Forex Analysis & Reviews: Hot Forecast on EUR/USD From 17.10.2024

The market seems to no longer doubt that the European Central Bank will again lower the refinancing rate today—by another 25 basis points, from 3.65% to 3.40%. This decision is already being priced into the value of the euro, which has significantly depreciated recently, and there's no doubt that it's oversold. Therefore, even after the ECB announces its decision, there's no need to expect a noticeable weakening of the euro. Given the market's apparent need for at least a local correction, it's likely that soon after the ECB's governing council meeting, we will see the euro rise. This is especially likely if Christine Lagarde announces that inflation targets have been met, meaning that further monetary policy easing is not expected. Such a scenario is quite possible, as preliminary inflation data suggests that the rate of consumer price growth has slowed from 2.2% to 1.8%. The final inflation figures are expected to be published just before the meeting, which should confirm the preliminary estimates.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/409xJNc

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: Q3 Brings Records: Morgan Stanley on Fire, Amazon Makes Surprise Deals

Dow Jones Is Back on Track: Wall Street Ends with Records The Dow Jones Industrial Average surprised markets on Wednesday, hitting a new all-time high despite pressure from tech stocks. Financials and small caps offset the decline in tech, leading to a positive outcome for all major Wall Street indexes. Third Record in Four Sessions This is the third time in the last four trading sessions that the Dow has performed better, closing comfortably above 43,000. Thus, the index has completely recovered its losses from the previous day, once again proving its resilience. S&P 500: Near a Record The S&P 500 was also close to setting a new record. However, despite positive dynamics during the day, it ended trading slightly behind, adding 27.21 points (0.47%) and stopping at 5,842.47. Nasdaq Remains in the Green The tech-heavy Nasdaq Composite also showed a positive result, ending the day up 51.49 points (0.28%) and reaching 18,367.08. Despite pressure from the large tech companies, the index remained in the green. Financials Lead the Day The overall positive mood of the day was dictated by the active growth of financial companies, which became the main drivers of market growth. "Investors have started to move capital from the tech sector to financial companies," said Michael Kantrowitz, chief investment strategist at Piper Sandler. In his opinion, such a reshuffle looks logical, since current rates favor bank earnings, while optimism around artificial intelligence is already priced into high tech companies. Thus, Wall Street ended the day in the green zone, confirming investor optimism and the resilience of the financial sector in the current market situation.

News are provided by InstaForex.

Read more: https://ifxpr.com/4f8Gvzm

Dow Jones Is Back on Track: Wall Street Ends with Records The Dow Jones Industrial Average surprised markets on Wednesday, hitting a new all-time high despite pressure from tech stocks. Financials and small caps offset the decline in tech, leading to a positive outcome for all major Wall Street indexes. Third Record in Four Sessions This is the third time in the last four trading sessions that the Dow has performed better, closing comfortably above 43,000. Thus, the index has completely recovered its losses from the previous day, once again proving its resilience. S&P 500: Near a Record The S&P 500 was also close to setting a new record. However, despite positive dynamics during the day, it ended trading slightly behind, adding 27.21 points (0.47%) and stopping at 5,842.47. Nasdaq Remains in the Green The tech-heavy Nasdaq Composite also showed a positive result, ending the day up 51.49 points (0.28%) and reaching 18,367.08. Despite pressure from the large tech companies, the index remained in the green. Financials Lead the Day The overall positive mood of the day was dictated by the active growth of financial companies, which became the main drivers of market growth. "Investors have started to move capital from the tech sector to financial companies," said Michael Kantrowitz, chief investment strategist at Piper Sandler. In his opinion, such a reshuffle looks logical, since current rates favor bank earnings, while optimism around artificial intelligence is already priced into high tech companies. Thus, Wall Street ended the day in the green zone, confirming investor optimism and the resilience of the financial sector in the current market situation.

News are provided by InstaForex.

Read more: https://ifxpr.com/4f8Gvzm

- IFX Bella

- Posts: 271

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on 18.10.2024

As expected, the European Central Bank lowered the refinancing rate by 25 basis points. However, the central bank managed to deliver a surprise. Over the last three months, the ECB has reduced interest rates by a total of 85 basis points, while inflation has slowed to 1.7%. This was, incidentally, below the preliminary estimate of 1.8%. Against this backdrop, a pause in further monetary easing seemed logical, at the very least. Instead, Christine Lagarde announced yesterday that there would be another rate cut as soon as December of this year by an additional 25 basis points. This development was a complete surprise to investors, and the single European currency continued to lose ground. However, the euro weakening could have been much more significant if it had not been for the U.S. macroeconomic data. Specifically, the growth rate of retail sales in the United States slowed from 2.2% to 1.7%, which, however, turned out to be slightly better than the forecast of 1.6%. On the other hand, the decline in industrial production accelerated from -0.2% to -0.6%, whereas a 0.4% growth had been expected. In other words, the U.S. data provided some support for the euro. In any case, the dollar's overbought condition has worsened even further, and the market will clearly latch onto any minor reason to initiate at least a local correction. However, today's macroeconomic calendar is generally empty. Perhaps the media will provide a reason. The market will likely consolidate around current levels if there are no significant events.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/405TYnj

As expected, the European Central Bank lowered the refinancing rate by 25 basis points. However, the central bank managed to deliver a surprise. Over the last three months, the ECB has reduced interest rates by a total of 85 basis points, while inflation has slowed to 1.7%. This was, incidentally, below the preliminary estimate of 1.8%. Against this backdrop, a pause in further monetary easing seemed logical, at the very least. Instead, Christine Lagarde announced yesterday that there would be another rate cut as soon as December of this year by an additional 25 basis points. This development was a complete surprise to investors, and the single European currency continued to lose ground. However, the euro weakening could have been much more significant if it had not been for the U.S. macroeconomic data. Specifically, the growth rate of retail sales in the United States slowed from 2.2% to 1.7%, which, however, turned out to be slightly better than the forecast of 1.6%. On the other hand, the decline in industrial production accelerated from -0.2% to -0.6%, whereas a 0.4% growth had been expected. In other words, the U.S. data provided some support for the euro. In any case, the dollar's overbought condition has worsened even further, and the market will clearly latch onto any minor reason to initiate at least a local correction. However, today's macroeconomic calendar is generally empty. Perhaps the media will provide a reason. The market will likely consolidate around current levels if there are no significant events.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/405TYnj

- IFX Bella

- Posts: 271

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Netflix Back on Track, Elevance Health in Free Fall: Who Were the Winners and Losers in Q3?

Dow Jones Back on Top: Record Highs, Consumer Demand Rising The Dow Jones Industrial Average hit new highs again, ending Thursday at its fourth all-time high in the last five sessions. The reason for this rise was the results of retail sales in the US, which turned out to be significantly higher than expected, indicating sustainable consumer demand. Subdued dynamics on Wall Street Other key Wall Street indices remained generally stable. The S&P 500 slightly rolled back, recording a small loss, while the Nasdaq Composite, on the contrary, was able to show modest growth. TSMC surprised the market: revenue growth due to demand for AI One of the main drivers of positive sentiment in the market was Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest contract chipmaker. The company exceeded analysts' profit expectations and announced a likely jump in revenue in the fourth quarter due to strong demand for chips used in artificial intelligence technologies. TSMC shares, traded on US exchanges, soared by 9.8%. The company's customer and AI leader Nvidia also saw gains, up 0.9%. Chip Sector on the Rise The optimistic sentiment spread to other semiconductor companies, with the Philadelphia SE Semiconductor Index rising 1%, showing broad market support.

News are provided by InstaForex.

Read more: https://ifxpr.com/4hd8S0S

Dow Jones Back on Top: Record Highs, Consumer Demand Rising The Dow Jones Industrial Average hit new highs again, ending Thursday at its fourth all-time high in the last five sessions. The reason for this rise was the results of retail sales in the US, which turned out to be significantly higher than expected, indicating sustainable consumer demand. Subdued dynamics on Wall Street Other key Wall Street indices remained generally stable. The S&P 500 slightly rolled back, recording a small loss, while the Nasdaq Composite, on the contrary, was able to show modest growth. TSMC surprised the market: revenue growth due to demand for AI One of the main drivers of positive sentiment in the market was Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest contract chipmaker. The company exceeded analysts' profit expectations and announced a likely jump in revenue in the fourth quarter due to strong demand for chips used in artificial intelligence technologies. TSMC shares, traded on US exchanges, soared by 9.8%. The company's customer and AI leader Nvidia also saw gains, up 0.9%. Chip Sector on the Rise The optimistic sentiment spread to other semiconductor companies, with the Philadelphia SE Semiconductor Index rising 1%, showing broad market support.

News are provided by InstaForex.

Read more: https://ifxpr.com/4hd8S0S

- IFX Bella

- Posts: 271

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD and GBP/USD Technical Analysis for October 21

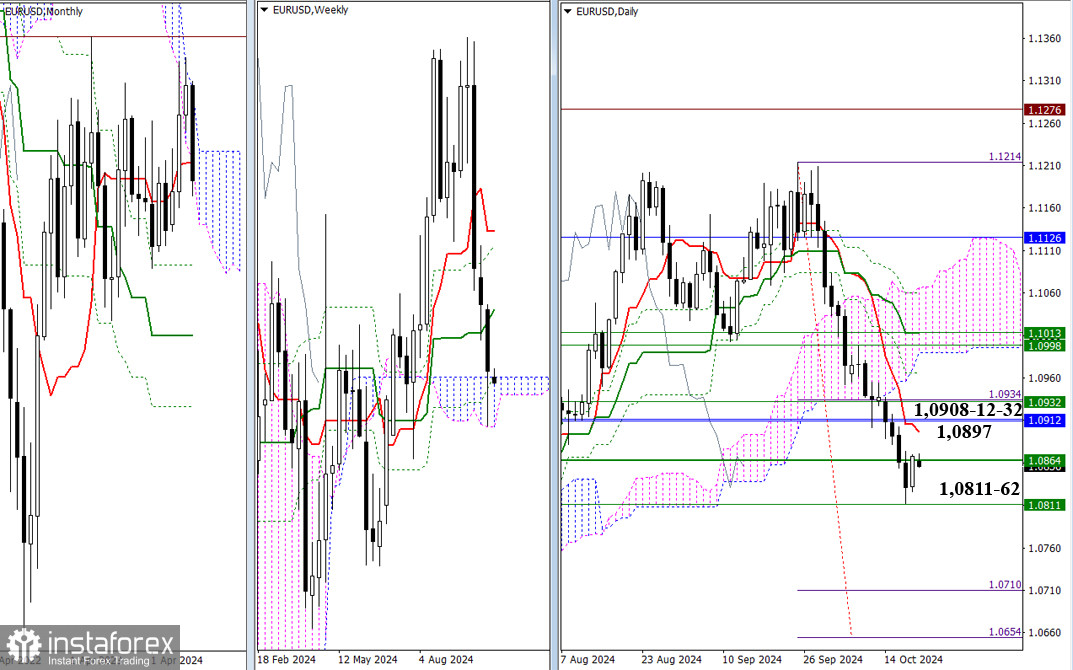

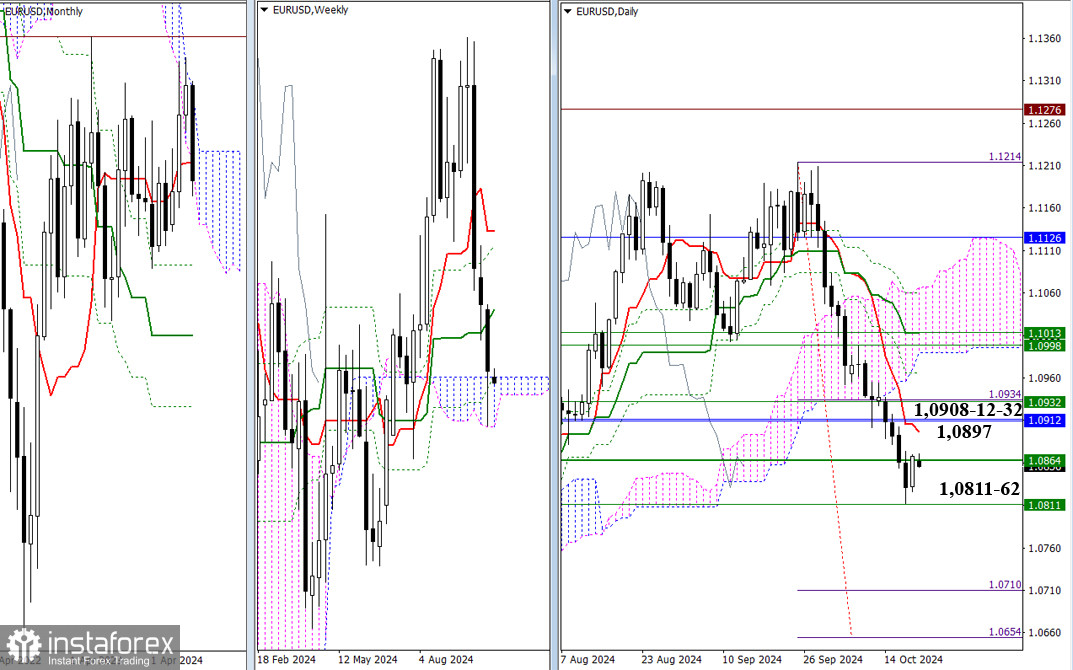

Higher Time Frames Last week, the bears tested the weekly cloud (1.0862 – 1.0811), but the week ended with only a long lower shadow. The market closed the week above the weekly cloud, so testing these levels will continue. The bears' immediate plans still include breaking through the cloud (1.0862 – 1.0811) and forming a weekly downward target. Meanwhile, the bulls will be aided by the momentum that led to the emergence of an upward correction at the end of last week. This correction's immediate target is the daily short-term trend (1.0897). The next focus will be on the monthly time frame resistances at 1.0912-08 (monthly short-term trend and lower boundary of the monthly cloud) and 1.0932 (weekly medium-term trend).

H4 – H1 The bears still maintain their advantage in the lower time frames, but the pair has risen to the key levels at 1.0855 (central Pivot point of the day) – 1.0874 (weekly long-term trend). Consolidation above this trend and its reversal could shift the balance of power in favor of the bulls. The following targets for upward movement during the day would be the resistances of the classic Pivot points (1.0883 – 1.0899 – 1.0927). If bearish activity resumes and the decline continues, the market's focus will shift to breaking through the supports of the classic Pivot points (1.0839 – 1.0811 – 1.0795).

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/40i9NHH

Higher Time Frames Last week, the bears tested the weekly cloud (1.0862 – 1.0811), but the week ended with only a long lower shadow. The market closed the week above the weekly cloud, so testing these levels will continue. The bears' immediate plans still include breaking through the cloud (1.0862 – 1.0811) and forming a weekly downward target. Meanwhile, the bulls will be aided by the momentum that led to the emergence of an upward correction at the end of last week. This correction's immediate target is the daily short-term trend (1.0897). The next focus will be on the monthly time frame resistances at 1.0912-08 (monthly short-term trend and lower boundary of the monthly cloud) and 1.0932 (weekly medium-term trend).

H4 – H1 The bears still maintain their advantage in the lower time frames, but the pair has risen to the key levels at 1.0855 (central Pivot point of the day) – 1.0874 (weekly long-term trend). Consolidation above this trend and its reversal could shift the balance of power in favor of the bulls. The following targets for upward movement during the day would be the resistances of the classic Pivot points (1.0883 – 1.0899 – 1.0927). If bearish activity resumes and the decline continues, the market's focus will shift to breaking through the supports of the classic Pivot points (1.0839 – 1.0811 – 1.0795).

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/40i9NHH

- IFX Bella

- Posts: 271

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Netflix Growth Hopes vs. Semiconductor Worries: Market at Fork

Communications and IT Lead the Way Netflix's rise boosted the communications sector, which rose 0.9% to lead the 11 S&P 500 sectors. Meanwhile, the information technology sector added 0.5%, also helping to strengthen the overall market. Records Continue as Stock Indexes Continue to Move Higher The major U.S. stock market indices continued to rise on Friday. The S&P 500 rose 23.20 points, or 0.40%, to close at 5,864.67. The Nasdaq Composite added 115.94 points, or 0.63%, to close at 18,489.55. The Dow Jones Industrial Average rose 36.86 points, or 0.09%, to close at 43,275.91. Dow Jones Gains Subdued The Dow posted its fifth record close in the last six sessions. However, its gains were less dramatic due to a decline in American Express shares. The financial giant lost 3.1% after reporting quarterly earnings that missed analysts' expectations. Financials: Highs and Lows Despite the disappointment from American Express, the financial sector as a whole ended the earnings season on a positive note. However, the S&P Banks Index, which measures banking stocks, fell 0.1%, snapping a five-week winning streak. Market Optimism, but Risks Remain Positive financial reports and favorable economic indicators helped propel the indices steadily higher. However, it's worth noting that the S&P 500 trades at 22 times projected earnings. This, coupled with expectations for strong corporate results and uncertainty surrounding the upcoming US presidential election on November 5, could lead to increased volatility and market corrections. Small Cap Interest Wanes Investors have shown increasing interest in small-cap stocks in recent days. Over the week, the Russell 2000 and S&P Small Cap 600 indexes outperformed the major indices. However, both indexes fell on Friday, demonstrating a weakening interest in small companies amid overall market optimism. Energy Under Pressure: Falling Amid Weaker Oil Prices Amid weaker oil prices, the energy sector was the only one in the S&P 500 to show negative dynamics, falling 0.4%. The sector was particularly pressured by shares of SLB, which fell 4.7% after the publication of quarterly results that did not meet investor expectations. The decline also weighed on other oilfield services players such as Baker Hughes and Halliburton, which fell 1.3% and 2.1%, respectively.

News are provided by InstaForex.

Read more: https://ifxpr.com/3YxaTOg

Communications and IT Lead the Way Netflix's rise boosted the communications sector, which rose 0.9% to lead the 11 S&P 500 sectors. Meanwhile, the information technology sector added 0.5%, also helping to strengthen the overall market. Records Continue as Stock Indexes Continue to Move Higher The major U.S. stock market indices continued to rise on Friday. The S&P 500 rose 23.20 points, or 0.40%, to close at 5,864.67. The Nasdaq Composite added 115.94 points, or 0.63%, to close at 18,489.55. The Dow Jones Industrial Average rose 36.86 points, or 0.09%, to close at 43,275.91. Dow Jones Gains Subdued The Dow posted its fifth record close in the last six sessions. However, its gains were less dramatic due to a decline in American Express shares. The financial giant lost 3.1% after reporting quarterly earnings that missed analysts' expectations. Financials: Highs and Lows Despite the disappointment from American Express, the financial sector as a whole ended the earnings season on a positive note. However, the S&P Banks Index, which measures banking stocks, fell 0.1%, snapping a five-week winning streak. Market Optimism, but Risks Remain Positive financial reports and favorable economic indicators helped propel the indices steadily higher. However, it's worth noting that the S&P 500 trades at 22 times projected earnings. This, coupled with expectations for strong corporate results and uncertainty surrounding the upcoming US presidential election on November 5, could lead to increased volatility and market corrections. Small Cap Interest Wanes Investors have shown increasing interest in small-cap stocks in recent days. Over the week, the Russell 2000 and S&P Small Cap 600 indexes outperformed the major indices. However, both indexes fell on Friday, demonstrating a weakening interest in small companies amid overall market optimism. Energy Under Pressure: Falling Amid Weaker Oil Prices Amid weaker oil prices, the energy sector was the only one in the S&P 500 to show negative dynamics, falling 0.4%. The sector was particularly pressured by shares of SLB, which fell 4.7% after the publication of quarterly results that did not meet investor expectations. The decline also weighed on other oilfield services players such as Baker Hughes and Halliburton, which fell 1.3% and 2.1%, respectively.

News are provided by InstaForex.

Read more: https://ifxpr.com/3YxaTOg

- IFX Bella

- Posts: 271

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on 10/22/2024

The anticipated correction for the dollar remains unfulfilled, as the modest signs of its beginning led nowhere. The dollar began to grow actively again. The reason behind this development is a series of statements from Federal Reserve representatives suggesting that there is no need to maintain the current pace of rate cuts. Instead, they even hinted at possibly slowing down the cuts, suggesting a potential pause. This means that by the end of the year, the U.S. central bank might lower rates only once rather than twice as previously anticipated. Not surprisingly, this has fueled the dollar's upward movement. Today, it's the turn of the European Central Bank (ECB) representatives to make statements regarding monetary policy. There's a high chance that the euro might see a rebound, potentially marking the start of the much-anticipated correction. Over the past three months, the ECB has cut the refinancing rate by a total of 85 basis points—a significant reduction. Many expected that the recent ECB Governing Council meeting would not change the rates, which seemed quite reasonable. After such active monetary easing and a drop in inflation below 2.0%, the ECB might opt to pause and observe further developments. This situation could lead to a scenario where, even if the Fed slows its pace of monetary easing, it continues to lower interest rates while the ECB at least takes a short pause, keeping rates steady. This would be enough for the euro to strengthen. Thus, the second attempt at a correction could be successful.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3Yy4vGI

The anticipated correction for the dollar remains unfulfilled, as the modest signs of its beginning led nowhere. The dollar began to grow actively again. The reason behind this development is a series of statements from Federal Reserve representatives suggesting that there is no need to maintain the current pace of rate cuts. Instead, they even hinted at possibly slowing down the cuts, suggesting a potential pause. This means that by the end of the year, the U.S. central bank might lower rates only once rather than twice as previously anticipated. Not surprisingly, this has fueled the dollar's upward movement. Today, it's the turn of the European Central Bank (ECB) representatives to make statements regarding monetary policy. There's a high chance that the euro might see a rebound, potentially marking the start of the much-anticipated correction. Over the past three months, the ECB has cut the refinancing rate by a total of 85 basis points—a significant reduction. Many expected that the recent ECB Governing Council meeting would not change the rates, which seemed quite reasonable. After such active monetary easing and a drop in inflation below 2.0%, the ECB might opt to pause and observe further developments. This situation could lead to a scenario where, even if the Fed slows its pace of monetary easing, it continues to lower interest rates while the ECB at least takes a short pause, keeping rates steady. This would be enough for the euro to strengthen. Thus, the second attempt at a correction could be successful.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3Yy4vGI

- IFX Bella

- Posts: 271

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on 10/23/2024

Although the refinancing rate in the eurozone has been cut by eighty-five basis points over the past three months, the European Central Bank has no plans to slow the pace of its monetary policy easing. Christine Lagarde essentially stated this directly. However, this did not lead to a significant weakening of the single European currency. The scale of the dollar's strengthening has been purely symbolic, mainly because the dollar is already excessively overbought. Moreover, the European Central Bank head made similar statements during the press conference following the last meeting of the European Central Bank's board. So, she didn't provide any fundamentally new information. Nonetheless, the dollar's overbought condition remains. On the contrary, it has slightly intensified. However, the market cannot grasp anything to implement the much-needed correction. Given that today's macroeconomic calendar is almost empty, at best, we may see only a symbolic weakening of the US dollar.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4fi7B7h

Although the refinancing rate in the eurozone has been cut by eighty-five basis points over the past three months, the European Central Bank has no plans to slow the pace of its monetary policy easing. Christine Lagarde essentially stated this directly. However, this did not lead to a significant weakening of the single European currency. The scale of the dollar's strengthening has been purely symbolic, mainly because the dollar is already excessively overbought. Moreover, the European Central Bank head made similar statements during the press conference following the last meeting of the European Central Bank's board. So, she didn't provide any fundamentally new information. Nonetheless, the dollar's overbought condition remains. On the contrary, it has slightly intensified. However, the market cannot grasp anything to implement the much-needed correction. Given that today's macroeconomic calendar is almost empty, at best, we may see only a symbolic weakening of the US dollar.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4fi7B7h

- IFX Bella

- Posts: 271

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Verizon and GE Aerospace Fall, GM Gains: Three Key Stocks of the Day on Wall Street

U.S. stocks ended the day with little change Tuesday's trading session on U.S. stock markets closed without significant movements, although Nasdaq showed a slight rise. Investors continue to closely monitor the dynamics of Treasury bond yields while awaiting corporate earnings reports to better assess the state of the U.S. economy. Market digesting bond yields "In recent days, the market has been trying to digest changes in Treasury bond yields. We're seeing quite significant fluctuations in this segment," said Jack Janasiewicz, portfolio manager at Natixis Investment Managers Solutions. Key index results During volatile trading, the Dow Jones Industrial Average (.DJI) fell by 6.71 points, or 0.02%, to 42,924.89. The S&P 500 (.SPX) dropped by 2.78 points, or 0.05%, closing at 5,851.20. Meanwhile, Nasdaq Composite (.IXIC) saw a gain of 33.12 points, or 0.18%, reaching 18,573.13. Consumer goods sector leads gains Nearly half of the S&P sectors closed in positive territory, with the consumer goods sector (.SPLRCS) leading the charge, up by 0.92%, driving market optimism. Treasury yields hit new highs Earlier in the day, the yield on 10-year Treasury bonds hit 4.222%, its highest level since July 26, as investors reassessed expectations for the Federal Reserve's monetary policy. However, yields dipped slightly during the session. Investors fear Fed's aggressive moves "The main concern is rising interest rates and fears that the Federal Reserve may have been too aggressive in September. This is fueling a global sell-off in bonds," noted Michael Green, portfolio manager at Simplify Asset Management. GE Aerospace drags industrial sector down Shares of GE Aerospace (GE.N) tumbled by 9%, despite an optimistic profit forecast for 2024. Persistent supply chain issues negatively impacted the company's revenue, weighing down the broader industrial index (.SPLRCI), which fell by 1.19%.

News are provided by InstaForex.

Read more: https://ifxpr.com/3NAoPAL

U.S. stocks ended the day with little change Tuesday's trading session on U.S. stock markets closed without significant movements, although Nasdaq showed a slight rise. Investors continue to closely monitor the dynamics of Treasury bond yields while awaiting corporate earnings reports to better assess the state of the U.S. economy. Market digesting bond yields "In recent days, the market has been trying to digest changes in Treasury bond yields. We're seeing quite significant fluctuations in this segment," said Jack Janasiewicz, portfolio manager at Natixis Investment Managers Solutions. Key index results During volatile trading, the Dow Jones Industrial Average (.DJI) fell by 6.71 points, or 0.02%, to 42,924.89. The S&P 500 (.SPX) dropped by 2.78 points, or 0.05%, closing at 5,851.20. Meanwhile, Nasdaq Composite (.IXIC) saw a gain of 33.12 points, or 0.18%, reaching 18,573.13. Consumer goods sector leads gains Nearly half of the S&P sectors closed in positive territory, with the consumer goods sector (.SPLRCS) leading the charge, up by 0.92%, driving market optimism. Treasury yields hit new highs Earlier in the day, the yield on 10-year Treasury bonds hit 4.222%, its highest level since July 26, as investors reassessed expectations for the Federal Reserve's monetary policy. However, yields dipped slightly during the session. Investors fear Fed's aggressive moves "The main concern is rising interest rates and fears that the Federal Reserve may have been too aggressive in September. This is fueling a global sell-off in bonds," noted Michael Green, portfolio manager at Simplify Asset Management. GE Aerospace drags industrial sector down Shares of GE Aerospace (GE.N) tumbled by 9%, despite an optimistic profit forecast for 2024. Persistent supply chain issues negatively impacted the company's revenue, weighing down the broader industrial index (.SPLRCI), which fell by 1.19%.

News are provided by InstaForex.

Read more: https://ifxpr.com/3NAoPAL

- IFX Bella

- Posts: 271

- Joined: Sat Dec 08, 2012 12:39 am