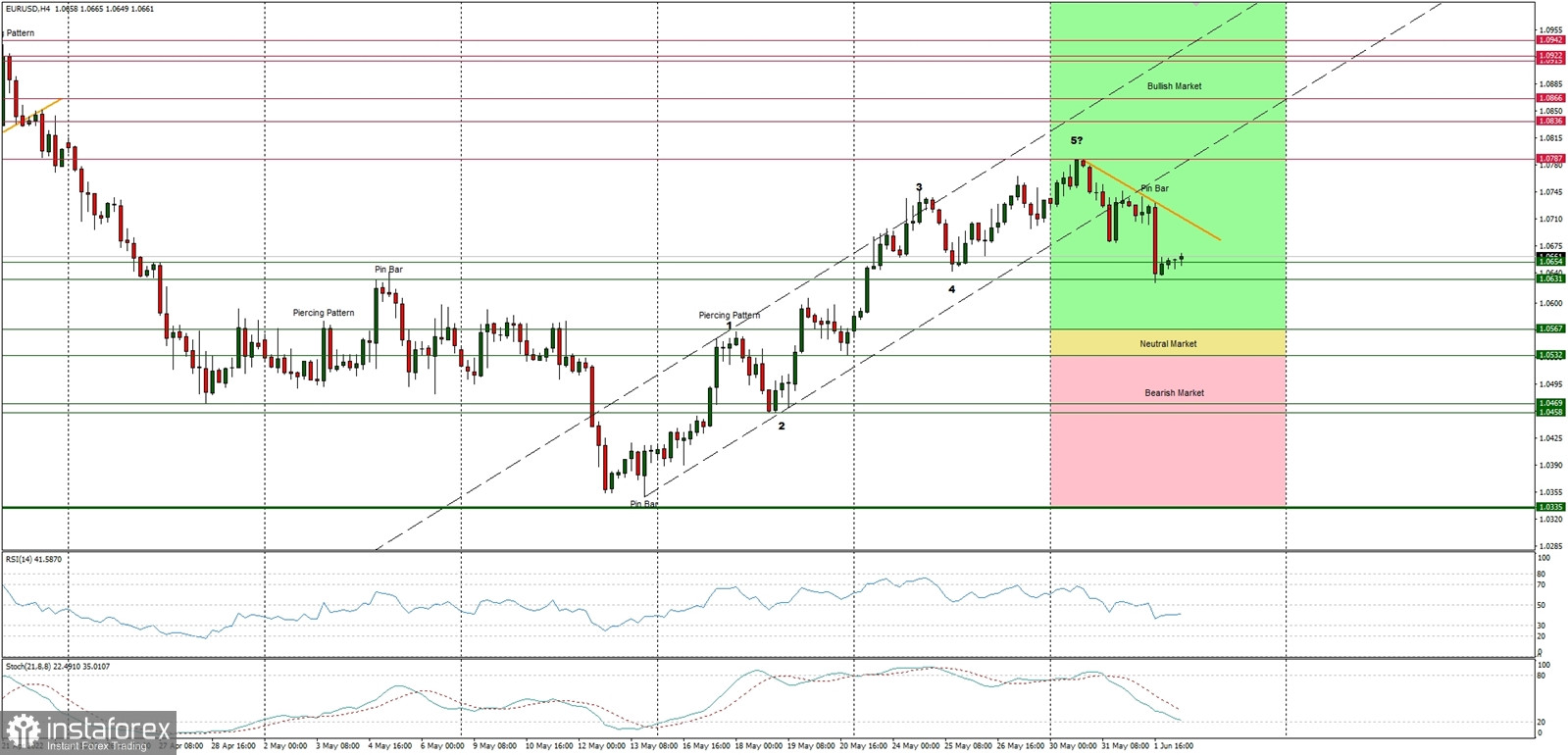

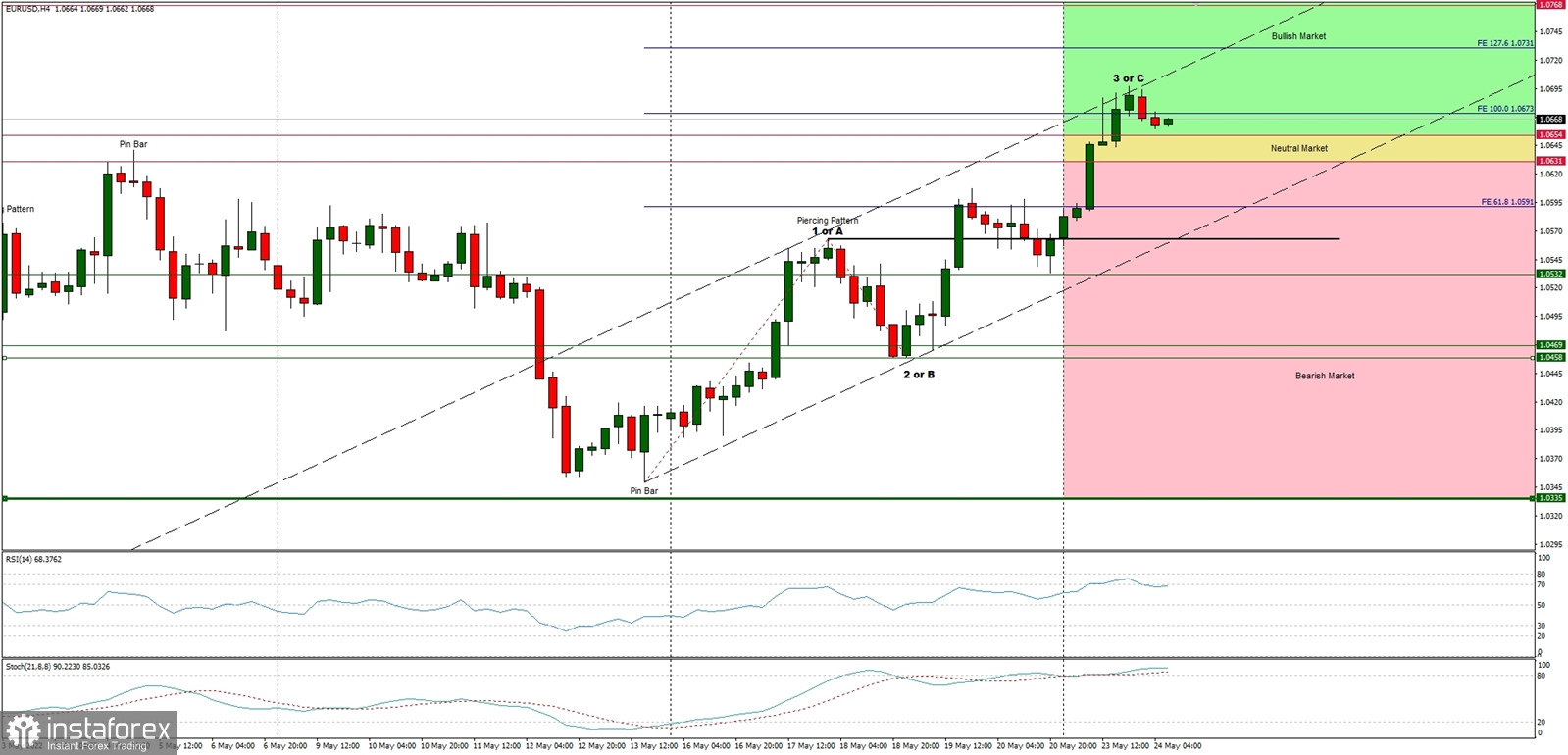

Technical Market Outlook:

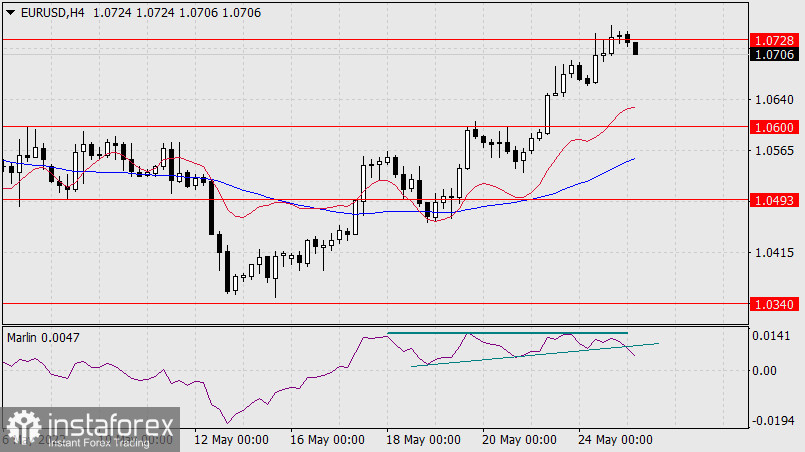

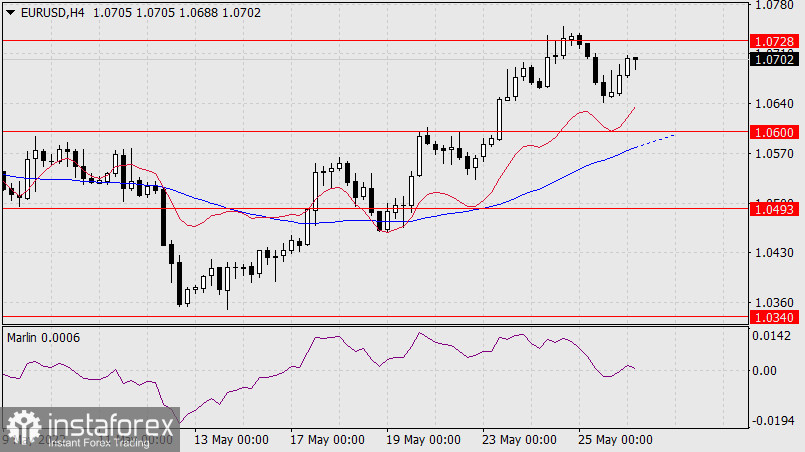

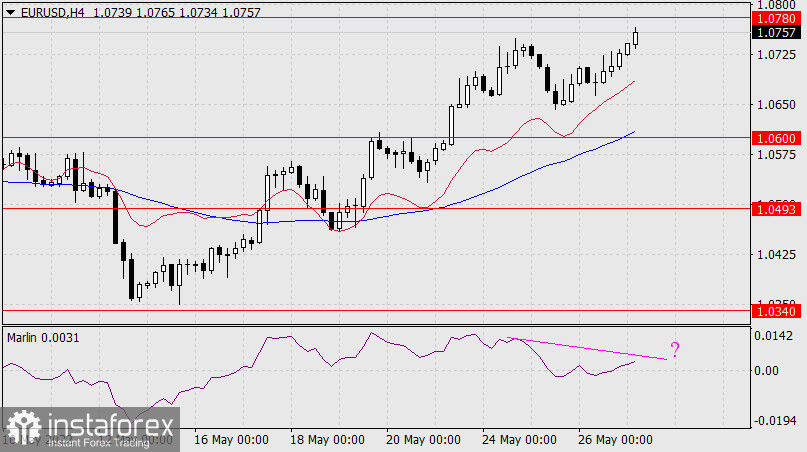

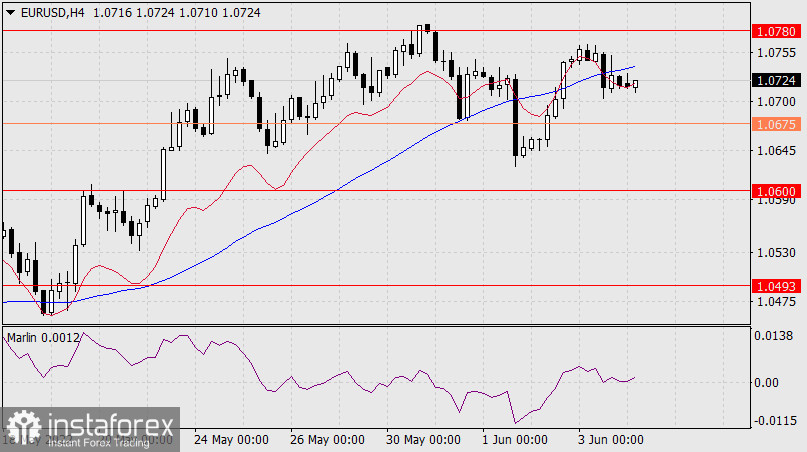

The EUR/USD pair has bounced from the lows seen at the level of 1.0349 last week and continues to move higher. Currently, bulls had broken above the neutral market zone located between the levels of 1.0631 - 1.0654 and are trading inside the bullish zone. The strong and positive momentum support the short-term bullish outlook for Euro, however the ABC corrective cycle for bulls looks completed and the level of 1.0673 was the 100% Fibonacci extension for the up wave. If the bulls will continue higher, the next target is seen at 1.0731 (127% Fibonacci extension). The immediate technical support is located at 1.0654 and 1.0631 (the previous resistance).

Weekly Pivot Points:

WR3 - 1.0888

WR2 - 1.0735

WR1 - 1.0635

Weekly Pivot - 1.0526

WS1 - 1.0448

WS2 - 1.0311

WS3 - 1.0227

Trading Outlook:

The market is still in control by bears that pushed the price way below the level of 1.0639, so a breakout above this level is a must for bulls for a long-term trend reversal. The up trend can be continued towards the next long-term target located at the level of 1.1186 only if bullish cycle scenario is confirmed by breakout above the level of 1.0726, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0336 or below.

Analysis are provided byInstaForex.

https://ifxpr.com/3NrdJMm