Forex Analysis & Reviews: EUR/USD. June 24th. Friday remained for the bears, but the bulls went on the attack on Monday

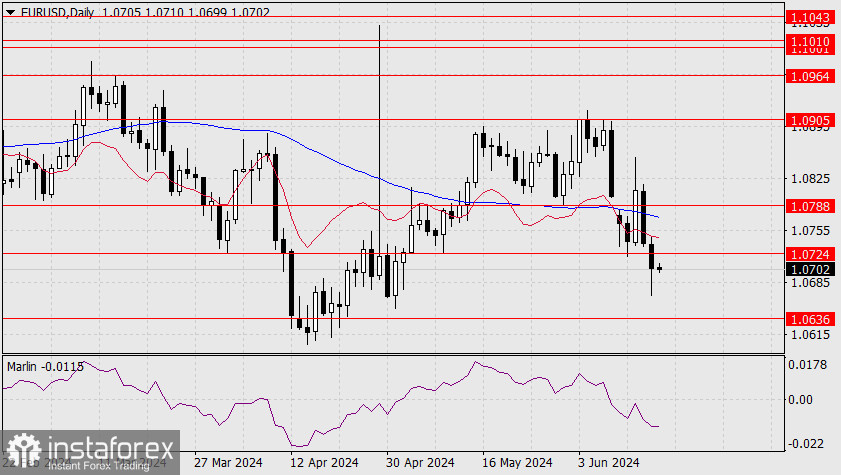

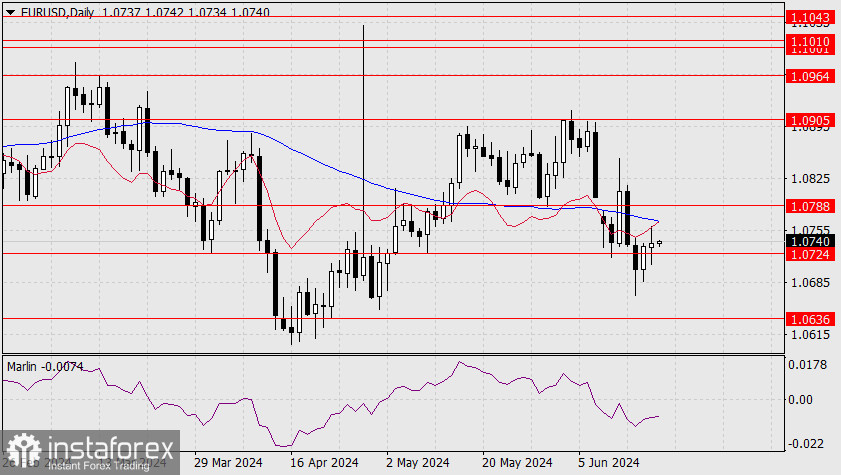

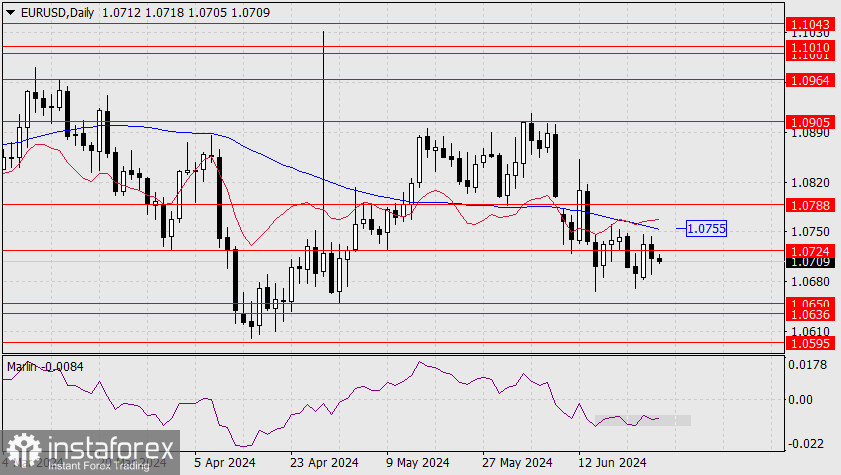

The EUR/USD pair on Friday made a reversal in favor of the US dollar around the corrective level of 61.8%-1.0722, and dropped to the Fibonacci level of 76.4%-1.0676. Such a movement was expected. The rebound of the pair from the level of 1.0676 already worked in favor of the European currency and started to rise towards the level of 1.0722. A rebound today from this level will return the pair into "bearish hands" with a potential drop back to 1.0676. Firming above the level of 1.0722 will increase the probability of further growth towards the next corrective level of 50.0%-1.0760.

The wave situation remains clear. The last completed upward wave turned out to be very weak and failed to break the peak of the previous wave. The last downward wave (which may still need to be completed) also failed to break the low of the previous wave. Thus, the "bearish" trend persists, but in the near future, the first sign of a trend change to "bullish" may appear. This sign will be a breakthrough of the peak of the last upward wave from June 18th. If this does not happen, I will expect a return to the level of 1.0676. The information background on Friday influenced traders' sentiment, but I cannot say it was strong. Business activity indices in the European Union and Germany turned out to be weaker than traders' expectations, which led to selling the pair in the first half of the day. American business activity indices were slightly better than forecast, but bears failed to overcome the level of 1.0676, so the decline did not continue. The combination of graphical and information analysis worked quite well on Friday. The further prospects of the EUR/USD pair depend more on graphical analysis, as the information background this week will be relatively weak.

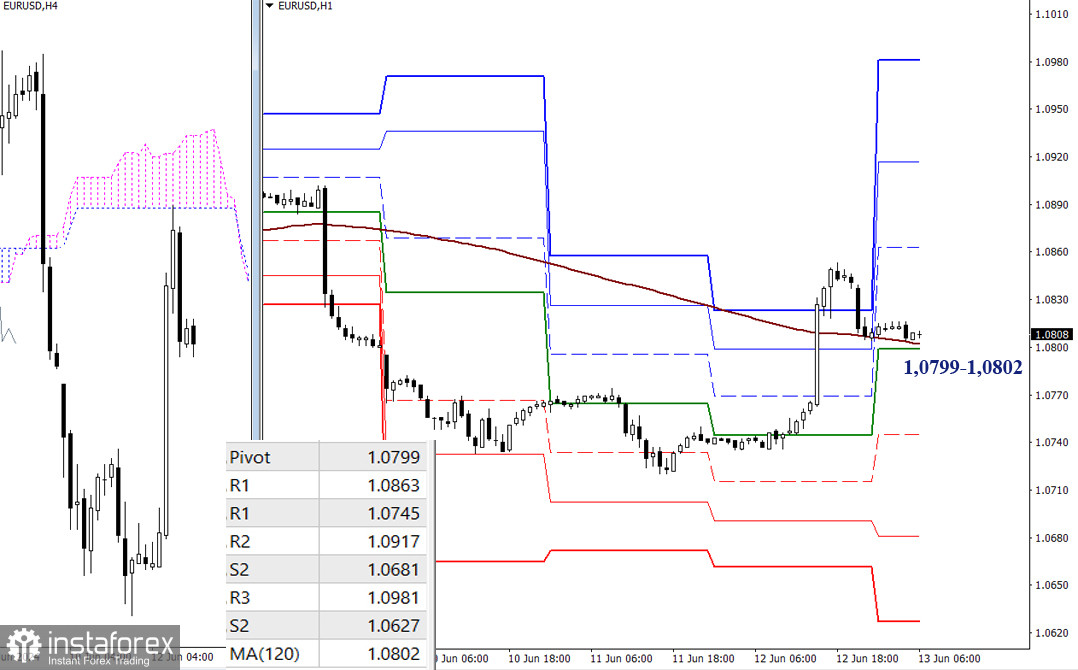

On the 4-hour chart, the pair has made a new reversal in favor of the euro after forming a "bullish" divergence on the CCI indicator. The quotes have retraced to the Fibonacci level of 61.8%-1.0714, but I still do not believe in a long-term rise of the euro. Last week, on the 4-hour chart, there was a close below the trend line, which changed traders' sentiment to "bearish". Therefore, I expect a small (in strength) correction now, followed by a resumption of the "bearish" trend. I recommend using levels from the hourly chart at the moment.

Analysis are provided by InstaForex.

Read more:

https://ifxpr.com/4czkg42