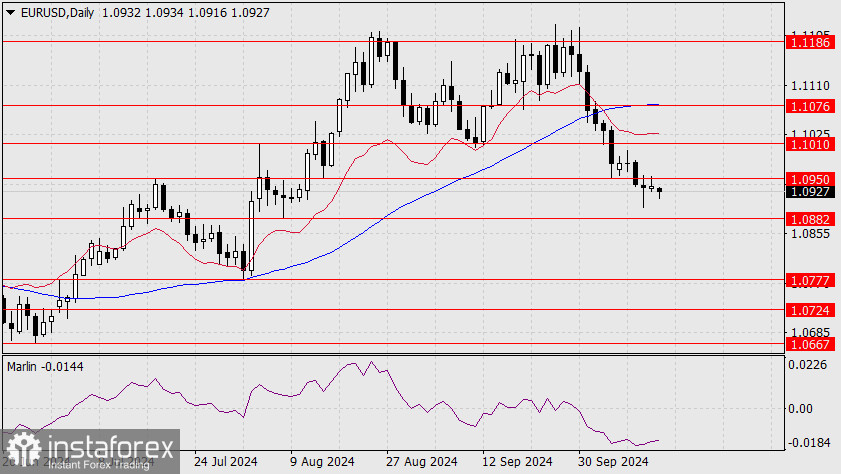

Yesterday's moderately pessimistic news from the U.S. unsettled the euro, causing it to fluctuate within a daily range of 55 points and close the day with a loss of only 4 points. The number of unemployment benefit claimants increased by 42,000 over the week, casting doubts on the strong employment data from last Friday. The core CPI rose in September from 3.2% to 3.3% year-on-year, while the overall CPI fell from 2.5% to 2.4%, against an expectation of 2.3%. Naturally, the potential ECB rate cut next week is also adding pressure. However, the dollar's balance remains uncertain due to tensions in the Middle East and the simultaneous easing of monetary policy by both the ECB and the Federal Reserve. Considering the ongoing strong growth in the stock and commodity markets, the euro could potentially begin to strengthen ahead of the ECB meeting, as it seeks this balance. Since the start of the week, the euro has only declined by 38 points, clearly indicating its reluctance to fall further.

On the daily chart, the price has consolidated below the 1.0950 level. The long lower shadow indicates that another attempt to reach 1.0882 is unlikely. Even if the euro is declining from the 1.1185 level, this entire movement appears as indecisive trading driven by geopolitical factors. It is likely to end with the price breaking above the 1.1010 level. A breakthrough above 1.1076, along with the MACD line, would signal the euro's return to medium-term growth.

On the four-hour chart, the price's convergence with the oscillator has evolved. The Marlin oscillator is in positive territory but has not yet exited the consolidation range. The reversal is still in progress. Here, the price needs to break above the 1.1010 level to also overcome the resistance of the MACD line. We continue to wait.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3ZUzH3Y

Yesterday's moderately pessimistic news from the U.S. unsettled the euro, causing it to fluctuate within a daily range of 55 points and close the day with a loss of only 4 points. The number of unemployment benefit claimants increased by 42,000 over the week, casting doubts on the strong employment data from last Friday. The core CPI rose in September from 3.2% to 3.3% year-on-year, while the overall CPI fell from 2.5% to 2.4%, against an expectation of 2.3%. Naturally, the potential ECB rate cut next week is also adding pressure. However, the dollar's balance remains uncertain due to tensions in the Middle East and the simultaneous easing of monetary policy by both the ECB and the Federal Reserve. Considering the ongoing strong growth in the stock and commodity markets, the euro could potentially begin to strengthen ahead of the ECB meeting, as it seeks this balance. Since the start of the week, the euro has only declined by 38 points, clearly indicating its reluctance to fall further.

On the daily chart, the price has consolidated below the 1.0950 level. The long lower shadow indicates that another attempt to reach 1.0882 is unlikely. Even if the euro is declining from the 1.1185 level, this entire movement appears as indecisive trading driven by geopolitical factors. It is likely to end with the price breaking above the 1.1010 level. A breakthrough above 1.1076, along with the MACD line, would signal the euro's return to medium-term growth.

On the four-hour chart, the price's convergence with the oscillator has evolved. The Marlin oscillator is in positive territory but has not yet exited the consolidation range. The reversal is still in progress. Here, the price needs to break above the 1.1010 level to also overcome the resistance of the MACD line. We continue to wait.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3ZUzH3Y

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: The reporting season is not far off: what will banks show against the backdrop of unemployment and an unstable market?

Inflation: expectations are surpassed According to the latest data, the consumer price index (CPI) in September increased by 0.2% compared to the previous month and by 2.4% in annual terms. Both indicators slightly ahead of the forecasts of analysts, which indicates the preservation of inflationary pressure. The main index was most attention, which eliminates fluctuations in food and energy products: in the annual calculus, its growth was 3.3%, which also exceeded the expected 3.2%. Unemployment benefits: Alarm Another important factor that determined the mood in the market was the report on applications for unemployment benefits. During the week, which ended on October 5, the number of new applications increased to 258 thousand, significantly exceeding the forecast of 230 thousand. This was a bell for those who carefully monitor the state of the labor market and its influence on the US economy. "Investors were in a difficult situation: on the one hand, the inflation report indicates its higher pace than expected, on the other hand, unemployment data indicate a slowdown in the economy," Jack Ablin, chief investment director of Cresset Capital, commented on the situation. "The combination of these factors creates an unfavorable picture - this is the worst of the possible scenarios." FRS bets: Where will the scales swing? The publication of new economic data instantly reflected in the expectations of traders about the actions of the federal reserve system (Fed). According to the latest data from CME FedWatch, the probability of reducing the rate by 25 basic points in November increased to 80%. At the same time, the chance that the regulator will leave the bets unchanged is about 20%. Such uncertainty enhances pressure on the market and causes fluctuations among the participants. The result of the trade day was a decrease in the main indices, which reflects the general mood of investors who turned out to be between conflicting economic signals.

News are provided by InstaForex.

Read more: https://ifxpr.com/3zXWjpz

Inflation: expectations are surpassed According to the latest data, the consumer price index (CPI) in September increased by 0.2% compared to the previous month and by 2.4% in annual terms. Both indicators slightly ahead of the forecasts of analysts, which indicates the preservation of inflationary pressure. The main index was most attention, which eliminates fluctuations in food and energy products: in the annual calculus, its growth was 3.3%, which also exceeded the expected 3.2%. Unemployment benefits: Alarm Another important factor that determined the mood in the market was the report on applications for unemployment benefits. During the week, which ended on October 5, the number of new applications increased to 258 thousand, significantly exceeding the forecast of 230 thousand. This was a bell for those who carefully monitor the state of the labor market and its influence on the US economy. "Investors were in a difficult situation: on the one hand, the inflation report indicates its higher pace than expected, on the other hand, unemployment data indicate a slowdown in the economy," Jack Ablin, chief investment director of Cresset Capital, commented on the situation. "The combination of these factors creates an unfavorable picture - this is the worst of the possible scenarios." FRS bets: Where will the scales swing? The publication of new economic data instantly reflected in the expectations of traders about the actions of the federal reserve system (Fed). According to the latest data from CME FedWatch, the probability of reducing the rate by 25 basic points in November increased to 80%. At the same time, the chance that the regulator will leave the bets unchanged is about 20%. Such uncertainty enhances pressure on the market and causes fluctuations among the participants. The result of the trade day was a decrease in the main indices, which reflects the general mood of investors who turned out to be between conflicting economic signals.

News are provided by InstaForex.

Read more: https://ifxpr.com/3zXWjpz

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD Forecast for October 14, 2024

The new economic measures announced by the Chinese government on Saturday did not meet investors' expectations. Essentially, it was only a statement of intent, with plans for gradual implementation, especially in the real estate sector and local governments. Nevertheless, Asian markets are up today, continuing Friday's optimism (S&P 500 up by 0.61%).

Tomorrow, data on industrial production in the Eurozone (1.8% for August) and ZEW indices, which are also expected to show strong growth dynamics, will be released. We expect the price to break above the 1.0950 resistance level.

On the four-hour chart, the signal line of the Marlin oscillator is fluctuating near the zero line, and the price is under pressure from the indicator lines. The price needs to consolidate above the 1.0950 level before encountering the MACD line; otherwise, the euro could decline below 1.0882.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4flDU5l

The new economic measures announced by the Chinese government on Saturday did not meet investors' expectations. Essentially, it was only a statement of intent, with plans for gradual implementation, especially in the real estate sector and local governments. Nevertheless, Asian markets are up today, continuing Friday's optimism (S&P 500 up by 0.61%).

Tomorrow, data on industrial production in the Eurozone (1.8% for August) and ZEW indices, which are also expected to show strong growth dynamics, will be released. We expect the price to break above the 1.0950 resistance level.

On the four-hour chart, the signal line of the Marlin oscillator is fluctuating near the zero line, and the price is under pressure from the indicator lines. The price needs to consolidate above the 1.0950 level before encountering the MACD line; otherwise, the euro could decline below 1.0882.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4flDU5l

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: JPMorgan, Wells Fargo Profits Blast Indexes: S&P 500, Dow Hit New Highs

Financials Light Up Market: S&P 500 and Dow Set Records The S&P 500 and Dow Jones set new records on Friday as financial stocks surged. Strong quarterly earnings from major banks drove a significant jump, while fresh inflation data only fueled expectations that the Federal Reserve could cut rates as early as November. Banks Lead the Way The earnings season has started off strong, with JPMorgan Chase ending the day up 4.4%, thanks to third-quarter results that beat analysts' expectations. Moreover, the bank raised its full-year interest income forecast, which did not go unnoticed by investors. Wells Fargo is also not far behind, with its shares rising 5.6% after reporting earnings that also beat market expectations. BlackRock, meanwhile, added 3.6% to its value, as its assets under management reached a record high for the third quarter in a row. Financials on the Rise The success of major players has pushed the entire financial sector up, with the S&P 500 Financials Index leading the gains among all sectors of the S&P 500 Index. This creates a positive backdrop for the entire market. "We're seeing strong results from the major financials, which sets an optimistic tone for the earnings season," said Evan Brown, portfolio manager and head of multi-asset strategy at UBS Asset Management. Signs of a soft landing for the economy Experts say strong financials could signal that the economy is heading for a so-called "soft landing," where growth continues despite inflationary pressures. "When financials post strong results, it's a positive sign for the economy as a whole," Brown added, noting that it could herald strong earnings from other industries in the coming weeks. Strong gains: Dow Jones, S&P 500, Nasdaq continue to rally The major U.S. indexes ended the day with significant gains on Friday, bolstering investor confidence in the stability of the market. The Dow Jones Industrial Average rose 409.74 points, or 0.97%, to 42,863.86. The S&P 500 added 34.98 points, or 0.61%, to 5,815.03. The Nasdaq Composite also rose 60.89 points, or 0.33%, to close at 18,342.94.

News are provided by InstaForex.

Read more: https://ifxpr.com/3BC9iO7

Financials Light Up Market: S&P 500 and Dow Set Records The S&P 500 and Dow Jones set new records on Friday as financial stocks surged. Strong quarterly earnings from major banks drove a significant jump, while fresh inflation data only fueled expectations that the Federal Reserve could cut rates as early as November. Banks Lead the Way The earnings season has started off strong, with JPMorgan Chase ending the day up 4.4%, thanks to third-quarter results that beat analysts' expectations. Moreover, the bank raised its full-year interest income forecast, which did not go unnoticed by investors. Wells Fargo is also not far behind, with its shares rising 5.6% after reporting earnings that also beat market expectations. BlackRock, meanwhile, added 3.6% to its value, as its assets under management reached a record high for the third quarter in a row. Financials on the Rise The success of major players has pushed the entire financial sector up, with the S&P 500 Financials Index leading the gains among all sectors of the S&P 500 Index. This creates a positive backdrop for the entire market. "We're seeing strong results from the major financials, which sets an optimistic tone for the earnings season," said Evan Brown, portfolio manager and head of multi-asset strategy at UBS Asset Management. Signs of a soft landing for the economy Experts say strong financials could signal that the economy is heading for a so-called "soft landing," where growth continues despite inflationary pressures. "When financials post strong results, it's a positive sign for the economy as a whole," Brown added, noting that it could herald strong earnings from other industries in the coming weeks. Strong gains: Dow Jones, S&P 500, Nasdaq continue to rally The major U.S. indexes ended the day with significant gains on Friday, bolstering investor confidence in the stability of the market. The Dow Jones Industrial Average rose 409.74 points, or 0.97%, to 42,863.86. The S&P 500 added 34.98 points, or 0.61%, to 5,815.03. The Nasdaq Composite also rose 60.89 points, or 0.33%, to close at 18,342.94.

News are provided by InstaForex.

Read more: https://ifxpr.com/3BC9iO7

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD Forecast for October 15, 2024

The euro stubbornly refuses to reverse direction. Even yesterday's 0.77% rise in the stock market, which set a new all-time high, did not halt the euro's decline. The euro is close to consolidating below the 1.0882 level and collapsing to 1.0777. If this happens, the long-term reversal to a downtrend would have already begun with a turn from 1.1186 in a dull and uneventful manner, without triggering the liquidation of large sell orders (reportedly the largest volumes since April).

This scenario became highly probable this morning due to the proximity of the price to the key level. Additionally, the S&P 500 reached its anticipated reversal target, and oil prices dropped by 3.45% yesterday. Now, we doubt the euro will find the strength, or investors' will, to support the single currency against the ECB's rate cut. If the euro does rise, it is unlikely to go above 1.1010, with the best-case scenario being a move to 1.1076 for a retest of the MACD line. Today, European industrial production data and ZEW business sentiment indexes might provide some support for the euro

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/408Aaj1

The euro stubbornly refuses to reverse direction. Even yesterday's 0.77% rise in the stock market, which set a new all-time high, did not halt the euro's decline. The euro is close to consolidating below the 1.0882 level and collapsing to 1.0777. If this happens, the long-term reversal to a downtrend would have already begun with a turn from 1.1186 in a dull and uneventful manner, without triggering the liquidation of large sell orders (reportedly the largest volumes since April).

This scenario became highly probable this morning due to the proximity of the price to the key level. Additionally, the S&P 500 reached its anticipated reversal target, and oil prices dropped by 3.45% yesterday. Now, we doubt the euro will find the strength, or investors' will, to support the single currency against the ECB's rate cut. If the euro does rise, it is unlikely to go above 1.1010, with the best-case scenario being a move to 1.1076 for a retest of the MACD line. Today, European industrial production data and ZEW business sentiment indexes might provide some support for the euro

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/408Aaj1

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Dow Breaks 43K, Nvidia Breaks Records, Caterpillar Suffers Losses – What's Next?

Wall Street Continues Its Upward Trend: Dow and S&P 500 Hit New Records Monday's trading session on Wall Street ended with a confident rise in key indices, including the S&P 500 and Dow Jones, which reached historical highs. The main driver — investor interest in tech giants ahead of the upcoming corporate earnings reports and important economic data. Light Trading Volume Due to the Holiday Despite fairly calm trading activity due to the bond markets being closed for a federal holiday, 9.55 billion shares were traded. In comparison, the average volume for the past 20 days was 12.05 billion shares. Yet, even with reduced trading volumes, Wall Street maintained the upward momentum that began on Friday when the largest U.S. banks kicked off the third-quarter earnings season on a positive note. Dow Surpasses 43,000 Points for the First Time Amid this optimism, the Dow Jones Industrial Average surpassed the 43,000-point mark for the first time in history. This growth is fueled by expectations of corporate earnings: 41 companies from the S&P 500 are expected to release their results this week. These figures will help investors assess the current state of the U.S. economy and determine whether corporations can continue to justify the high valuations of the stock market. Tech Giants Lead the Market The primary contribution to the rise of the indices on Monday came from tech companies, especially in the semiconductor sector. The semiconductor index (.SOX) rose by 1.8%, reaching a two-month high. Notably, Arm Holdings' shares gained 6.8%, and Nvidia (NVDA.O) closed up 2.4%, hitting a record closing price. These companies became growth leaders, pulling the market along with them.

News are provided by InstaForex.

Read more: https://ifxpr.com/4893FmT

Wall Street Continues Its Upward Trend: Dow and S&P 500 Hit New Records Monday's trading session on Wall Street ended with a confident rise in key indices, including the S&P 500 and Dow Jones, which reached historical highs. The main driver — investor interest in tech giants ahead of the upcoming corporate earnings reports and important economic data. Light Trading Volume Due to the Holiday Despite fairly calm trading activity due to the bond markets being closed for a federal holiday, 9.55 billion shares were traded. In comparison, the average volume for the past 20 days was 12.05 billion shares. Yet, even with reduced trading volumes, Wall Street maintained the upward momentum that began on Friday when the largest U.S. banks kicked off the third-quarter earnings season on a positive note. Dow Surpasses 43,000 Points for the First Time Amid this optimism, the Dow Jones Industrial Average surpassed the 43,000-point mark for the first time in history. This growth is fueled by expectations of corporate earnings: 41 companies from the S&P 500 are expected to release their results this week. These figures will help investors assess the current state of the U.S. economy and determine whether corporations can continue to justify the high valuations of the stock market. Tech Giants Lead the Market The primary contribution to the rise of the indices on Monday came from tech companies, especially in the semiconductor sector. The semiconductor index (.SOX) rose by 1.8%, reaching a two-month high. Notably, Arm Holdings' shares gained 6.8%, and Nvidia (NVDA.O) closed up 2.4%, hitting a record closing price. These companies became growth leaders, pulling the market along with them.

News are provided by InstaForex.

Read more: https://ifxpr.com/4893FmT

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast on EUR/USD from 16.10.2024

It was initially expected that the rate of decline in industrial production in the eurozone would slow from -2.2% to -1.0%, but the decline was replaced by growth of 0.1%. Moreover, previous data was revised upward to -2.1%. The situation in the eurozone's industrial sector was much better than anticipated. Nevertheless, no correction occurred in the currency market. The dollar continued to rise, although the scale of its growth was merely symbolic. The market's behavior seems strange unless we consider the upcoming ECB board meeting. A month and a half ago, the ECB cut the refinancing rate from 4.25% to 3.65%, and after such a significant easing of monetary policy, everyone was confident that interest rates would remain unchanged for the rest of the year. However, at the beginning of this week, rumors started circulating that the ECB might cut the refinancing rate by another 25 basis points—possibly as soon as this Thursday. This is particularly suggested by inflation, which continues to decline steadily. And indeed, on Thursday, the final inflation data will be published, which should confirm this assumption. Thus, the strong industrial production data supported the euro, preventing it from weakening further. Today, the macroeconomic calendar is nearly empty, and the market will likely consolidate around current levels. Ahead of significant events such as the ECB board meeting and the release of inflation data in the eurozone, few will be willing to take major risks.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3A1KmiC

It was initially expected that the rate of decline in industrial production in the eurozone would slow from -2.2% to -1.0%, but the decline was replaced by growth of 0.1%. Moreover, previous data was revised upward to -2.1%. The situation in the eurozone's industrial sector was much better than anticipated. Nevertheless, no correction occurred in the currency market. The dollar continued to rise, although the scale of its growth was merely symbolic. The market's behavior seems strange unless we consider the upcoming ECB board meeting. A month and a half ago, the ECB cut the refinancing rate from 4.25% to 3.65%, and after such a significant easing of monetary policy, everyone was confident that interest rates would remain unchanged for the rest of the year. However, at the beginning of this week, rumors started circulating that the ECB might cut the refinancing rate by another 25 basis points—possibly as soon as this Thursday. This is particularly suggested by inflation, which continues to decline steadily. And indeed, on Thursday, the final inflation data will be published, which should confirm this assumption. Thus, the strong industrial production data supported the euro, preventing it from weakening further. Today, the macroeconomic calendar is nearly empty, and the market will likely consolidate around current levels. Ahead of significant events such as the ECB board meeting and the release of inflation data in the eurozone, few will be willing to take major risks.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3A1KmiC

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Semiconductors Under Attack: Nvidia and ASML Drag Market, Walgreens Takes Lead

Wall Street Ends in the Red: Nasdaq Leads Losers The major U.S. stock market indexes ended the day lower on Tuesday. The tech-heavy Nasdaq was the biggest loser, losing 1% as chip-related stocks declined. Meanwhile, the energy sector also fell, this time by 3%, amid lower oil prices. Mixed Reports, UnitedHealth Shares Sink Quarterly earnings reports were mixed, prompting mixed reactions from investors. While some companies posted positive results, UnitedHealth shares slumped 8% after outlook for 2025 was below Wall Street expectations. Nvidia Under Pressure: Chip Market in Red Zone The Nasdaq was under intense pressure, mainly due to a sharp drop in shares of Nvidia, the largest maker of chips for artificial intelligence. The company's shares fell 4.7% after hitting a record high the day before. The decline was driven by speculation that the Biden administration could impose new restrictions on the export of U.S. AI chips. Chip Market Pessimism: ASML Shares Plunge Chip makers also suffered a sharp sell-off after disappointing data from hardware maker ASML Holdings. The company issued disappointing sales guidance for 2025, sending its shares down 16%. That, in turn, weighed on the Philadelphia Semiconductor Index, which lost 5.3% in a day, its biggest drop since September. The mixed earnings and heightened regulatory risks weighed on investor sentiment, which was reflected in Wall Street's leading indexes. Energy Sector Plunges: Record Drop Since October The energy sector index (.SPNY) posted its biggest single-day drop, falling 3%, its biggest since early October 2023. The key factor was the news that Israel has no plans to attack Iranian oil facilities, which eased concerns about possible supply disruptions and, accordingly, lowered commodity prices.

News are provided by InstaForex.

Read more: https://ifxpr.com/405Eu2o

Wall Street Ends in the Red: Nasdaq Leads Losers The major U.S. stock market indexes ended the day lower on Tuesday. The tech-heavy Nasdaq was the biggest loser, losing 1% as chip-related stocks declined. Meanwhile, the energy sector also fell, this time by 3%, amid lower oil prices. Mixed Reports, UnitedHealth Shares Sink Quarterly earnings reports were mixed, prompting mixed reactions from investors. While some companies posted positive results, UnitedHealth shares slumped 8% after outlook for 2025 was below Wall Street expectations. Nvidia Under Pressure: Chip Market in Red Zone The Nasdaq was under intense pressure, mainly due to a sharp drop in shares of Nvidia, the largest maker of chips for artificial intelligence. The company's shares fell 4.7% after hitting a record high the day before. The decline was driven by speculation that the Biden administration could impose new restrictions on the export of U.S. AI chips. Chip Market Pessimism: ASML Shares Plunge Chip makers also suffered a sharp sell-off after disappointing data from hardware maker ASML Holdings. The company issued disappointing sales guidance for 2025, sending its shares down 16%. That, in turn, weighed on the Philadelphia Semiconductor Index, which lost 5.3% in a day, its biggest drop since September. The mixed earnings and heightened regulatory risks weighed on investor sentiment, which was reflected in Wall Street's leading indexes. Energy Sector Plunges: Record Drop Since October The energy sector index (.SPNY) posted its biggest single-day drop, falling 3%, its biggest since early October 2023. The key factor was the news that Israel has no plans to attack Iranian oil facilities, which eased concerns about possible supply disruptions and, accordingly, lowered commodity prices.

News are provided by InstaForex.

Read more: https://ifxpr.com/405Eu2o

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am