Forex Analysis & Reviews: Nvidia's Historic Triumph: Outpacing Nasdaq and S&P 500

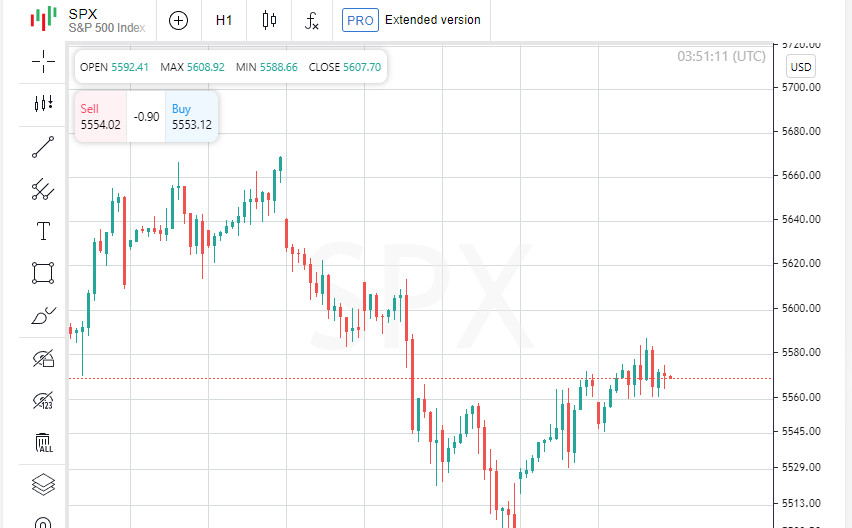

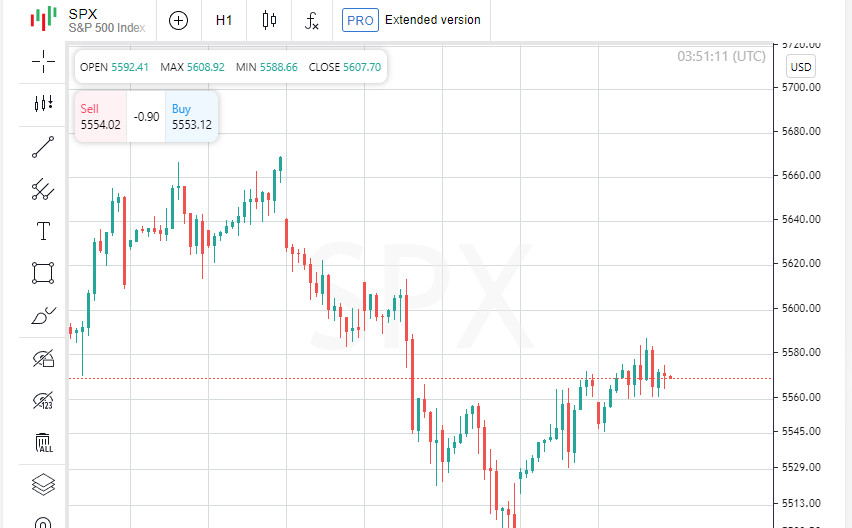

The Nasdaq and S&P 500 indexes hit new record highs on Wednesday, driven by gains in Nvidia and other major Wall Street names ahead of inflation data and quarterly earnings reports due this week. It was the Nasdaq's seventh straight record close, while the S&P 500 posted its sixth. The S&P 500 broke 5,600 for the first time after Federal Reserve Chairman Jerome Powell raised expectations for a rate cut in September. In testimony to Congress, Powell said it was too early to say inflation was completely conquered, but stressed that the U.S. was moving toward stable prices and low unemployment, and that the Fed would monitor that process closely. Powell also said Tuesday that with the U.S. economy no longer in overheating mode, the central bank could take risks into account and would be prepared to cut rates once inflation showed significant progress. Investors are looking ahead to June consumer price index data on Thursday and producer price index data on Friday, hoping that the data will bolster confidence that the Fed will be able to cut rates this year. Traders are currently pricing a 46% chance that the Fed will cut rates by two points by the end of December, and a 70% chance of the first cut as early as September, according to CME Group's FedWatch tool. The Philadelphia Semiconductor Index (.SOX) rose 2.4% to a new high after contract manufacturer Taiwan Semiconductor Manufacturing Co reported strong quarterly earnings. "The TSMC report gave artificial intelligence a boost, and that's probably the most meaningful data point right now," said Thomas Martin, senior portfolio manager at Globalt Investments in Atlanta. Micron Technology (MU.O) jumped 4%, Nvidia (NVDA.O) rose 2.7%, and Advanced Micro Devices (AMD.O) rose 3.9%. Apple (AAPL.O) shares rose 1.9% to a new record, pushing the company's market value to $3.6 trillion. While Wall Street's gains this year have been driven largely by a few big names, some investors are worried about a potential sell-off if earnings miss expectations. The S&P 500 rose 1.02% to close at 5,633.91. On Wall Street, the Dow Jones Industrial Average (.DJI) rose 429.39 points, or 1.09%, to 39,721.36, the S&P 500 (.SPX) added 56.93 points, or 1.02%, to 5,633.91 and the Nasdaq Composite (.IXIC) rose 218.16 points, or 1.18%, to 18,647.45. All 11 S&P 500 sector indexes were up Wednesday, with information technology (.SPLRCT) leading the way with a 1.63% gain, followed by materials (.SPLRCM) with a 1.34% gain. Volume on U.S. exchanges was relatively light on Wednesday, with 10 billion shares traded, below the 11.5 billion average for the past 20 trading sessions. Ahead of U.S. inflation data, including the consumer price index on Thursday and the producer price index on Friday, are keeping investors' attention. The probability of a 25 basis point rate cut by September has risen to 74%, up from 70% on Tuesday and 45% a month ago, according to CME's FedWatch data. The second-quarter earnings season, which begins this week with the largest banks reporting on Friday, will be a test for large, large-cap companies to justify their lofty estimates and prove continued growth. Intuit (INTU.O) shares fell 2.6% after announcing plans to cut about 10% of its workforce. Shares of gene sequencing equipment maker Illumina (ILMN.O) rose more than 6% after announcing it would acquire privately held Fluent BioSciences. Advancing stocks outnumbered decliners in the S&P 500 (.AD.SPX) 4.3-to-1. The S&P 500 posted 33 new highs and 11 new lows; the Nasdaq posted 65 new highs and 117 new lows. The U.S. dollar weakened, while the euro gained slightly and sterling rose as comments from the Bank of England's chief economist reduced expectations for an interest rate cut in August. The MSCI Worldwide Index (.MIWD00000PUS) rose 7.03 points, or 0.86%, to 824.81. It was the world index's sixth record close in the last seven sessions and its biggest one-day percentage gain since June 12. Europe's STOXX 600 index (.STOXX) also closed up 0.91%. In Treasurys, Powell's dovish comments helped push yields lower, while a successful auction of 10-year U.S. Treasuries pushed rates up slightly, putting pressure on yields. The 10-year U.S. Treasury yield fell 1.8 basis points to 4.282% from 4.3% late Tuesday, while the 30-year yield fell 2.5 basis points to 4.4702%. The 2-year yield, which typically reflects interest rate expectations, fell 0.6 basis points to 4.6221% from 4.628% late Tuesday. In the currency market, the dollar weakened as investors focused on the possibility of a rate cut as Powell wrapped up his remarks. The dollar index, which measures the dollar against a basket of currencies including the yen and euro, was down 0.09% at 105.02. The euro was up 0.13% at $1.0826, while sterling was up 0.48% at $1.2844. However, the dollar was up 0.26% at 161.73 against the Japanese yen. Oil prices rose after data showed a big increase in U.S. refining activity last week. That led to a bigger-than-expected rise in gasoline and crude inventories, but Hurricane Beryl caused only minimal supply disruptions, limiting price gains. U.S. crude oil prices rose 0.85%, or 69 cents, to $82.10 a barrel, while Brent crude rose 0.5%, or 42 cents, to $85.08 a barrel. Gold prices also rose on expectations of a U.S. interest rate cut. Investors are awaiting inflation data due on Thursday for further confirmation of those expectations. Spot gold rose 0.36% to $2,372.25 an ounce, while U.S. gold futures rose 0.72% to $2,377.00 an ounce.

News are provided by InstaForex

Read more: https://ifxpr.com/3WirEeY

Forex News from InstaForex

Re: Forex News from InstaForex

Forex Analysis & Reviews: Investors lift market on Trump, rate cuts

Wall Street ended higher on Monday, extending Friday's gains, as expectations grew for a second term for Donald Trump after a failed assassination attempt raised hopes for looser regulation. Expectations that the Federal Reserve could cut its key interest rate as early as September also helped boost risk appetite among investors. While all three major U.S. stock indexes closed well below their intraday highs, the Dow Jones Industrial Average hit a record close. Small, economically sensitive stocks (.RUT) and transportation stocks (.DJT) have outperformed the broader market. The assassination attempt on Trump, the presumptive Republican presidential nominee, on Saturday in Pennsylvania appears to have boosted his chances of being elected. A Trump presidency is expected to usher in more aggressive trade policies, further tax cuts, and deregulation in areas ranging from climate change to cryptocurrencies. "The main event — the assassination attempt on Donald Trump — hasn't quite hit its mark," said Sam Stovall, chief investment strategist at CFRA Research in New York. "GDP forecasts are unchanged, expectations for a Fed rate cut in September are unchanged, and corporate earnings are ahead of expectations." "So the market momentum remains driven by investor optimism," Stovall added. Investor sentiment was also supported by expectations that the Federal Reserve will begin a rate-cutting cycle as early as September, with as many as three cuts possible before the end of the year. "A rate cut in September is virtually guaranteed," said Ross Mayfield, an analyst at Baird Investment Strategy in Louisville, Kentucky. "We're in the same position we were seven months ago, which is the promise of a Fed rate cut without the risk of a recession. But there's still a lot riding on the Fed's actions." Speaking to the Economic Club of Washington, Fed Chairman Jerome Powell reiterated his confidence that the U.S. economy can avoid a recession, with recent data showing progress in bringing inflation back to the central bank's 2% target. The Dow Jones Industrial Average (.DJI) rose 210.82 points, or 0.53%, to 40,211.72. The S&P 500 (.SPX) rose 15.87 points, or 0.28%, to 5,631.22, while the Nasdaq Composite (.IXIC) rose 74.12 points, or 0.40%, to 18,472.57. Among the 11 major sectors in the S&P 500, energy stocks (.SPNY) posted the biggest percentage gains, while utilities (.SPLRCU) lagged. Goldman Sachs (GS.N) more than doubled its second-quarter profit, beating analysts' expectations on solid performance in debt insurance and fixed-income trading. The brokerage's shares rose 2.6%. Macy's Inc (MN) shares fell 11.7% after the department store ended buyout talks with Arkhouse Management and Brigade Capital. The prospect of a second term for Donald Trump sent shares of Trump Media & Technology Group (DJT.O) soaring 31.4%. Cryptocurrency stocks also saw significant gains, with Coinbase Global (COIN.O), Marathon Digital Holdings (MARA.O) and Riot Platforms (RIOT.O) all rising between 11.4% and 18.3%. Other stocks that would likely benefit from a possible second Trump term also saw gains, with gun maker Smith & Wesson (SWBI.O) and correctional facility operator GEO Group (GEO.N) up 11.4% and 9.3%, respectively. Meanwhile, solar energy stocks fell as the prospect of a Trump election dampened expectations for U.S. renewable energy subsidies. Sunrun (RUN.O) and SolarEdge Technologies (SEDGO.O) fell 9.0% and 15.4%, respectively. U.S.-listed Chinese stocks also fell on concerns about tighter trade restrictions under the new Trump administration. The iShares China Largecap ETF fell 2.2%. On the New York Stock Exchange, gainers outnumbered losers 1.35-to-1; on the Nasdaq, gainers outnumbered losers 1.50-to-1.

News are provided by InstaForex

Read more: https://ifxpr.com/3LrBcyg

Wall Street ended higher on Monday, extending Friday's gains, as expectations grew for a second term for Donald Trump after a failed assassination attempt raised hopes for looser regulation. Expectations that the Federal Reserve could cut its key interest rate as early as September also helped boost risk appetite among investors. While all three major U.S. stock indexes closed well below their intraday highs, the Dow Jones Industrial Average hit a record close. Small, economically sensitive stocks (.RUT) and transportation stocks (.DJT) have outperformed the broader market. The assassination attempt on Trump, the presumptive Republican presidential nominee, on Saturday in Pennsylvania appears to have boosted his chances of being elected. A Trump presidency is expected to usher in more aggressive trade policies, further tax cuts, and deregulation in areas ranging from climate change to cryptocurrencies. "The main event — the assassination attempt on Donald Trump — hasn't quite hit its mark," said Sam Stovall, chief investment strategist at CFRA Research in New York. "GDP forecasts are unchanged, expectations for a Fed rate cut in September are unchanged, and corporate earnings are ahead of expectations." "So the market momentum remains driven by investor optimism," Stovall added. Investor sentiment was also supported by expectations that the Federal Reserve will begin a rate-cutting cycle as early as September, with as many as three cuts possible before the end of the year. "A rate cut in September is virtually guaranteed," said Ross Mayfield, an analyst at Baird Investment Strategy in Louisville, Kentucky. "We're in the same position we were seven months ago, which is the promise of a Fed rate cut without the risk of a recession. But there's still a lot riding on the Fed's actions." Speaking to the Economic Club of Washington, Fed Chairman Jerome Powell reiterated his confidence that the U.S. economy can avoid a recession, with recent data showing progress in bringing inflation back to the central bank's 2% target. The Dow Jones Industrial Average (.DJI) rose 210.82 points, or 0.53%, to 40,211.72. The S&P 500 (.SPX) rose 15.87 points, or 0.28%, to 5,631.22, while the Nasdaq Composite (.IXIC) rose 74.12 points, or 0.40%, to 18,472.57. Among the 11 major sectors in the S&P 500, energy stocks (.SPNY) posted the biggest percentage gains, while utilities (.SPLRCU) lagged. Goldman Sachs (GS.N) more than doubled its second-quarter profit, beating analysts' expectations on solid performance in debt insurance and fixed-income trading. The brokerage's shares rose 2.6%. Macy's Inc (MN) shares fell 11.7% after the department store ended buyout talks with Arkhouse Management and Brigade Capital. The prospect of a second term for Donald Trump sent shares of Trump Media & Technology Group (DJT.O) soaring 31.4%. Cryptocurrency stocks also saw significant gains, with Coinbase Global (COIN.O), Marathon Digital Holdings (MARA.O) and Riot Platforms (RIOT.O) all rising between 11.4% and 18.3%. Other stocks that would likely benefit from a possible second Trump term also saw gains, with gun maker Smith & Wesson (SWBI.O) and correctional facility operator GEO Group (GEO.N) up 11.4% and 9.3%, respectively. Meanwhile, solar energy stocks fell as the prospect of a Trump election dampened expectations for U.S. renewable energy subsidies. Sunrun (RUN.O) and SolarEdge Technologies (SEDGO.O) fell 9.0% and 15.4%, respectively. U.S.-listed Chinese stocks also fell on concerns about tighter trade restrictions under the new Trump administration. The iShares China Largecap ETF fell 2.2%. On the New York Stock Exchange, gainers outnumbered losers 1.35-to-1; on the Nasdaq, gainers outnumbered losers 1.50-to-1.

News are provided by InstaForex

Read more: https://ifxpr.com/3LrBcyg

- IFX Bella

- Posts: 433

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: Global economy under pressure: prices fall on trade tensions

US small-cap stocks have seen a strong rally amid expectations of lower interest rates and an improving outlook for Donald Trump, the Republican presidential nominee known for his support for policies that favor small domestic companies. The Russell 2000 (.RUT), an index of small companies, has risen more than 11.5% over the past five days, its biggest gain in that time frame since April 2020. However, technology and growth stocks have been choppy, supporting the view that small-cap stocks have benefited from investors shifting away from this year's best-performing companies to less popular parts of the market. The selloff in tech stocks has intensified this week after reports that the U.S. is considering tougher restrictions on chip exports to China and after Donald Trump's comments on Taiwan raised geopolitical concerns about the sector. The Nasdaq 100 tech index (.NDX) has fallen 3% since last week, including its biggest one-day drop this year on Wednesday. The S&P 500 (.SPX), typically used as a benchmark for large-cap stocks, rose 0.2%. "The landscape has changed," said Eric Kuby, chief investment officer at North Star Investment Management Corp., a small-cap firm. "I'm hopeful that this rally over the past week is just the beginning of a multi-year period where small companies can gain significant ground." Smaller stocks have been sliding for months as investors pile into the big tech stocks that have dominated the market for much of 2024. Despite the recent jump, the Russell 2000 is up only 10.5% year to date, while the S&P 500 is up 17% and the Nasdaq 100 is up nearly 18%.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4cMLULw

US small-cap stocks have seen a strong rally amid expectations of lower interest rates and an improving outlook for Donald Trump, the Republican presidential nominee known for his support for policies that favor small domestic companies. The Russell 2000 (.RUT), an index of small companies, has risen more than 11.5% over the past five days, its biggest gain in that time frame since April 2020. However, technology and growth stocks have been choppy, supporting the view that small-cap stocks have benefited from investors shifting away from this year's best-performing companies to less popular parts of the market. The selloff in tech stocks has intensified this week after reports that the U.S. is considering tougher restrictions on chip exports to China and after Donald Trump's comments on Taiwan raised geopolitical concerns about the sector. The Nasdaq 100 tech index (.NDX) has fallen 3% since last week, including its biggest one-day drop this year on Wednesday. The S&P 500 (.SPX), typically used as a benchmark for large-cap stocks, rose 0.2%. "The landscape has changed," said Eric Kuby, chief investment officer at North Star Investment Management Corp., a small-cap firm. "I'm hopeful that this rally over the past week is just the beginning of a multi-year period where small companies can gain significant ground." Smaller stocks have been sliding for months as investors pile into the big tech stocks that have dominated the market for much of 2024. Despite the recent jump, the Russell 2000 is up only 10.5% year to date, while the S&P 500 is up 17% and the Nasdaq 100 is up nearly 18%.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4cMLULw

- IFX Bella

- Posts: 433

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: Friday and Biden Weekend: Fiscal Week Outlook

Wall Street opened the morning with news that came as no surprise: President Joe Biden announced his withdrawal from the presidential race. The market reacted mutedly to the news, with Wall Street futures slightly higher, bond yields slightly lower, and the dollar virtually unchanged. Biden has thrown his support behind his Vice President Kamala Harris, giving her a lead position for the nomination at the Democratic National Convention, which runs from August 19 to 22. It is also possible that the party may consider a virtual nomination before the convention. According to online betting site PredictIT, the price for Donald Trump to win has fallen 5 cents to 59 cents, while the price for Harris has increased 13 cents to 40 cents. California Governor Gavin Newsom, another possible Democratic candidate, is still behind at 3 cents. Goldman Sachs said in a report that it does not expect significant changes in the Democrats' fiscal and trade policies if Harris wins. Back to Friday's events. U.S. stocks continued to decline on Friday as chaos continued to rage around a global software outage, adding further uncertainty to an already volatile market. Massive technology disruptions have hit industries including aviation, banking and healthcare after a software bug at Crowdstrike (CRWD.O) disrupted Microsoft's (MSFT.O) Windows operating system. While the vulnerability has been identified and fixed, some services continue to experience technical difficulties. Crowdstrike shares fell 11.1%, while rival cybersecurity companies Palo Alto Networks (PANW.O) and SentinelOne (S.N) rose 2.2% and 7.8%, respectively.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3WwFjPF

Wall Street opened the morning with news that came as no surprise: President Joe Biden announced his withdrawal from the presidential race. The market reacted mutedly to the news, with Wall Street futures slightly higher, bond yields slightly lower, and the dollar virtually unchanged. Biden has thrown his support behind his Vice President Kamala Harris, giving her a lead position for the nomination at the Democratic National Convention, which runs from August 19 to 22. It is also possible that the party may consider a virtual nomination before the convention. According to online betting site PredictIT, the price for Donald Trump to win has fallen 5 cents to 59 cents, while the price for Harris has increased 13 cents to 40 cents. California Governor Gavin Newsom, another possible Democratic candidate, is still behind at 3 cents. Goldman Sachs said in a report that it does not expect significant changes in the Democrats' fiscal and trade policies if Harris wins. Back to Friday's events. U.S. stocks continued to decline on Friday as chaos continued to rage around a global software outage, adding further uncertainty to an already volatile market. Massive technology disruptions have hit industries including aviation, banking and healthcare after a software bug at Crowdstrike (CRWD.O) disrupted Microsoft's (MSFT.O) Windows operating system. While the vulnerability has been identified and fixed, some services continue to experience technical difficulties. Crowdstrike shares fell 11.1%, while rival cybersecurity companies Palo Alto Networks (PANW.O) and SentinelOne (S.N) rose 2.2% and 7.8%, respectively.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3WwFjPF

- IFX Bella

- Posts: 433

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: Tech Profits Fail to Save Wall Street from Declines

Wall Street's major indices ended the session marginally lower on Tuesday, erasing modest intraday gains in the final minutes of trading as investors looked to fresh earnings reports from Alphabet (GOOGL.O) and Tesla (TSLA.O). The so-called "Magnificent Seven" companies reported results after the market closed, posting positive financial results for the second quarter. Tesla surprised analysts with an unexpected revenue gain, delivering more cars than expected on the back of price cuts and incentives. Meanwhile, Alphabet beat revenue estimates, helped by higher digital ad sales and strong demand for its cloud services. However, ahead of the earnings call, Tesla shares fell 2%, while Google's parent company rose 0.1%. The tech giants' financial results are critical to understanding whether they can sustain their record growth in 2024 or whether U.S. stocks are overvalued. Investors are also concerned about whether the shift away from mega-caps to less-efficient sectors will continue. The Russell 2000 small-cap (.RUT) rose 1% on the day. "We're focusing on earnings because that's what's going to be the story this week and next, and the market's reaction to those numbers will be very telling," said Jack Janasiewicz, chief portfolio strategist at Natixis Investment Managers. Speaking about the shift in focus in smaller-cap stocks, the expert added: "The jury is still out on this and we need more evidence that this is sustainable, which again comes down to earnings." Big-cap stocks initially supported the markets on Tuesday, with all three benchmark indexes in positive territory. However, while the likes of Apple (AAPL.O), Microsoft (MSFT.O) and Amazon.com (AMZN.O) rose between 0.3% and 2.1%, the overall market rally slowed in the afternoon, leading to a slight decline in the final results. Stock markets were also under pressure from disappointing earnings from big-name companies. United Parcel Service (UPS.N), a leading indicator of the health of the global economy, fell 12.1% after earnings fell short of expectations amid weaker delivery demand and rising labor costs. UPS shares ended the day at their lowest in four years. General Motors (GM.N) fell 6.4% despite reporting strong second-quarter results and raising its full-year profit forecast. Comcast (CMCSA.O) lost 2.6% after disappointing revenue data. NXP Semiconductors (NXPI.O) fell 7.6% after reporting third-quarter revenue that missed expectations, dragging the Philadelphia SE Semiconductor (.SOX) index down 1.5%. Spotify (SPOT.N) jumped 12% after reporting record quarterly profit that slightly beat analysts' expectations. Coca-Cola (KO.N) also rose 0.3% after raising its full-year sales and profit forecasts. Of the first 74 S&P 500 companies to report quarterly results this season, 81.1% beat estimates, according to LSEG. Yanasevich noted that while it's too early to draw definitive conclusions, the current earnings call shows that companies that miss expectations are suffering greatly, even if their results are generally positive. High market prices and expectations don't always guarantee significant stock gains. "If your results don't meet expectations, the punishment may be more severe given current market conditions," he added. The S&P 500 (.SPX) fell 8.67 points, or 0.16%, to 5,555.74. The Nasdaq Composite (.IXIC) fell 10.22 points, or 0.06%, to 17,997.35. The Dow Jones Industrial Average (.DJI) lost 57.35 points, or 0.14%, to 40,358.09. Eight of the S&P's 11 major sectors ended the day in the red, with energy (.SPNY) the worst performer, down 1.6% as U.S. oil prices fell to a six-week low.

News are provided by InstaForex.

Read more: https://ifxpr.com/4cKejlv

Wall Street's major indices ended the session marginally lower on Tuesday, erasing modest intraday gains in the final minutes of trading as investors looked to fresh earnings reports from Alphabet (GOOGL.O) and Tesla (TSLA.O). The so-called "Magnificent Seven" companies reported results after the market closed, posting positive financial results for the second quarter. Tesla surprised analysts with an unexpected revenue gain, delivering more cars than expected on the back of price cuts and incentives. Meanwhile, Alphabet beat revenue estimates, helped by higher digital ad sales and strong demand for its cloud services. However, ahead of the earnings call, Tesla shares fell 2%, while Google's parent company rose 0.1%. The tech giants' financial results are critical to understanding whether they can sustain their record growth in 2024 or whether U.S. stocks are overvalued. Investors are also concerned about whether the shift away from mega-caps to less-efficient sectors will continue. The Russell 2000 small-cap (.RUT) rose 1% on the day. "We're focusing on earnings because that's what's going to be the story this week and next, and the market's reaction to those numbers will be very telling," said Jack Janasiewicz, chief portfolio strategist at Natixis Investment Managers. Speaking about the shift in focus in smaller-cap stocks, the expert added: "The jury is still out on this and we need more evidence that this is sustainable, which again comes down to earnings." Big-cap stocks initially supported the markets on Tuesday, with all three benchmark indexes in positive territory. However, while the likes of Apple (AAPL.O), Microsoft (MSFT.O) and Amazon.com (AMZN.O) rose between 0.3% and 2.1%, the overall market rally slowed in the afternoon, leading to a slight decline in the final results. Stock markets were also under pressure from disappointing earnings from big-name companies. United Parcel Service (UPS.N), a leading indicator of the health of the global economy, fell 12.1% after earnings fell short of expectations amid weaker delivery demand and rising labor costs. UPS shares ended the day at their lowest in four years. General Motors (GM.N) fell 6.4% despite reporting strong second-quarter results and raising its full-year profit forecast. Comcast (CMCSA.O) lost 2.6% after disappointing revenue data. NXP Semiconductors (NXPI.O) fell 7.6% after reporting third-quarter revenue that missed expectations, dragging the Philadelphia SE Semiconductor (.SOX) index down 1.5%. Spotify (SPOT.N) jumped 12% after reporting record quarterly profit that slightly beat analysts' expectations. Coca-Cola (KO.N) also rose 0.3% after raising its full-year sales and profit forecasts. Of the first 74 S&P 500 companies to report quarterly results this season, 81.1% beat estimates, according to LSEG. Yanasevich noted that while it's too early to draw definitive conclusions, the current earnings call shows that companies that miss expectations are suffering greatly, even if their results are generally positive. High market prices and expectations don't always guarantee significant stock gains. "If your results don't meet expectations, the punishment may be more severe given current market conditions," he added. The S&P 500 (.SPX) fell 8.67 points, or 0.16%, to 5,555.74. The Nasdaq Composite (.IXIC) fell 10.22 points, or 0.06%, to 17,997.35. The Dow Jones Industrial Average (.DJI) lost 57.35 points, or 0.14%, to 40,358.09. Eight of the S&P's 11 major sectors ended the day in the red, with energy (.SPNY) the worst performer, down 1.6% as U.S. oil prices fell to a six-week low.

News are provided by InstaForex.

Read more: https://ifxpr.com/4cKejlv

- IFX Bella

- Posts: 433

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: How Mega-Cap Uncertainty Impacted S&P, Nasdaq Drops

The S&P 500 and Nasdaq Composite ended a volatile session lower on Thursday, failing to recover lost ground from the previous day's tech-driven selloff. Investors struggled with uncertainty over the outlook for mega-caps. The Dow Jones Industrial Average, on the other hand, extended its morning gains to close higher on strong U.S. gross domestic product data. Small-cap stocks also rose as investors turned away from megacaps. The Russell 2000 (.RUT) rose 1.3%, partly offsetting its mid-cap losses. Large companies started the day with uncertainty but traded higher in the afternoon, though many of them later fell again. Microsoft (MSFT.O) and Nvidia (NVDA.O) ended the session down 1.7% to 2.4%. Alphabet (GOOGL.O) fell for a second straight day, falling 3.1% to its lowest since May 6. Meanwhile, Tesla (TSLA.O) rose. Weak financial results from Google's parent company and the electric car maker hurt the "Magnificent Seven" group of tech stocks on Wednesday, sending the Nasdaq (.IXIC) and S&P 500 (.SPX) to their biggest declines since 2022. The Cboe Volatility Index (.VIX), known as Wall Street's fear gauge, extended recent gains to close at 18.46, a fresh 14-week high. A GDP report released Thursday showed the U.S. economy grew 2.8% in the second quarter, well above expectations for a 2% rate cut by the Federal Reserve. Inflation eased and expectations for a potential Federal Reserve rate cut in September remained unchanged. Investors are eagerly awaiting Friday's consumer spending data to confirm their belief that the Federal Reserve may soon cut rates.

News are provided by InstaForex.

Read more: https://ifxpr.com/3A79eoM

The S&P 500 and Nasdaq Composite ended a volatile session lower on Thursday, failing to recover lost ground from the previous day's tech-driven selloff. Investors struggled with uncertainty over the outlook for mega-caps. The Dow Jones Industrial Average, on the other hand, extended its morning gains to close higher on strong U.S. gross domestic product data. Small-cap stocks also rose as investors turned away from megacaps. The Russell 2000 (.RUT) rose 1.3%, partly offsetting its mid-cap losses. Large companies started the day with uncertainty but traded higher in the afternoon, though many of them later fell again. Microsoft (MSFT.O) and Nvidia (NVDA.O) ended the session down 1.7% to 2.4%. Alphabet (GOOGL.O) fell for a second straight day, falling 3.1% to its lowest since May 6. Meanwhile, Tesla (TSLA.O) rose. Weak financial results from Google's parent company and the electric car maker hurt the "Magnificent Seven" group of tech stocks on Wednesday, sending the Nasdaq (.IXIC) and S&P 500 (.SPX) to their biggest declines since 2022. The Cboe Volatility Index (.VIX), known as Wall Street's fear gauge, extended recent gains to close at 18.46, a fresh 14-week high. A GDP report released Thursday showed the U.S. economy grew 2.8% in the second quarter, well above expectations for a 2% rate cut by the Federal Reserve. Inflation eased and expectations for a potential Federal Reserve rate cut in September remained unchanged. Investors are eagerly awaiting Friday's consumer spending data to confirm their belief that the Federal Reserve may soon cut rates.

News are provided by InstaForex.

Read more: https://ifxpr.com/3A79eoM

- IFX Bella

- Posts: 433

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: Inflation data, tech gains lift Wall Street

"What we see from Apple, Microsoft and Amazon.com next week will really determine whether the current stock rotation continues and which direction the market goes," said Greg Bootle, head of U.S. equity and derivatives strategy at BNP Paribas. Market rotation refers to investors moving from high-growth stocks with high valuations to less valued sectors such as mid- and small-cap stocks. This process appears to have accelerated in recent weeks, as small-cap indices such as the Russell 2000 (.RUT) and the S&P Small Cap 600 (.SPCY) hit their fourth weekly closing highs. The Russell 2000 (.RUT) posted its third straight weekly gain, its best three-week performance since August 2022. These small-cap, economically sensitive companies were supported on Friday by a modest rise in U.S. prices in June, highlighting weakening inflation and potentially opening the door for the Fed to begin easing policy as early as September. The probability of a 25 basis point rate cut at the Fed's September meeting remained unchanged at about 88% following the release of PCE inflation data, according to CME FedWatch data. Traders continue to expect two rate cuts by December, LSEG data show. "We do think the robust economic data is supportive of broader trading," said Adam Hetts, global head of multi-asset at Janus Henderson, noting that small-cap stocks have outperformed the S&P 500 by more than 10% over the past month. The rise in trading activity has also helped lift cyclical sectors. All 11 sectors of the S&P 500 index rose on Friday, led by industrials (.SPLRCI) and materials (.SPLRCM). On Friday, the S&P 500 (.SPX) rose 59.88 points, or 1.11%, to 5,459.10, while the Nasdaq Composite (.IXIC) rose 176.16 points, or 1.03%, to 17,357.88. The Dow Jones Industrial Average (.DJI) rose 654.27 points, or 1.64%, to 40,589.34. Over the past week, the Dow has gained 0.75%, while the S&P 500 has fallen 0.82% and the Nasdaq has fallen 2.08%. Among the companies that saw their shares rise on positive earnings reports were Deckers Outdoor (DECK.N), which jumped 6.3% after raising its full-year profit forecast, and oilfield services company Baker Hughes (BKR.O), which rose 5.8% after it beat second-quarter profit estimates. Norfolk Southern (NSC.N) shares rose 10.9%, its biggest one-day gain since March 2020, after the rail operator posted quarterly profit that beat Wall Street expectations, thanks to strong pricing for its services. Meanwhile, shares of medical equipment maker Dexcom (DXCM.O) plunged 40.6% after cutting its full-year revenue forecast, causing significant disappointment among investors. Trading volume on U.S. exchanges totaled 10.92 billion shares, below the 20-day average of 11.61 billion shares. While the S&P 500 is still just 5% below its all-time high and has gained nearly 14% this year, some investors are beginning to worry that Wall Street may be overly optimistic about future earnings growth. That could leave stocks vulnerable if companies fail to meet expectations in the coming months. Investors are also looking ahead to comments from the Federal Reserve's meeting on Wednesday to see if policymakers plan to cut interest rates, something many market participants expect in September. Employment data due later in the week, including the monthly labor market report, could provide a clearer picture of how severe the labor market slump is becoming. These events could have a significant impact on the future direction of the market, and investors will be watching closely to adjust their strategies and mitigate risk. "This is a critical time for the markets," said Bryant VanCronkhite, senior portfolio manager at Allspring. "Investors are starting to question why they are paying such high prices for AI-related companies, while the market is worried that the Fed may miss out on a soft landing, causing significant volatility." Recent weeks have shown a shift away from leading tech giants and toward sectors that have long been overlooked, including small-cap and value stocks like financial institutions. The Russell 1000 Value Index has gained more than 3% over the past month, while the Russell 1000 Growth Index has fallen nearly 3%. The Russell 2000 Small Cap Index has gained nearly 9% over the period, while the S&P 500 has lost more than 1%. Markets are currently fairly certain that the Fed will begin cutting interest rates at its September meeting, with a 66 basis point cut forecast by year-end, according to the CME FedWatch tool. Expected employment data due later this week could change those forecasts. If the data shows the economy is slowing more quickly, the odds of a rate cut could increase. Conversely, if employment picks up, it could signal an economic recovery, which could in turn impact the Fed's decisions. Thomas Frank Analytical expert of InstaForex © 2007-2024 Back to the list Open trading account InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading. Analysis Articles Fundamental Analysis Trading Plan Cryptocurrencies Technical Analysis Breaking Forecast All Analytics Crypto-currencies Technical Analysis of Intraday Price Movement of Solana Cryptocurrency, Friday July 26, 2024. Arief Makmur 04:14 2024-07-29 +02:00 1105 Fundamental analysis Overview of GBP/USD. Preview of the week: NonFarm Payrolls and Unemployment in the US will not affect anything Paolo Greco 03:48 2024-07-29 +02:00 1120 Forecast USD/JPY: trading tips for beginners for the European session on July 29 Overview of trading and tips on USD/JPY The price test of 153.44 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward Jakub Novak 10:00 2024-07-29 +02:00 1015 Forecast GBP/USD: trading tips for beginners for the European session on July 29 Overview of trading and tips on GBP/USD The price test of 1.2856 coincided with the MACD indicator just starting to move down from the zero mark, confirming the correct entry Jakub Novak 10:00 2024-07-29 +02:00 1105 Forecast EUR/USD: trading tips for beginners for the European session on July 29 Overview of trading and tips on EUR/USD Despite the release of some important US data, the levels I mentioned were not tested in the second half Jakub Novak 10:00 2024-07-29 +02:00 1120 Technical analysis Forex forecast 07/29/2024: EUR/USD, GBP/USD, USD/JPY and Bitcoin from Sebastian Seliga Video Agenda: 00:00 INTRO 00:30 Totay's key events: German Retail Sales, Retail Sales, GDP, BCB Focus Market Readout 01:29 EUR/USD 03:44 GBP/USD 05:19 USD/JPY 06:59 BTC/USD Useful links: My other Sebastian Seliga 09:56 2024-07-29 +02:00 1120 Analytical News Inflation data, tech gains lift Wall Street PCE inflation rises modestly in June Russell 2000, S&P Small Cap 600 gain for fourth day in five Deckers, Baker Hughes, Norfolk Southern rally after results Indices rise Friday Thomas Frank 09:50 2024-07-29 +02:00 1045 Hot forecast Hot forecast for EUR/USD on July 29, 2024 Considering the empty economic calendar, it's no surprise that market conditions remain unchanged. The dollar is treading water. This situation will likely persist until the Federal Open Market Committee (FOMC) Dean Leo 08:32 2024-07-29 +02:00 1195 Technical analysis Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs , Monday July 29, 2024. Arief Makmur 08:05 2024-07-29 +02:00 1075 Technical analysis Technical Analysis of Intraday Price Movement of Silver Commodity Asset, Monday July 29 2024. Arief Makmur 08:05 2024-07-29 +02:00 1060 Fundamental analysis EUR/USD. July Fed meeting, Eurozone inflation, ISM Manufacturing Index, Non-Farm Payrolls Irina Manzenko 07:58 2024-07-29 +02:00 1270 Technical analysis Forecast for EUR/USD on July 29, 2024 EUR/USD Ahead of the Federal Reserve's rate decision on July 31, the euro has decided to drift within the range of 1.0788-1.0905. This indicates market instability, which is most likely Laurie Bailey 05:28 2024-07-29 +02:00 1435 Technical analysis Forecast for GBP/USD on July 29, 2024 GBP/USD The British pound is slightly rising from the support level at 1.2847. The Marlin oscillator hovers around the zero line, indicating sideways movement. Traditionally, to confirm the direction Laurie Bailey 05:28 2024-07-29 +02:00 1435 Technical analysis Forecast for USD/JPY on July 29, 2024 USD/JPY On Thursday and Friday, the yen experienced high volatility, but both days closed less than 20 pips above the support level of 153.60. This was a form of consolidation Laurie Bailey 05:28 2024-07-29 +02:00 1300 Crypto-currencies Technical Analysis of Intraday Price Movement of Cardano Cryptocurrency, Friday July 26, 2024. Arief Makmur 04:14 2024-07-29 +02:00 1135 Crypto-currencies Technical Analysis of Intraday Price Movement of Solana Cryptocurrency, Friday July 26, 2024. Arief Makmur 04:14 2024-07-29 +02:00 1105 Fundamental analysis Overview of GBP/USD. Preview of the week: NonFarm Payrolls and Unemployment in the US will not affect anything Paolo Greco 03:48 2024-07-29 +02:00 1120 Forecast USD/JPY: trading tips for beginners for the European session on July 29 Overview of trading and tips on USD/JPY The price test of 153.44 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward Jakub Novak 10:00 2024-07-29 +02:00 1015 Forecast GBP/USD: trading tips for beginners for the European session on July 29 Overview of trading and tips on GBP/USD The price test of 1.2856 coincided with the MACD indicator just starting to move down from the zero mark, confirming the correct entry Jakub Novak 10:00 2024-07-29 +02:00 1105 Awards InstaForex as Most Innovative Forex Broker 2021 by GBM Best managed account 2019 Best Affiliate Program 2022 Best Forex Broker / International Investor Awards 2022 InstaForex as Most Innovative Forex Broker 2021 by GBM Best managed account 2019 Best Affiliate Program 2022 Best Forex Broker / International Investor Awards 2022 Sponsorship General sponsor of HKM Zvolen Official partner of Dragon Racing Participant of the Dakar rally InstaForex Loprais Team General sponsor of HKM Zvolen Official partner of Dragon Racing Participant of the Dakar rally InstaForex Loprais Team General sponsor of HKM Zvolen Open trading account For Traders Trading Platforms Trading Instruments Account Types Types of order execution Professional Trader VIP accounts Deposit and Withdrawal CFD Trading Cryptocurrency trading For Beginners Getting Started Guide to Forex Training Open Demo Account About InstaForex Why Choose Us Company News Careers For Partners Awards InstaSport Regulation Support FAQ Contacts Take a break Forex Portal Forex humour Webinars Download Trading Platform English Legal documentation | Cookie settings | Disclaimers | Site map Scam alerts on fraudsters impersonating our Company INSTANT TRADING EU LTD is Cyprus Investment Firm (HE266937) regulated by the Cyprus Securities and Exchange Commission, license number 266/15, and registered address: Spetson 23A, Leda Court, Block B, B203, 4000, Mesa Geitonia, Limassol, Cyprus. INSTANT TRADING EU LTD is providing investment services under InstaForex brand and operates www.instaforex.eu website CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.34% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

News are provided by InstaForex.

Read more: https://ifxpr.com/3yhADUv

"What we see from Apple, Microsoft and Amazon.com next week will really determine whether the current stock rotation continues and which direction the market goes," said Greg Bootle, head of U.S. equity and derivatives strategy at BNP Paribas. Market rotation refers to investors moving from high-growth stocks with high valuations to less valued sectors such as mid- and small-cap stocks. This process appears to have accelerated in recent weeks, as small-cap indices such as the Russell 2000 (.RUT) and the S&P Small Cap 600 (.SPCY) hit their fourth weekly closing highs. The Russell 2000 (.RUT) posted its third straight weekly gain, its best three-week performance since August 2022. These small-cap, economically sensitive companies were supported on Friday by a modest rise in U.S. prices in June, highlighting weakening inflation and potentially opening the door for the Fed to begin easing policy as early as September. The probability of a 25 basis point rate cut at the Fed's September meeting remained unchanged at about 88% following the release of PCE inflation data, according to CME FedWatch data. Traders continue to expect two rate cuts by December, LSEG data show. "We do think the robust economic data is supportive of broader trading," said Adam Hetts, global head of multi-asset at Janus Henderson, noting that small-cap stocks have outperformed the S&P 500 by more than 10% over the past month. The rise in trading activity has also helped lift cyclical sectors. All 11 sectors of the S&P 500 index rose on Friday, led by industrials (.SPLRCI) and materials (.SPLRCM). On Friday, the S&P 500 (.SPX) rose 59.88 points, or 1.11%, to 5,459.10, while the Nasdaq Composite (.IXIC) rose 176.16 points, or 1.03%, to 17,357.88. The Dow Jones Industrial Average (.DJI) rose 654.27 points, or 1.64%, to 40,589.34. Over the past week, the Dow has gained 0.75%, while the S&P 500 has fallen 0.82% and the Nasdaq has fallen 2.08%. Among the companies that saw their shares rise on positive earnings reports were Deckers Outdoor (DECK.N), which jumped 6.3% after raising its full-year profit forecast, and oilfield services company Baker Hughes (BKR.O), which rose 5.8% after it beat second-quarter profit estimates. Norfolk Southern (NSC.N) shares rose 10.9%, its biggest one-day gain since March 2020, after the rail operator posted quarterly profit that beat Wall Street expectations, thanks to strong pricing for its services. Meanwhile, shares of medical equipment maker Dexcom (DXCM.O) plunged 40.6% after cutting its full-year revenue forecast, causing significant disappointment among investors. Trading volume on U.S. exchanges totaled 10.92 billion shares, below the 20-day average of 11.61 billion shares. While the S&P 500 is still just 5% below its all-time high and has gained nearly 14% this year, some investors are beginning to worry that Wall Street may be overly optimistic about future earnings growth. That could leave stocks vulnerable if companies fail to meet expectations in the coming months. Investors are also looking ahead to comments from the Federal Reserve's meeting on Wednesday to see if policymakers plan to cut interest rates, something many market participants expect in September. Employment data due later in the week, including the monthly labor market report, could provide a clearer picture of how severe the labor market slump is becoming. These events could have a significant impact on the future direction of the market, and investors will be watching closely to adjust their strategies and mitigate risk. "This is a critical time for the markets," said Bryant VanCronkhite, senior portfolio manager at Allspring. "Investors are starting to question why they are paying such high prices for AI-related companies, while the market is worried that the Fed may miss out on a soft landing, causing significant volatility." Recent weeks have shown a shift away from leading tech giants and toward sectors that have long been overlooked, including small-cap and value stocks like financial institutions. The Russell 1000 Value Index has gained more than 3% over the past month, while the Russell 1000 Growth Index has fallen nearly 3%. The Russell 2000 Small Cap Index has gained nearly 9% over the period, while the S&P 500 has lost more than 1%. Markets are currently fairly certain that the Fed will begin cutting interest rates at its September meeting, with a 66 basis point cut forecast by year-end, according to the CME FedWatch tool. Expected employment data due later this week could change those forecasts. If the data shows the economy is slowing more quickly, the odds of a rate cut could increase. Conversely, if employment picks up, it could signal an economic recovery, which could in turn impact the Fed's decisions. Thomas Frank Analytical expert of InstaForex © 2007-2024 Back to the list Open trading account InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading. Analysis Articles Fundamental Analysis Trading Plan Cryptocurrencies Technical Analysis Breaking Forecast All Analytics Crypto-currencies Technical Analysis of Intraday Price Movement of Solana Cryptocurrency, Friday July 26, 2024. Arief Makmur 04:14 2024-07-29 +02:00 1105 Fundamental analysis Overview of GBP/USD. Preview of the week: NonFarm Payrolls and Unemployment in the US will not affect anything Paolo Greco 03:48 2024-07-29 +02:00 1120 Forecast USD/JPY: trading tips for beginners for the European session on July 29 Overview of trading and tips on USD/JPY The price test of 153.44 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward Jakub Novak 10:00 2024-07-29 +02:00 1015 Forecast GBP/USD: trading tips for beginners for the European session on July 29 Overview of trading and tips on GBP/USD The price test of 1.2856 coincided with the MACD indicator just starting to move down from the zero mark, confirming the correct entry Jakub Novak 10:00 2024-07-29 +02:00 1105 Forecast EUR/USD: trading tips for beginners for the European session on July 29 Overview of trading and tips on EUR/USD Despite the release of some important US data, the levels I mentioned were not tested in the second half Jakub Novak 10:00 2024-07-29 +02:00 1120 Technical analysis Forex forecast 07/29/2024: EUR/USD, GBP/USD, USD/JPY and Bitcoin from Sebastian Seliga Video Agenda: 00:00 INTRO 00:30 Totay's key events: German Retail Sales, Retail Sales, GDP, BCB Focus Market Readout 01:29 EUR/USD 03:44 GBP/USD 05:19 USD/JPY 06:59 BTC/USD Useful links: My other Sebastian Seliga 09:56 2024-07-29 +02:00 1120 Analytical News Inflation data, tech gains lift Wall Street PCE inflation rises modestly in June Russell 2000, S&P Small Cap 600 gain for fourth day in five Deckers, Baker Hughes, Norfolk Southern rally after results Indices rise Friday Thomas Frank 09:50 2024-07-29 +02:00 1045 Hot forecast Hot forecast for EUR/USD on July 29, 2024 Considering the empty economic calendar, it's no surprise that market conditions remain unchanged. The dollar is treading water. This situation will likely persist until the Federal Open Market Committee (FOMC) Dean Leo 08:32 2024-07-29 +02:00 1195 Technical analysis Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs , Monday July 29, 2024. Arief Makmur 08:05 2024-07-29 +02:00 1075 Technical analysis Technical Analysis of Intraday Price Movement of Silver Commodity Asset, Monday July 29 2024. Arief Makmur 08:05 2024-07-29 +02:00 1060 Fundamental analysis EUR/USD. July Fed meeting, Eurozone inflation, ISM Manufacturing Index, Non-Farm Payrolls Irina Manzenko 07:58 2024-07-29 +02:00 1270 Technical analysis Forecast for EUR/USD on July 29, 2024 EUR/USD Ahead of the Federal Reserve's rate decision on July 31, the euro has decided to drift within the range of 1.0788-1.0905. This indicates market instability, which is most likely Laurie Bailey 05:28 2024-07-29 +02:00 1435 Technical analysis Forecast for GBP/USD on July 29, 2024 GBP/USD The British pound is slightly rising from the support level at 1.2847. The Marlin oscillator hovers around the zero line, indicating sideways movement. Traditionally, to confirm the direction Laurie Bailey 05:28 2024-07-29 +02:00 1435 Technical analysis Forecast for USD/JPY on July 29, 2024 USD/JPY On Thursday and Friday, the yen experienced high volatility, but both days closed less than 20 pips above the support level of 153.60. This was a form of consolidation Laurie Bailey 05:28 2024-07-29 +02:00 1300 Crypto-currencies Technical Analysis of Intraday Price Movement of Cardano Cryptocurrency, Friday July 26, 2024. Arief Makmur 04:14 2024-07-29 +02:00 1135 Crypto-currencies Technical Analysis of Intraday Price Movement of Solana Cryptocurrency, Friday July 26, 2024. Arief Makmur 04:14 2024-07-29 +02:00 1105 Fundamental analysis Overview of GBP/USD. Preview of the week: NonFarm Payrolls and Unemployment in the US will not affect anything Paolo Greco 03:48 2024-07-29 +02:00 1120 Forecast USD/JPY: trading tips for beginners for the European session on July 29 Overview of trading and tips on USD/JPY The price test of 153.44 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward Jakub Novak 10:00 2024-07-29 +02:00 1015 Forecast GBP/USD: trading tips for beginners for the European session on July 29 Overview of trading and tips on GBP/USD The price test of 1.2856 coincided with the MACD indicator just starting to move down from the zero mark, confirming the correct entry Jakub Novak 10:00 2024-07-29 +02:00 1105 Awards InstaForex as Most Innovative Forex Broker 2021 by GBM Best managed account 2019 Best Affiliate Program 2022 Best Forex Broker / International Investor Awards 2022 InstaForex as Most Innovative Forex Broker 2021 by GBM Best managed account 2019 Best Affiliate Program 2022 Best Forex Broker / International Investor Awards 2022 Sponsorship General sponsor of HKM Zvolen Official partner of Dragon Racing Participant of the Dakar rally InstaForex Loprais Team General sponsor of HKM Zvolen Official partner of Dragon Racing Participant of the Dakar rally InstaForex Loprais Team General sponsor of HKM Zvolen Open trading account For Traders Trading Platforms Trading Instruments Account Types Types of order execution Professional Trader VIP accounts Deposit and Withdrawal CFD Trading Cryptocurrency trading For Beginners Getting Started Guide to Forex Training Open Demo Account About InstaForex Why Choose Us Company News Careers For Partners Awards InstaSport Regulation Support FAQ Contacts Take a break Forex Portal Forex humour Webinars Download Trading Platform English Legal documentation | Cookie settings | Disclaimers | Site map Scam alerts on fraudsters impersonating our Company INSTANT TRADING EU LTD is Cyprus Investment Firm (HE266937) regulated by the Cyprus Securities and Exchange Commission, license number 266/15, and registered address: Spetson 23A, Leda Court, Block B, B203, 4000, Mesa Geitonia, Limassol, Cyprus. INSTANT TRADING EU LTD is providing investment services under InstaForex brand and operates www.instaforex.eu website CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.34% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

News are provided by InstaForex.

Read more: https://ifxpr.com/3yhADUv

- IFX Bella

- Posts: 433

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: Tech in stress: Stocks fall, chipmakers rise amid AI debate

US stock indices ended trading mixed on Tuesday, with the S&P 500 and Nasdaq falling under pressure from weak chipmakers and tech giants, while the Dow Jones Industrial Average showed a slight increase. Microsoft missed expectations Tech giant Microsoft, considered a leader in artificial intelligence, ended the day down 0.89%, reaching $422.92 per share. The company's shares fell another 5% in after-hours trading as quarterly results for its cloud service Azure fell short of analysts' forecasts. Nvidia and other chipmakers are losing ground Shares in Nvidia, a recognized leader among the beneficiaries of AI growth and the second-largest player in the S&P 500, fell 7.04% to $103.73 per share. The decline had a negative impact on other chip companies, leading to a 3.88% decline in the Philadelphia Semiconductor Index. Expectations from the giants' reports This week, investors are eagerly awaiting reports from giants such as Apple, Amazon, and Meta Platforms. Apple shares rose slightly by 0.26%, reaching $218.80, while Amazon lost 0.81%, falling to $181.71. Meta Platforms also showed a decline of 0.54%, ending the day at $463.19. Investors are concerned about the valuation of these companies against the backdrop of the current economic situation. "A lot of people are wondering right now how to profit from investing in artificial intelligence," said Stephen Massocca, senior vice president at Wedbush Securities in San Francisco. Investors are choosing caution: high stock prices are in question With expectations of a Fed rate cut growing, market participants are starting to question the fair value of stocks. "Companies are showing good financial results, but the main issue is how much their shares are worth. These are expensive securities, and investors should carefully evaluate their investments," the expert comments.

News are provided by InstaForex.

Read more: https://ifxpr.com/3LPnkxH

US stock indices ended trading mixed on Tuesday, with the S&P 500 and Nasdaq falling under pressure from weak chipmakers and tech giants, while the Dow Jones Industrial Average showed a slight increase. Microsoft missed expectations Tech giant Microsoft, considered a leader in artificial intelligence, ended the day down 0.89%, reaching $422.92 per share. The company's shares fell another 5% in after-hours trading as quarterly results for its cloud service Azure fell short of analysts' forecasts. Nvidia and other chipmakers are losing ground Shares in Nvidia, a recognized leader among the beneficiaries of AI growth and the second-largest player in the S&P 500, fell 7.04% to $103.73 per share. The decline had a negative impact on other chip companies, leading to a 3.88% decline in the Philadelphia Semiconductor Index. Expectations from the giants' reports This week, investors are eagerly awaiting reports from giants such as Apple, Amazon, and Meta Platforms. Apple shares rose slightly by 0.26%, reaching $218.80, while Amazon lost 0.81%, falling to $181.71. Meta Platforms also showed a decline of 0.54%, ending the day at $463.19. Investors are concerned about the valuation of these companies against the backdrop of the current economic situation. "A lot of people are wondering right now how to profit from investing in artificial intelligence," said Stephen Massocca, senior vice president at Wedbush Securities in San Francisco. Investors are choosing caution: high stock prices are in question With expectations of a Fed rate cut growing, market participants are starting to question the fair value of stocks. "Companies are showing good financial results, but the main issue is how much their shares are worth. These are expensive securities, and investors should carefully evaluate their investments," the expert comments.

News are provided by InstaForex.

Read more: https://ifxpr.com/3LPnkxH

- IFX Bella

- Posts: 433

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: The Week Ahead on Wall Street: Economic Fears and Last Week's Results

US Stocks Fall: Second Session in a Row The US stock market fell again on Friday, with the Nasdaq Composite Index reaffirming its position in correction territory. The reason was a weak labor report, which exacerbated fears of a possible recession. Disappointing Jobs Data Nonfarm payrolls increased by just 114,000 in July, according to the Labor Department, well below the 175,000 analysts had expected and the 200,000 minimum needed to maintain population growth. The unemployment rate rose to 4.3%, the highest in three years. Risks to the Economy The weak jobs data has fueled concerns that economic growth is slowing faster than expected, raising questions about the Federal Reserve's decision to leave interest rates unchanged at its meeting on Wednesday. Optimism Turns to Worry Investors have been optimistic for months, citing falling inflation and a modest slowdown in employment as reasons to cut interest rates. That optimism has helped stocks rally, with the S&P 500 up 12% year-to-date and the Nasdaq up nearly 12% despite recent losses. But with the prospect of a rate cut in September following the Fed meeting, investors are worried that higher borrowing costs could already be a drag on economic growth. Disappointing earnings reports from giants like Amazon, Alphabet and Intel are adding to those concerns, adding fuel to the market fire. The Curse of High Expectations Ocean Park Asset Management chief investment officer James St. Aubyn said investors are seeing the consequences of overly optimistic expectations. "We're seeing the curse of high expectations kick in. A soft landing seemed like the only scenario, and any hint of a different outcome is worrisome," he said. Rate Cut Expectations Rising The chance of a 50 basis point rate cut at the Fed's September meeting has jumped to 69.5%, up from 22% at the previous session, according to CME's FedWatch Tool. "We've all gotten used to the idea that the Fed will cut rates. The question now is: Have they waited too long? Is a recession on the horizon?" St. Aubyn asked. Recession Predictors Weak employment data has triggered the so-called "Sahma Rule," which is often seen as a surefire recession predictor. That has led to a selloff in stock markets.

News are provided by InstaForex

Read more: https://ifxpr.com/3WwKP3C

US Stocks Fall: Second Session in a Row The US stock market fell again on Friday, with the Nasdaq Composite Index reaffirming its position in correction territory. The reason was a weak labor report, which exacerbated fears of a possible recession. Disappointing Jobs Data Nonfarm payrolls increased by just 114,000 in July, according to the Labor Department, well below the 175,000 analysts had expected and the 200,000 minimum needed to maintain population growth. The unemployment rate rose to 4.3%, the highest in three years. Risks to the Economy The weak jobs data has fueled concerns that economic growth is slowing faster than expected, raising questions about the Federal Reserve's decision to leave interest rates unchanged at its meeting on Wednesday. Optimism Turns to Worry Investors have been optimistic for months, citing falling inflation and a modest slowdown in employment as reasons to cut interest rates. That optimism has helped stocks rally, with the S&P 500 up 12% year-to-date and the Nasdaq up nearly 12% despite recent losses. But with the prospect of a rate cut in September following the Fed meeting, investors are worried that higher borrowing costs could already be a drag on economic growth. Disappointing earnings reports from giants like Amazon, Alphabet and Intel are adding to those concerns, adding fuel to the market fire. The Curse of High Expectations Ocean Park Asset Management chief investment officer James St. Aubyn said investors are seeing the consequences of overly optimistic expectations. "We're seeing the curse of high expectations kick in. A soft landing seemed like the only scenario, and any hint of a different outcome is worrisome," he said. Rate Cut Expectations Rising The chance of a 50 basis point rate cut at the Fed's September meeting has jumped to 69.5%, up from 22% at the previous session, according to CME's FedWatch Tool. "We've all gotten used to the idea that the Fed will cut rates. The question now is: Have they waited too long? Is a recession on the horizon?" St. Aubyn asked. Recession Predictors Weak employment data has triggered the so-called "Sahma Rule," which is often seen as a surefire recession predictor. That has led to a selloff in stock markets.

News are provided by InstaForex

Read more: https://ifxpr.com/3WwKP3C

- IFX Bella

- Posts: 433

- Joined: Sat Dec 08, 2012 12:39 am