Forex Analysis & Reviews: EUR/USD Overview on January 6, 2026

The EUR/USD currency pair did not show any dazzling moves during Monday, although many traders were expecting exactly such a development. On Saturday, Donald Trump ordered the bombing of Venezuela's capital, Caracas, in order to paralyze the functioning of military and government institutions. The attack was required to capture the country's president, Nicolas Maduro, which was successfully accomplished in just five hours. At present, Maduro is already in the United States, where he is expected to stand trial before the "most humane court in the world." Of course, we will not speculate on whether Donald Trump has the right to issue such orders, or what international law, the UN, and various other organizations think about it. In principle, Trump has long demonstrated to the entire world that the law is the law—but there are exceptions. However, the most interesting part lies ahead. Throughout 2025, we said that Trump's policies (without dividing them into individual segments and spheres) were the key reason for the dollar's decline. We warned that 2026 could turn out to be no better than 2025—for the US dollar. And now, before 2026 has even properly begun, Trump has already carried out a military operation to capture the leader of another state and has also made it clear that his own statements from a year ago about the annexation of Greenland were not a joke. This morning, many analysts reported that the dollar would rise on Maduro's detention, as "risk-off sentiment" was growing in the markets and, therefore, demand for the safe-haven dollar would increase. However, we would like to note that, as a rule, the dollar was used as a "safe haven" in cases where the United States was not a participant in a geopolitical conflict. Now the whole world understands that if Washington wants a change of power in any country in the world (except, of course, heavyweights like Russia, the European Union, or China), it will simply carry out another military operation and capture any politician or official. Therefore, the trade war of 2025 may end up looking like "child's play" to the markets. This leaves us with only one question: how should traders treat a currency whose leader and head of state openly adheres no longer to the principles of protectionism, but to outright dictatorship? In our view, the US currency received another heavy blow at the beginning of the year. Yes, on Monday the dollar managed to strengthen slightly, but by the end of the day it had lost all its gains because the ISM business activity index was released—an indicator far more important for the dollar than events in Venezuela. Thus, our forecast and expectations remain unchanged: the decline of the US currency will continue in 2026. At present, the EUR/USD pair has fallen to the Senkou Span B line on the daily timeframe and is still trading within the sideways channel of 1.1400–1.1830. We continue to wait for the market to get tired of playing "tug of war" and finally push the pair out of the flat—naturally, through the upper boundary.

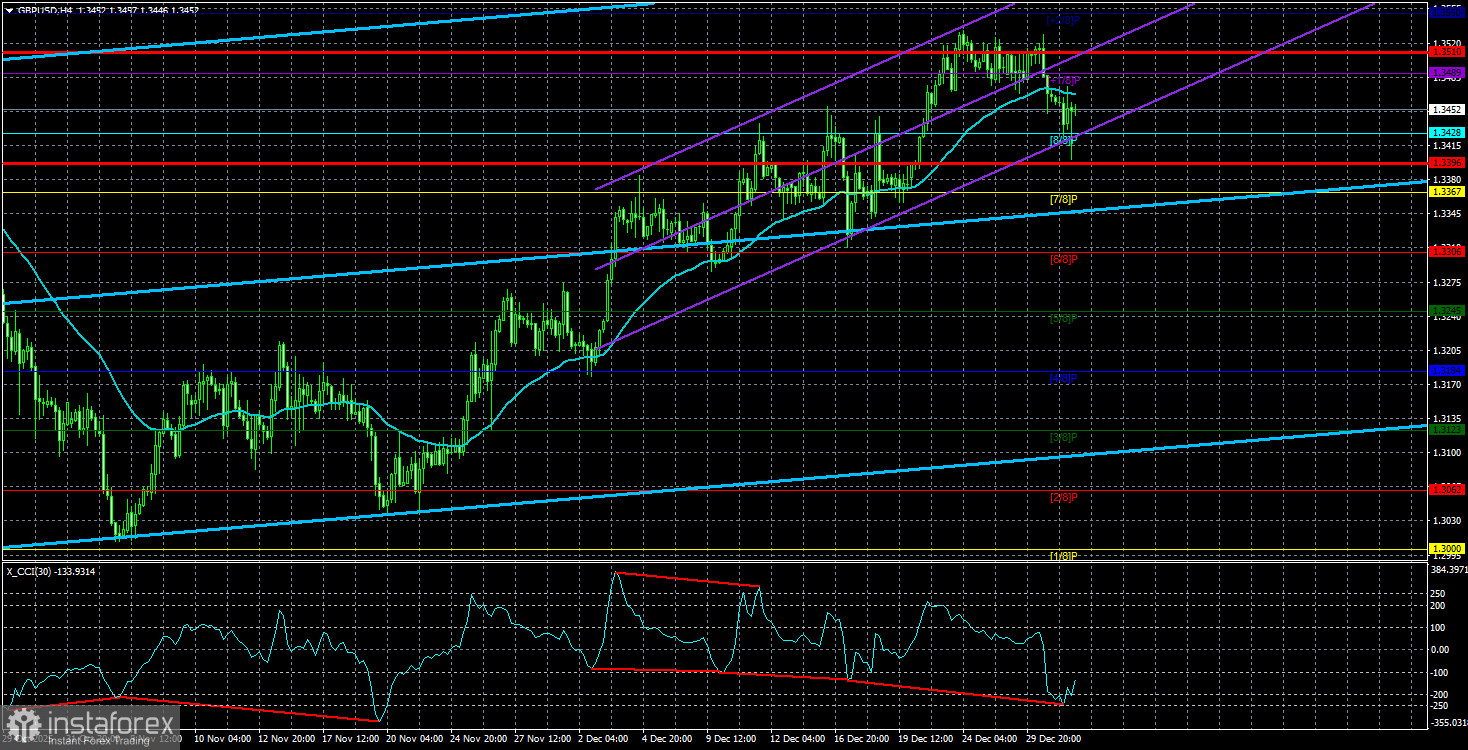

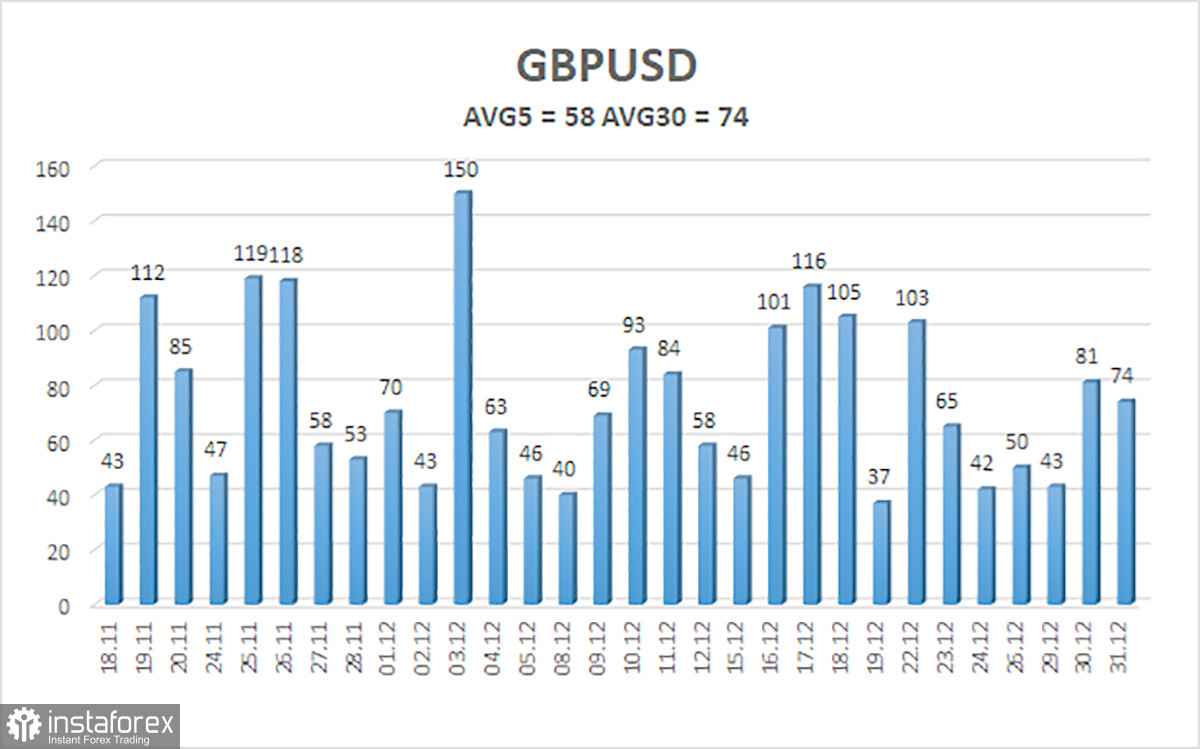

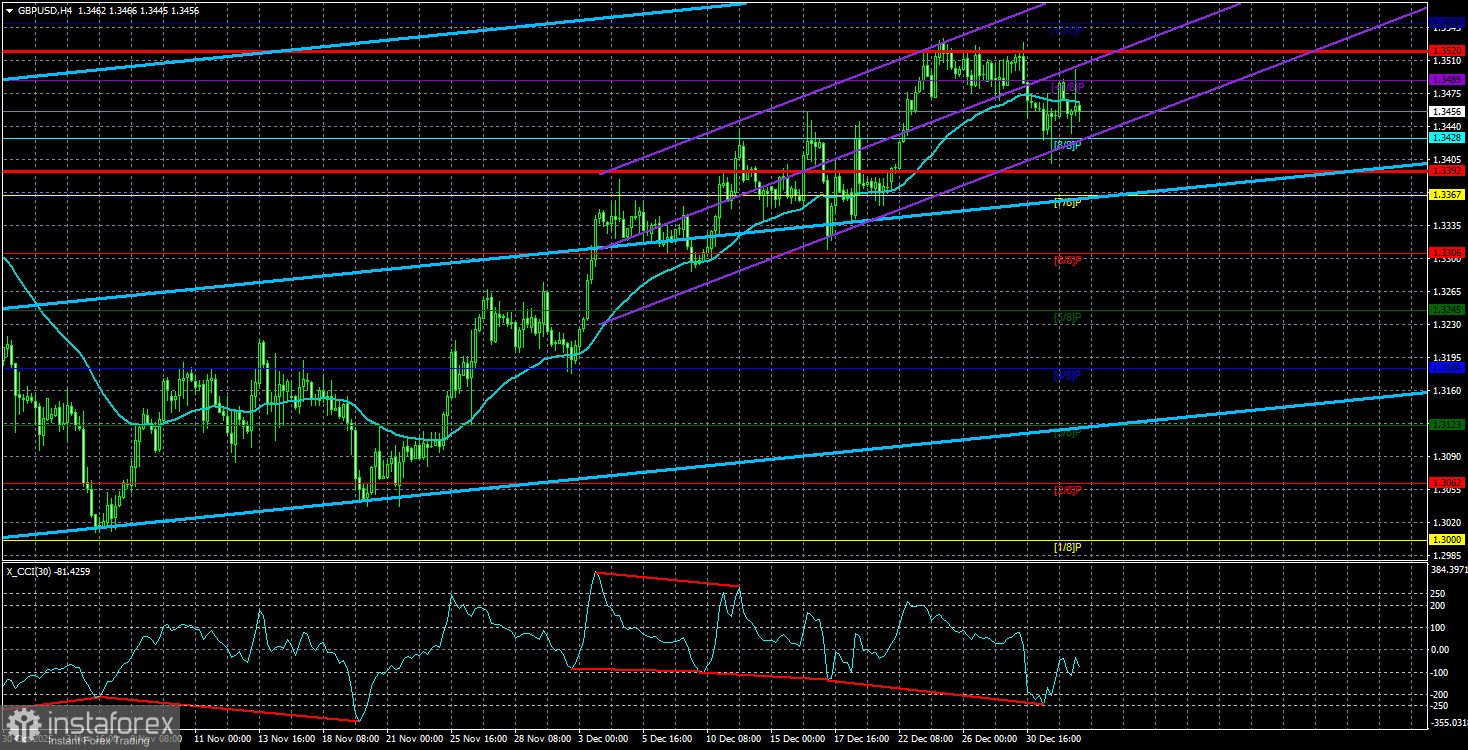

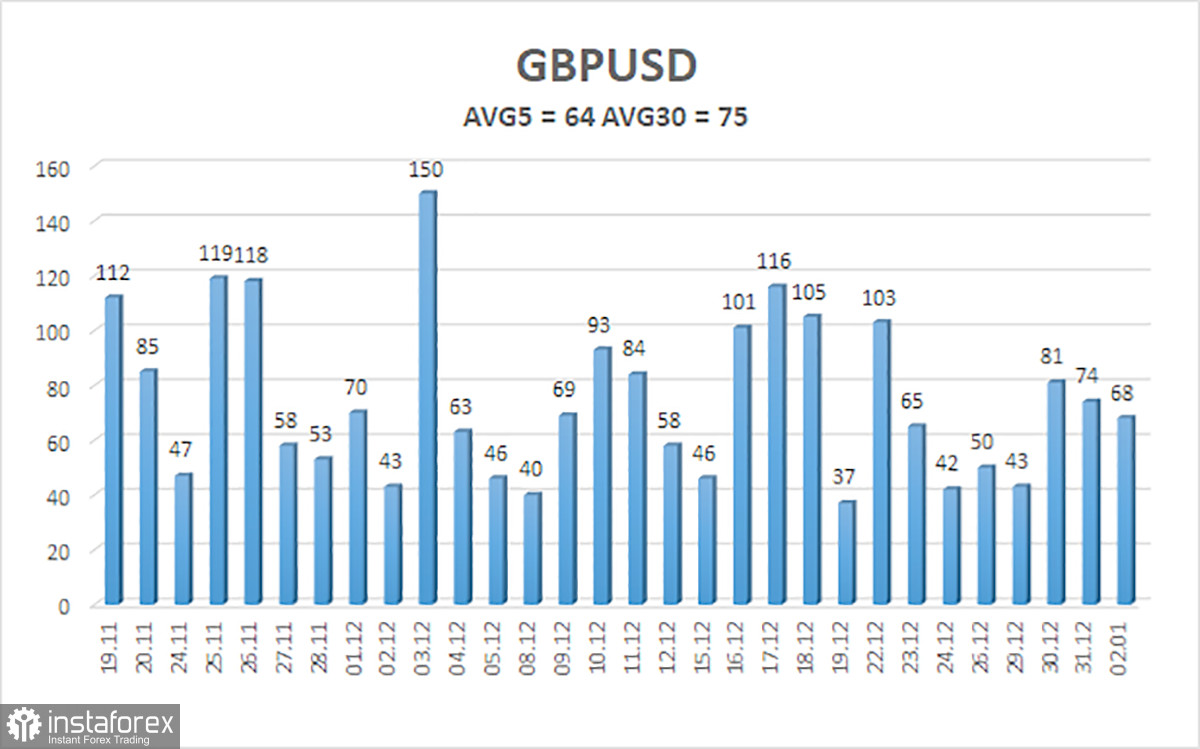

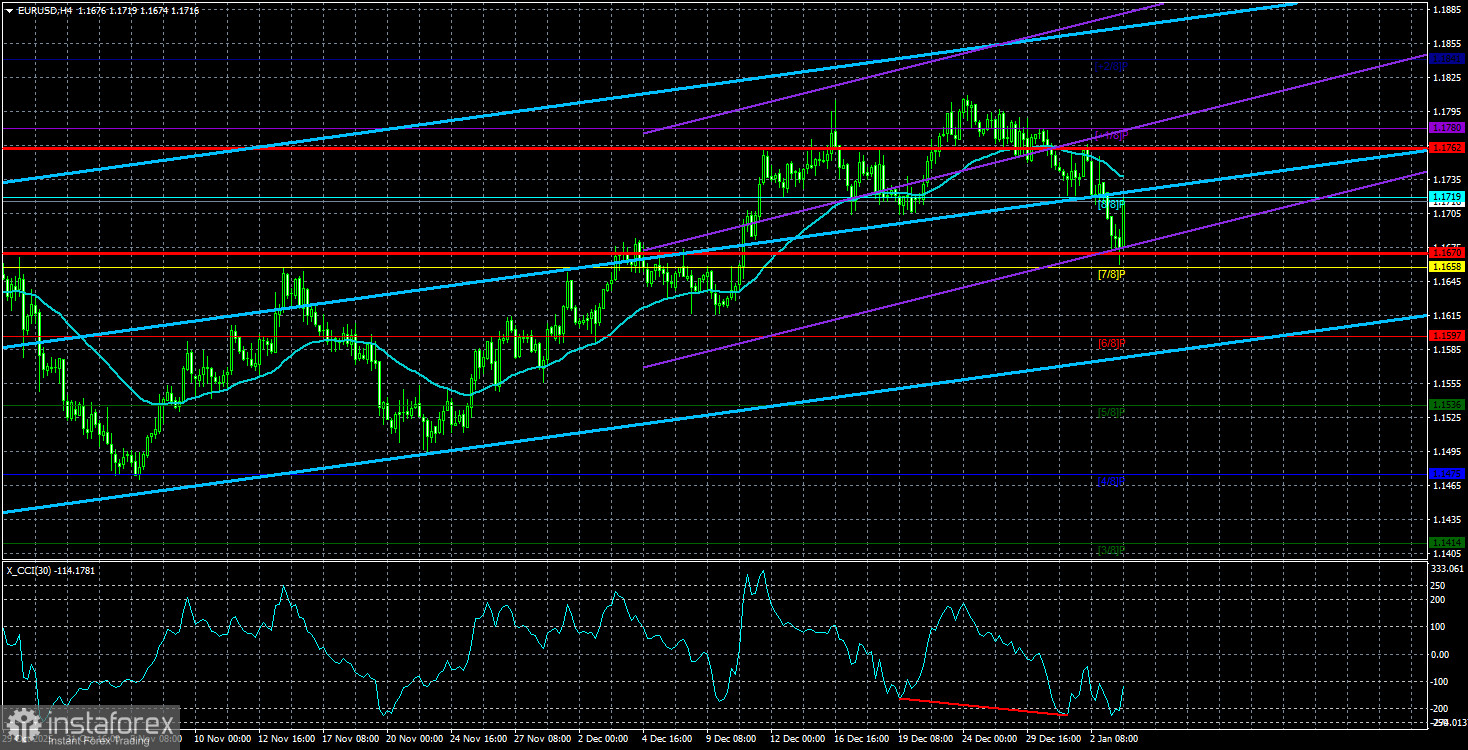

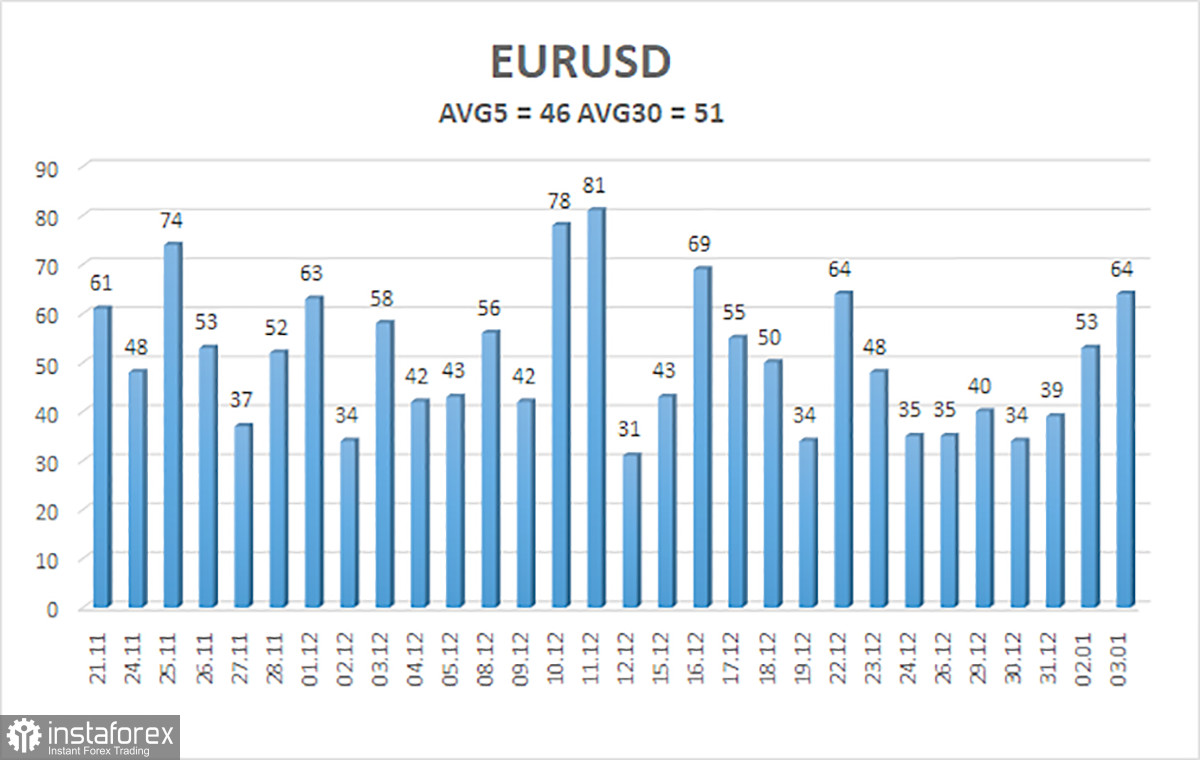

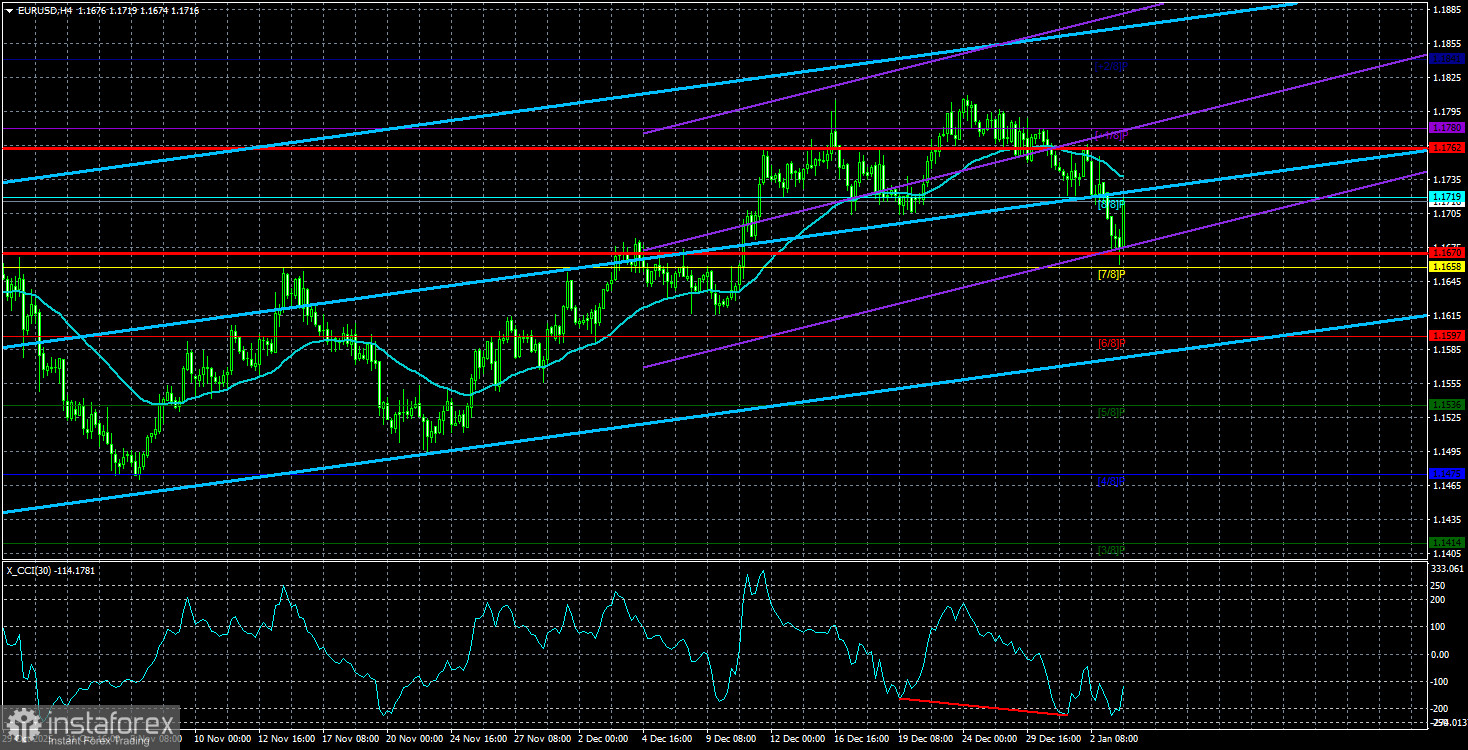

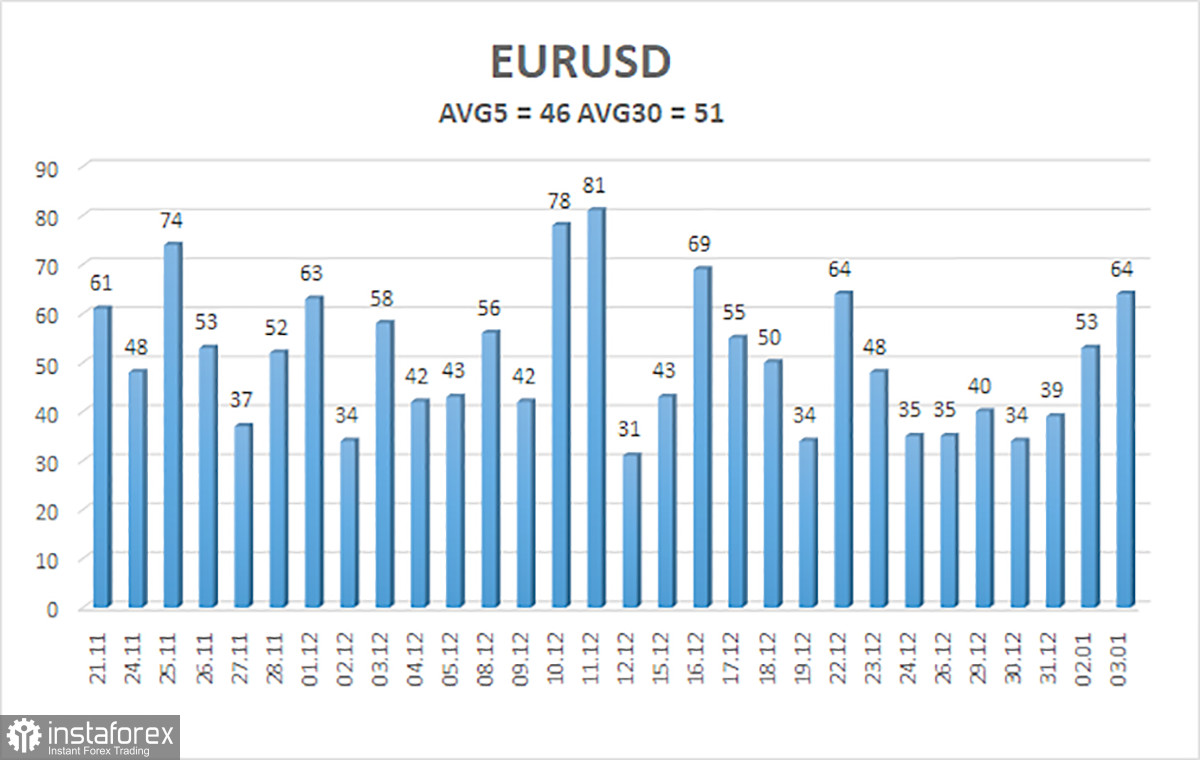

The average volatility of the EUR/USD pair over the last five trading days as of January 6 is 46 points, which is characterized as "low." We expect the pair to move between the levels of 1.1670 and 1.1762 on Tuesday. The higher linear regression channel is turning upward, but in practice the flat market on the daily timeframe is still ongoing. The CCI indicator entered the overbought zone at the beginning of December, but we have already seen a small pullback. Last week, a bullish divergence was formed, pointing to a resumption of the upward trend. Nearest Support Levels: S1 – 1.1658S2 – 1.1597S3 – 1.1536 Nearest Resistance Levels: R1 – 1.1719R2 – 1.1780R3 – 1.1841 Trading Recommendations The EUR/USD pair has consolidated below the moving average, but the upward trend remains intact on all higher timeframes, while a flat market has persisted on the daily timeframe for the sixth consecutive month. The global fundamental backdrop continues to be of great importance for the market, and it remains negative for the dollar. Over the past six months, the dollar has occasionally shown weak growth, but exclusively within the sideways channel. There is no fundamental basis for long-term strengthening. With the price located below the moving average, small short positions may be considered with targets at 1.1670 and 1.1658 on purely technical grounds. Above the moving average, long positions remain relevant with a target of 1.1830 (the upper boundary of the daily flat), which has effectively already been reached. Now the flat needs to end. Explanations to the Illustrations Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is currently strong. The moving average (settings 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted. Murray levels are target levels for movements and corrections. Volatility levels (red lines) represent the likely price channel in which the pair will trade over the next 24 hours, based on current volatility readings. The CCI indicator: when it enters the oversold zone (below ?250) or the overbought zone (above +250), it signals that a trend reversal in the opposite direction is approaching.

Analysis are provided by InstaForex.

Read more:

https://ifxpr.com/3N6LpnS