Forex Analysis & Reviews: Nasdaq red flags: Salesforce drops index 1%

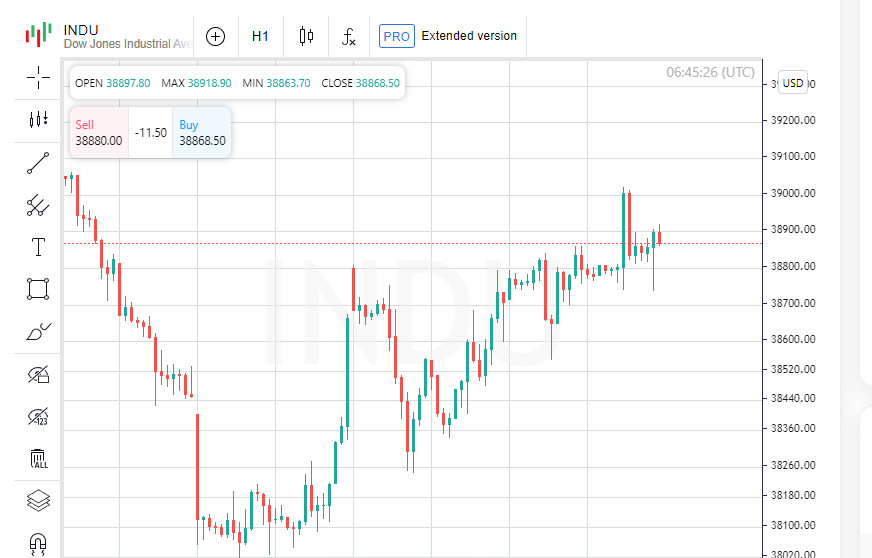

U.S. stock indexes ended lower on Thursday, with the Nasdaq losing more than 1% and tech stocks leading the decline after a disappointing outlook from Salesforce. Investors also weighed data showing the U.S. economy grew more slowly than expected in the first quarter. A separate report showed weekly jobless claims rose more than expected. Salesforce (CRM.N) shares fell 19.7% a day after the company forecast second-quarter profit and revenue below market expectations, citing weak customer spending on its cloud and enterprise products. The S&P 500's technology sector (.SPLRCT) fell 2.5%, leading the decline in the benchmark index. The communications services sector (.SPLRCL) fell 1.1%, while other S&P 500 sectors ended the day higher. The Commerce Department's report showed that first-quarter economic growth was revised down as consumer spending and equipment investment slowed, as well as a key inflation measure fell ahead of the April personal consumption expenditure report. "Typically, a downward revision to GDP would be expected to lift the market, as it would signal that the economy is slowing and signal that the Fed has accomplished its mission, which could lead to rate cuts. "But today we're seeing a different reaction," said Mark Hackett, head of investment research at Nationwide. "I'm a little surprised, but not too surprised, given that after six weeks of rallying, the situation looks pretty healthy. The expectation is that we'll see some consolidation or sideways movement in the market in the near term." The S&P 500 (.SPX) fell 31.47 points, or 0.60%, to end the session at 5,235.48. The Nasdaq Composite (.IXIC) lost 183.50 points, or 1.08%, to end at 16,737.08. The Dow Jones Industrial Average (.DJI) fell 330.06 points, or 0.86%, to 38,111.48. U.S. Treasury yields fell after the data, while the chance of a rate cut of at least 25 basis points in September rose to 50.4% from 48.7%, according to CME's FedWatch tool. Bond yields hit multi-week highs earlier in the week. In after-hours trading, Dell Technologies (DELL.N) shares fell more than 12% after the company reported its quarterly results. The stock ended the session down 5.2%. HP (HPQ.N) shares rose 17% in the regular session after second-quarter revenue beat expectations. Tesla (TSLA.O) shares added 1.5% after it said it was preparing to register its self-driving software in China. Best Buy (BBY.N) shares jumped 13.4% after the company beat quarterly profit estimates. Meanwhile, shares of department store chain Kohl's (KSS.N) fell 22.9% after cutting its full-year sales and profit forecasts. Advancing stocks outnumbered decliners 2.57-to-1 on the NYSE and 1.41-to-1 on the Nasdaq. The S&P 500 posted 14 new 52-week highs and 10 new lows, while the Nasdaq Composite posted 51 new highs and 95 new lows. U.S. exchanges reported trading volume of 12.10 billion shares, slightly below the 20-day average of 12.39 billion shares. The U.S. economy grew more slowly than expected in the first quarter, according to a Commerce Department report that showed consumer spending weakened. Gross domestic product increased 1.3% year-over-year, compared with initial estimates of 1.6%. The U.S. dollar index weakened after hitting a two-week high the day before. U.S. Treasury yields also fell Thursday after two days of gains on weak debt auction results. "The initial reaction to the data was that the likelihood of a Fed rate cut has increased as the slowdown in the economy and consumption could help ease inflation," said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. However, he views rates as one of many factors weighing on the market. The MSCI World Equity Index (.MIWD00000PUS) was down 3.22 points, or 0.41%, at 780.94. While investors digested the GDP data, they were eagerly awaiting Friday's April report on the core U.S. personal consumption expenditures (PCE) price index, a key inflation gauge for the Fed. Earlier in Europe, the STOXX 600 (.STOXX) rose 0.6% after a big drop on Wednesday, driven by data showing German inflation rose more than expected in May. Investors were eyeing key euro zone inflation data due on Friday. The yield on 10-year U.S. Treasury notes fell 7.6 basis points to 4.548%, from 4.624% late Wednesday. The yield on 30-year notes fell 6.3 basis points to 4.6814% from 4.744%, and the yield on 2-year notes, which typically reflects interest rate expectations, fell 5.6 basis points to 4.929% from 4.985%. In the foreign exchange market, the dollar index, which measures the dollar against a basket of currencies including the yen and the euro, fell 0.34% to 104.77. The euro gained 0.26% to $1.0828, while the dollar weakened 0.47% against the Japanese yen to 156.86 yen. In energy, oil prices fell for a second day after the U.S. government reported weak fuel demand and an unexpected increase in gasoline and distillate inventories. U.S. crude fell 1.67% to $77.91 a barrel, while Brent crude futures fell 2.08% to $81.86 a barrel. Spot gold prices rose 0.13% to $2,341.94 an ounce, led by lower dollar and Treasury yields.

News are provided by InstaForex

Read more: https://ifxpr.com/456yOGb

Forex News from InstaForex

Re: Forex News from InstaForex

Forex Analysis & Reviews: Wall Street Warning Signs: Dow Transportation Stocks, Treasuries Fall

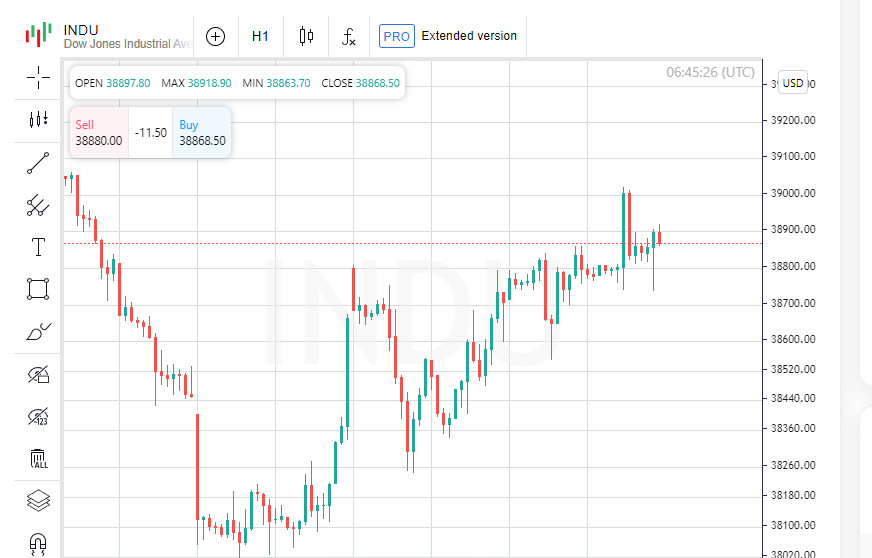

The Dow Jones Transportation Average (.DJT) is down about 5% this year, in stark contrast to the S&P 500's (.SPX) 9% year-to-date gain and the Dow Jones Industrial Average's (.DJI) 1% gain, which topped 40,000 for the first time this month. While major indexes like the S&P 500, Nasdaq Composite (.IXIC), and Dow have all hit new all-time highs this year, the Dow Transportation Average has yet to surpass its November 2021 record and is currently down about 12% from that level. Some investors believe that the continued decline in the 20-component transportation index, which includes railroads, airlines, trucking companies and trucking firms, could signal weakness in the economy. It could also prevent further strong gains in the broader market if these companies fail to recover. Other struggling sectors include small-cap stocks, which some analysts say are more sensitive to economic growth than larger companies. Also in trouble are real estate stocks and some large consumer companies such as Nike (NKE.N), McDonald's (MCD.N) and Starbucks (SBUX.O). Data this week showed that the U.S. economy grew at an annualized rate of 1.3% in the first quarter, well below the 3.4% growth rate seen in the fourth quarter of 2023. A major test of the strength of the economy and markets will be the release of the monthly U.S. jobs report on June 7. Among the Dow transportation companies, the biggest year-to-date losers have been car rental company Avis Budget (CAR.O), down 37%, trucking company J.B. Hunt Transport (JBHT.O), down 21%, and airline American Airlines (AAL.O), down 17%. Package delivery giants UPS (UPS.N) and FedEx (FDX.N) also lost ground, falling 13% and 1%, respectively. Railroads Union Pacific (UNP.N) and Norfolk Southern (NSC.N) are down about 7%. Only four of the 20 transportation components have outperformed the S&P 500 this year. Stock markets have also been lower this week, with the S&P 500 down more than 2% from its record high hit earlier in May. Rising bond yields have raised concerns about the future performance of stocks. Not all investors agree that the transportation index accurately reflects the health of the broader economy. The index, like the Dow Industrials, is weighted by price rather than market value and includes just 20 stocks. Meanwhile, another important group of companies that is also considered an economic indicator — semiconductor makers — are doing much better. The Philadelphia SE Semiconductor Index (.SOX) is up 20% this year. Investors are pouring in Nvidia and other chip companies that could benefit from growing interest in the business opportunity of artificial intelligence. The overall market trend remains bullish for Horizon's Carlson, who tracks both the transportation and Dow Industrials to gauge market trends according to "Dow Theory." The MSCI Global Equity Index rose Friday afternoon as investors reassessed their month-end positions. Meanwhile, the dollar and Treasury yields fell as data showed a modest rise in U.S. inflation in April. After trading heavily lower for much of the session, the MSCI All Country World Price Index (.MIWD00000PUS) turned positive ahead of the index rebalancing. When trading ended on Wall Street, the global index was up 0.57% to 785.54 after earlier falling to 776.86. Before the market opened on Friday, the Commerce Department announced that the personal consumption expenditure (PCE) price index, often seen as the Federal Reserve's preferred inflation gauge, rose 0.3% last month. That was in line with expectations and an increase for March. Meanwhile, the core PCE index increased 0.2%, compared with 0.3% in March. The Chicago Purchasing Managers' Index (PMI), which measures manufacturing in the Chicago region, fell to 35.4 from 37.9 in the previous month, well below economists' forecasts of 41. The MSCI index posted its second straight weekly decline, but still ended the month up. On Wall Street, the Dow Jones Industrial Average (.DJI) added 574.84 points, or 1.51%, to 38,686.32. The S&P 500 (.SPX) rose 42.03 points, or 0.80%, to 5,277.51, while the Nasdaq Composite (.IXIC) lost 2.06 points, or 0.01%, to 16,735.02. Earlier, Europe's STOXX 600 (.STOXX) closed up 0.3%. The index is up 2.6% for the month but down 0.5% for the week, its second straight weekly decline. Data showed eurozone inflation beat expectations in May, although analysts say it's unlikely to stop the European Central Bank from cutting rates next week. However, it could strengthen the case for a pause in July. The dollar index, which measures the greenback against a basket of currencies including the yen and euro, was down 0.15% at 104.61, its first monthly decline in 2024 since the data was released. The euro was up 0.16% at $1.0849, while the dollar was up 0.27% at 157.24 against the Japanese yen. Treasury yields fell amid signs that inflation was stabilizing in April, suggesting a possible Fed rate cut later this year. The 10-year U.S. Treasury yield was down 5.1 basis points to 4.503% from 4.554% late Thursday, while the 30-year yield was down 3.4 basis points to 4.6511% from 4.685%. The yield on the two-year note, which typically reflects interest rate expectations, fell 5.2 basis points to 4.8768% from 4.929% late Thursday. In the energy sector, oil prices fell as traders focused on the upcoming OPEC+ meeting on Sunday to decide on further output cuts. U.S. crude fell 1.18% to $76.99 a barrel, while Brent crude fell 0.29% to $81.62 a barrel. Gold also lost ground, falling 0.68% to $2,326.97 an ounce on the day. However, the precious metal still posted its fourth straight monthly gain.

News are provided by InstaForex

Read more: https://ifxpr.com/4aGnstD

The Dow Jones Transportation Average (.DJT) is down about 5% this year, in stark contrast to the S&P 500's (.SPX) 9% year-to-date gain and the Dow Jones Industrial Average's (.DJI) 1% gain, which topped 40,000 for the first time this month. While major indexes like the S&P 500, Nasdaq Composite (.IXIC), and Dow have all hit new all-time highs this year, the Dow Transportation Average has yet to surpass its November 2021 record and is currently down about 12% from that level. Some investors believe that the continued decline in the 20-component transportation index, which includes railroads, airlines, trucking companies and trucking firms, could signal weakness in the economy. It could also prevent further strong gains in the broader market if these companies fail to recover. Other struggling sectors include small-cap stocks, which some analysts say are more sensitive to economic growth than larger companies. Also in trouble are real estate stocks and some large consumer companies such as Nike (NKE.N), McDonald's (MCD.N) and Starbucks (SBUX.O). Data this week showed that the U.S. economy grew at an annualized rate of 1.3% in the first quarter, well below the 3.4% growth rate seen in the fourth quarter of 2023. A major test of the strength of the economy and markets will be the release of the monthly U.S. jobs report on June 7. Among the Dow transportation companies, the biggest year-to-date losers have been car rental company Avis Budget (CAR.O), down 37%, trucking company J.B. Hunt Transport (JBHT.O), down 21%, and airline American Airlines (AAL.O), down 17%. Package delivery giants UPS (UPS.N) and FedEx (FDX.N) also lost ground, falling 13% and 1%, respectively. Railroads Union Pacific (UNP.N) and Norfolk Southern (NSC.N) are down about 7%. Only four of the 20 transportation components have outperformed the S&P 500 this year. Stock markets have also been lower this week, with the S&P 500 down more than 2% from its record high hit earlier in May. Rising bond yields have raised concerns about the future performance of stocks. Not all investors agree that the transportation index accurately reflects the health of the broader economy. The index, like the Dow Industrials, is weighted by price rather than market value and includes just 20 stocks. Meanwhile, another important group of companies that is also considered an economic indicator — semiconductor makers — are doing much better. The Philadelphia SE Semiconductor Index (.SOX) is up 20% this year. Investors are pouring in Nvidia and other chip companies that could benefit from growing interest in the business opportunity of artificial intelligence. The overall market trend remains bullish for Horizon's Carlson, who tracks both the transportation and Dow Industrials to gauge market trends according to "Dow Theory." The MSCI Global Equity Index rose Friday afternoon as investors reassessed their month-end positions. Meanwhile, the dollar and Treasury yields fell as data showed a modest rise in U.S. inflation in April. After trading heavily lower for much of the session, the MSCI All Country World Price Index (.MIWD00000PUS) turned positive ahead of the index rebalancing. When trading ended on Wall Street, the global index was up 0.57% to 785.54 after earlier falling to 776.86. Before the market opened on Friday, the Commerce Department announced that the personal consumption expenditure (PCE) price index, often seen as the Federal Reserve's preferred inflation gauge, rose 0.3% last month. That was in line with expectations and an increase for March. Meanwhile, the core PCE index increased 0.2%, compared with 0.3% in March. The Chicago Purchasing Managers' Index (PMI), which measures manufacturing in the Chicago region, fell to 35.4 from 37.9 in the previous month, well below economists' forecasts of 41. The MSCI index posted its second straight weekly decline, but still ended the month up. On Wall Street, the Dow Jones Industrial Average (.DJI) added 574.84 points, or 1.51%, to 38,686.32. The S&P 500 (.SPX) rose 42.03 points, or 0.80%, to 5,277.51, while the Nasdaq Composite (.IXIC) lost 2.06 points, or 0.01%, to 16,735.02. Earlier, Europe's STOXX 600 (.STOXX) closed up 0.3%. The index is up 2.6% for the month but down 0.5% for the week, its second straight weekly decline. Data showed eurozone inflation beat expectations in May, although analysts say it's unlikely to stop the European Central Bank from cutting rates next week. However, it could strengthen the case for a pause in July. The dollar index, which measures the greenback against a basket of currencies including the yen and euro, was down 0.15% at 104.61, its first monthly decline in 2024 since the data was released. The euro was up 0.16% at $1.0849, while the dollar was up 0.27% at 157.24 against the Japanese yen. Treasury yields fell amid signs that inflation was stabilizing in April, suggesting a possible Fed rate cut later this year. The 10-year U.S. Treasury yield was down 5.1 basis points to 4.503% from 4.554% late Thursday, while the 30-year yield was down 3.4 basis points to 4.6511% from 4.685%. The yield on the two-year note, which typically reflects interest rate expectations, fell 5.2 basis points to 4.8768% from 4.929% late Thursday. In the energy sector, oil prices fell as traders focused on the upcoming OPEC+ meeting on Sunday to decide on further output cuts. U.S. crude fell 1.18% to $76.99 a barrel, while Brent crude fell 0.29% to $81.62 a barrel. Gold also lost ground, falling 0.68% to $2,326.97 an ounce on the day. However, the precious metal still posted its fourth straight monthly gain.

News are provided by InstaForex

Read more: https://ifxpr.com/4aGnstD

- IFX Bella

- Posts: 435

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

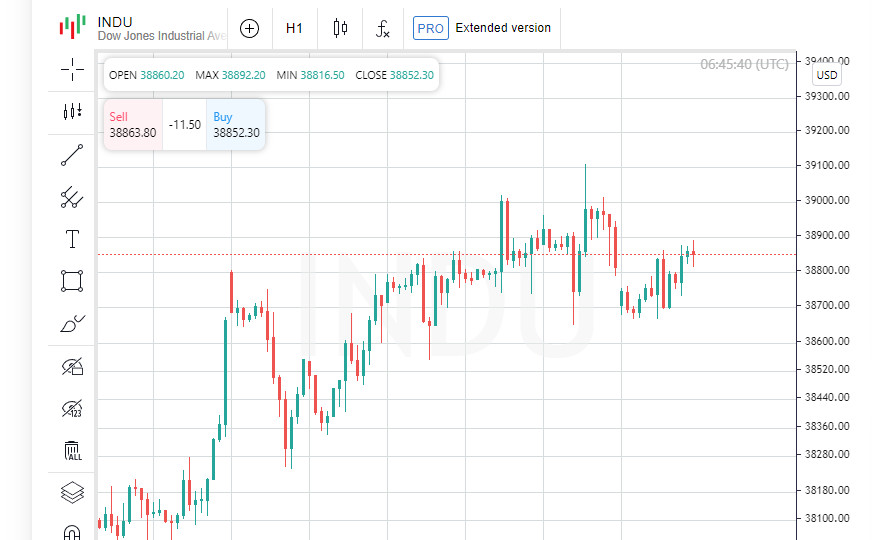

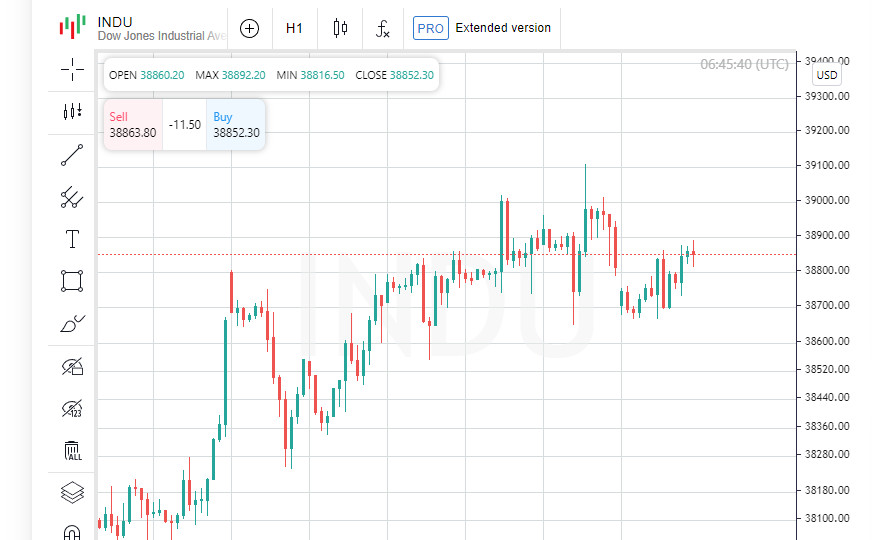

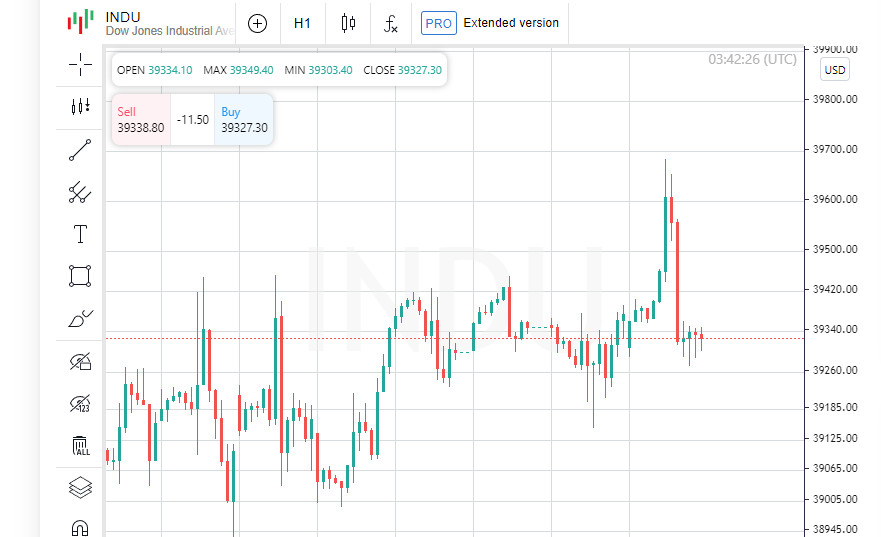

Forex Analysis & Reviews: Wall Street Sliding: S&P 500, Nasdaq Fall Ahead of Jobs Data

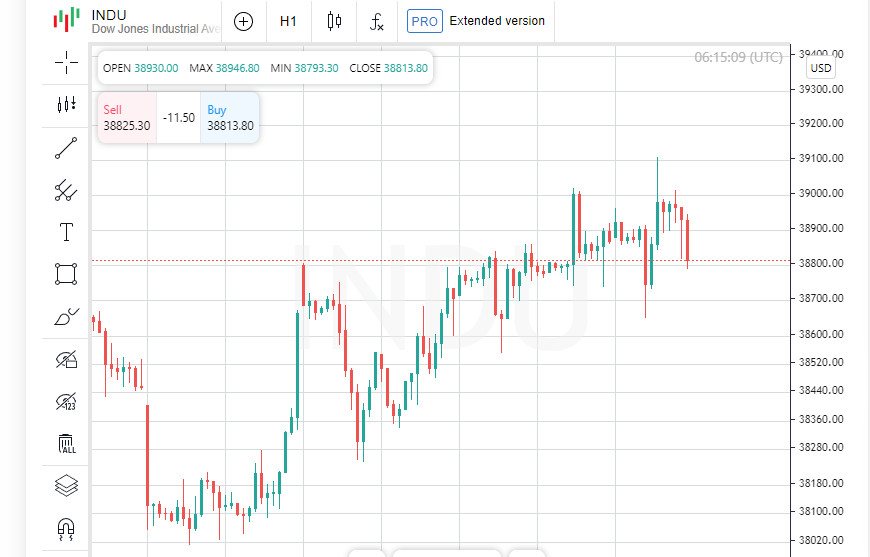

The S&P 500 and Nasdaq Composite ended Thursday with small losses ahead of a major jobs report, retreating from record highs hit the day before. The Dow, however, edged up slightly. The S&P 500 and Nasdaq started the day higher and hit intraday records, but then retreated as tech stocks slid. Utilities and industrials also contributed to the S&P 500's decline, with consumer discretionary and energy leading the gains. Nvidia shares fell 1.1%, falling to third place in the world's most valuable companies, behind Apple, which regained the second spot. Investors are eyeing a key U.S. nonfarm payrolls report on Friday. The latest weekly jobless claims report points to a softening labor market that could allow the Federal Reserve to begin cutting interest rates. The European Central Bank cut its interest rate for the first time since 2019. The Dow Jones Industrial Average gained 78.84 points, or 0.20%, to 38,886.17. The S&P 500 lost 1.07 points, or 0.02%, to 5,352.96, while the Nasdaq Composite fell 14.78 points, or 0.09%, to 17,173.12. Among the Dow Jones components, Salesforce Inc. was the top gainer, up 6.23 points (2.63%) to close at 242.76. Amazon.com Inc. was up 3.72 points (2.05%) to close at 185.00. Nike Inc. was up 1.40 points (1.48%) to close at 95.72. Intel Corporation was the top loser, down 0.36 points (1.17%) to 30.42. 3M Company shares added 0.84 points (0.85%) to close at 98.22, while Goldman Sachs Group Inc shares fell 3.58 points (0.78%) to end at 458.10. Among the S&P 500 index's top gainers were Illumina Inc shares, which rose 7.42% to close at 114.72. PayPal Holdings Inc shares rose 5.49% to close at 67.02, while MarketAxess Holdings Inc shares increased 4.86% to end at 205.97. NRG Energy Inc shares showed the biggest decline, losing 4.56% to close at 77.83. Hubbell Inc shares fell 4.11% to end at 365.94. Eaton Corporation PLC fell 4.02% to 313.46. The biggest gainers on the NASDAQ Composite were Virax Biolabs Group Ltd, up 85.85% to 1.97. SilverSun Technologies Inc rose 68.61% to close at 220.00, while Fibrobiologics Inc rose 53.88% to 10.31. Cue Health Inc was the worst performer, down 79.95% to 0.01. Plutonian Acquisition Corp fell 58.10% to close at 2.43. Actelis Networks Inc fell 47.04% to 1.97. The rise of Nvidia and other AI-related stocks has been a key factor in supporting Wall Street's rally this year. The chipmaker has contributed significantly to the S&P 500's gain of more than 12% for the year. Traders are pricing in a 68% chance of a rate cut in September, according to CME's FedWatch tool, and are pricing in two rate cuts this year, according to LSEG data. Forecasters polled by Reuters also expect two rate cuts. "We're in a period of uncertainty between now and tomorrow," said Thomas Hayes, chairman of Great Hill Capital in New York. "But overall, we're seeing the beginning of a global, coordinated easing policy from central banks in the West, with the exception of Japan, which is tightening," he added. GameStop shares jumped 47% after a popular online influencer known as "Roaring Kitty" announced on YouTube that she would be livestreaming on Friday. Lululemon Athletica shares rose 4.8% after the company beat first-quarter earnings and revenue estimates. U.S.-listed shares of Chinese electric vehicle maker NIO (9866.HK) fell 6.8% after reporting a quarterly net loss. Five Below shares fell 10.6% after the discount store operator lowered its full-year net sales forecast. Advancing stocks outnumbered declining stocks on the NYSE by a 1.05-to-1 ratio. On the Nasdaq, 1,729 stocks ended higher and 2,445 ended lower, for a 1.41-to-1 ratio in favor of decliners. The S&P 500 posted 25 new 52-week highs and five new lows, while the Nasdaq Composite posted 57 new highs and 110 new lows. Total equity trading volume on U.S. exchanges was about 10.4 billion, below the 20-day average of 12.7 billion. August gold futures rose 0.69%, or 16.50, to $2.00 a troy ounce. WTI crude oil futures for July delivery rose 2.01%, or 1.49, to $75.56 a barrel. Brent crude futures for August delivery rose 1.87%, or 1.47, to $79.88 a barrel.

News are provided by InstaForex

Read more: https://ifxpr.com/4aUAOlQ

The S&P 500 and Nasdaq Composite ended Thursday with small losses ahead of a major jobs report, retreating from record highs hit the day before. The Dow, however, edged up slightly. The S&P 500 and Nasdaq started the day higher and hit intraday records, but then retreated as tech stocks slid. Utilities and industrials also contributed to the S&P 500's decline, with consumer discretionary and energy leading the gains. Nvidia shares fell 1.1%, falling to third place in the world's most valuable companies, behind Apple, which regained the second spot. Investors are eyeing a key U.S. nonfarm payrolls report on Friday. The latest weekly jobless claims report points to a softening labor market that could allow the Federal Reserve to begin cutting interest rates. The European Central Bank cut its interest rate for the first time since 2019. The Dow Jones Industrial Average gained 78.84 points, or 0.20%, to 38,886.17. The S&P 500 lost 1.07 points, or 0.02%, to 5,352.96, while the Nasdaq Composite fell 14.78 points, or 0.09%, to 17,173.12. Among the Dow Jones components, Salesforce Inc. was the top gainer, up 6.23 points (2.63%) to close at 242.76. Amazon.com Inc. was up 3.72 points (2.05%) to close at 185.00. Nike Inc. was up 1.40 points (1.48%) to close at 95.72. Intel Corporation was the top loser, down 0.36 points (1.17%) to 30.42. 3M Company shares added 0.84 points (0.85%) to close at 98.22, while Goldman Sachs Group Inc shares fell 3.58 points (0.78%) to end at 458.10. Among the S&P 500 index's top gainers were Illumina Inc shares, which rose 7.42% to close at 114.72. PayPal Holdings Inc shares rose 5.49% to close at 67.02, while MarketAxess Holdings Inc shares increased 4.86% to end at 205.97. NRG Energy Inc shares showed the biggest decline, losing 4.56% to close at 77.83. Hubbell Inc shares fell 4.11% to end at 365.94. Eaton Corporation PLC fell 4.02% to 313.46. The biggest gainers on the NASDAQ Composite were Virax Biolabs Group Ltd, up 85.85% to 1.97. SilverSun Technologies Inc rose 68.61% to close at 220.00, while Fibrobiologics Inc rose 53.88% to 10.31. Cue Health Inc was the worst performer, down 79.95% to 0.01. Plutonian Acquisition Corp fell 58.10% to close at 2.43. Actelis Networks Inc fell 47.04% to 1.97. The rise of Nvidia and other AI-related stocks has been a key factor in supporting Wall Street's rally this year. The chipmaker has contributed significantly to the S&P 500's gain of more than 12% for the year. Traders are pricing in a 68% chance of a rate cut in September, according to CME's FedWatch tool, and are pricing in two rate cuts this year, according to LSEG data. Forecasters polled by Reuters also expect two rate cuts. "We're in a period of uncertainty between now and tomorrow," said Thomas Hayes, chairman of Great Hill Capital in New York. "But overall, we're seeing the beginning of a global, coordinated easing policy from central banks in the West, with the exception of Japan, which is tightening," he added. GameStop shares jumped 47% after a popular online influencer known as "Roaring Kitty" announced on YouTube that she would be livestreaming on Friday. Lululemon Athletica shares rose 4.8% after the company beat first-quarter earnings and revenue estimates. U.S.-listed shares of Chinese electric vehicle maker NIO (9866.HK) fell 6.8% after reporting a quarterly net loss. Five Below shares fell 10.6% after the discount store operator lowered its full-year net sales forecast. Advancing stocks outnumbered declining stocks on the NYSE by a 1.05-to-1 ratio. On the Nasdaq, 1,729 stocks ended higher and 2,445 ended lower, for a 1.41-to-1 ratio in favor of decliners. The S&P 500 posted 25 new 52-week highs and five new lows, while the Nasdaq Composite posted 57 new highs and 110 new lows. Total equity trading volume on U.S. exchanges was about 10.4 billion, below the 20-day average of 12.7 billion. August gold futures rose 0.69%, or 16.50, to $2.00 a troy ounce. WTI crude oil futures for July delivery rose 2.01%, or 1.49, to $75.56 a barrel. Brent crude futures for August delivery rose 1.87%, or 1.47, to $79.88 a barrel.

News are provided by InstaForex

Read more: https://ifxpr.com/4aUAOlQ

- IFX Bella

- Posts: 435

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

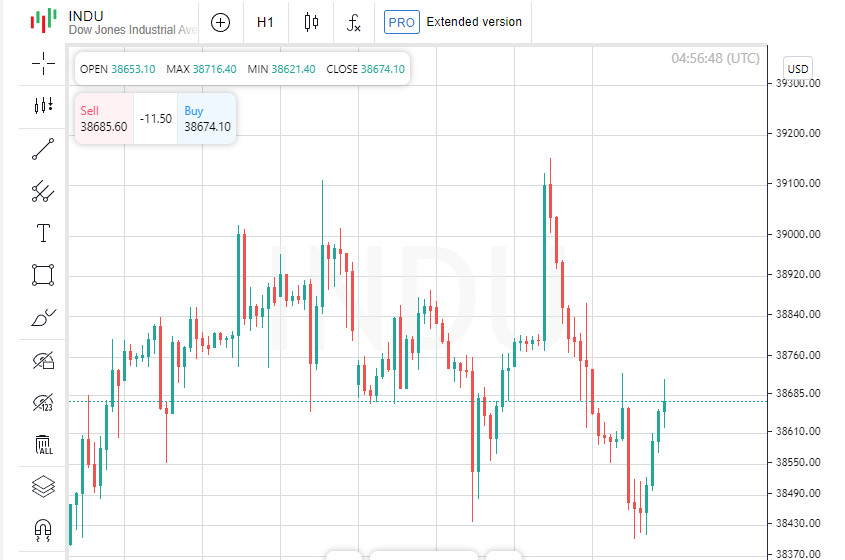

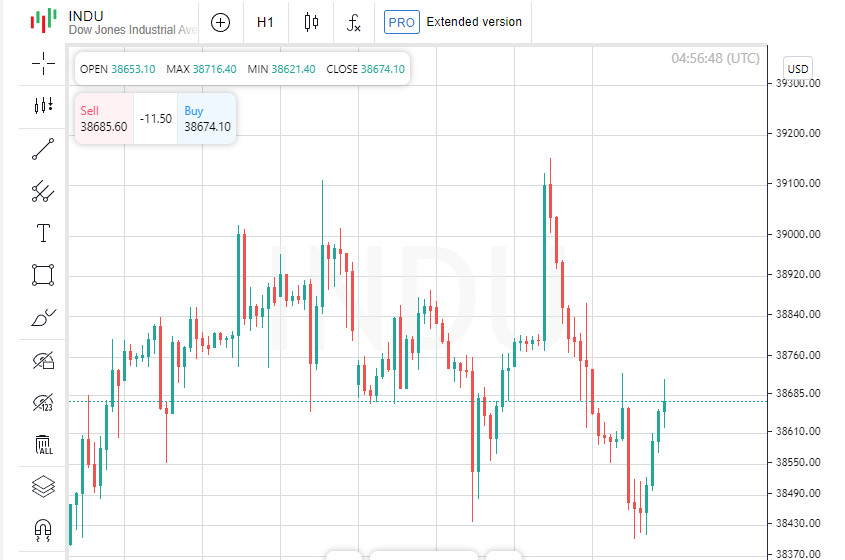

Forex Analysis & Reviews: Investors disappointed as no U.S. rate cut expected

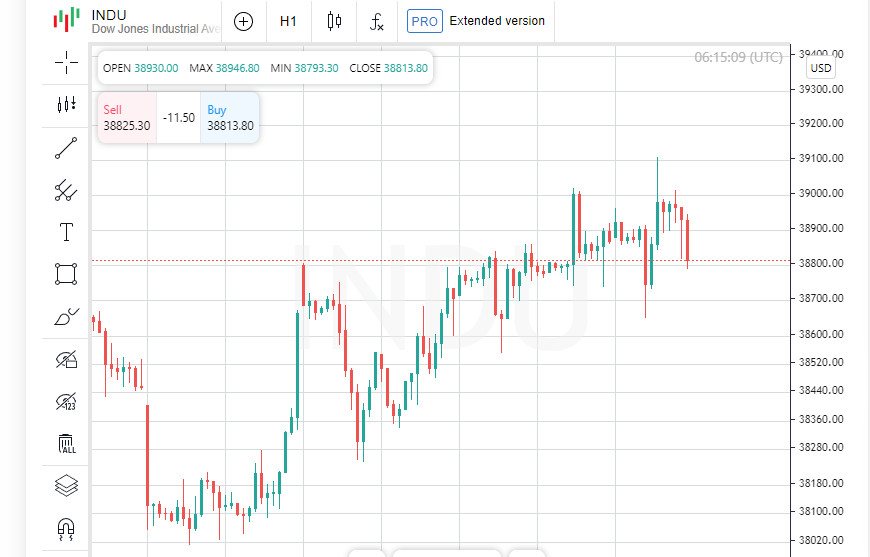

Wall Street stocks ended slightly lower on Friday amid turbulence after strong U.S. jobs data confirmed the resilience of the economy but also raised concerns that the Federal Reserve may keep interest rates high longer than many investors had expected. The U.S. Labor Department said it added about 272,000 jobs in May, well above analysts' forecasts of 185,000. The unemployment rate rose to 4%. The S&P 500 (.SPX) fell sharply after the report, while Treasury yields rose as traders revised down their expectations for a rate cut in September. The index then rebounded and briefly hit a new intraday record as investors viewed the data as confirmation of a healthy economy. Utilities (.SPLRCU), materials (.SPLRCM) and communications (.SPLRCL) were the biggest losers. Financials (.SPSY) and technology (.SPLRCT) were the best performers. For the week, the S&P 500 rose 1.32%, the Nasdaq gained 2.38% and the Dow Jones gained 0.29%. "This shows that a rate cut is not coming anytime soon. Rising bond yields are putting significant pressure on risk assets, including small-caps," said Sandy Villere, a portfolio manager at Villere & Co in New Orleans. "It's all about interest rates. They may stay higher longer than expected, and investors will have to adjust to the new environment," he added. Markets reacted to the employment data by changing expectations for the timing of the Fed's rate cut. After the data was released, traders speculated that the Fed's rate cut from the current level of 5.25% to 5.5% may not begin until November. According to Fedwatch LSEG, the probability of the Fed cutting rates by 25 basis points in September has fallen to 56% from about 70% the day before. The Dow Jones Industrial Average (.DJI) fell 87.18 points, or 0.22%, to 38,798.99, the S&P 500 (.SPX) lost 5.97 points, or 0.11%, to 5,346.99, and the Nasdaq Composite (.IXIC) fell 39.99 points, or 0.23%, to 17,133.13. GameStop (GME.N) shares fell 39% in volatile trading that coincided with popular blogger Roaring Kitty's first livestream in three years. The company announced a possible stock offering and a cut in quarterly sales. Other names popular with retail investors, such as AMC Entertainment (AMC.N) and Koss Corp (KOSS.O), also suffered significant losses, falling 15.1% and 17.4%, respectively. Nvidia (NVDA.O) shares extended their losses from the previous session, pushing their market cap back below the $3 trillion mark. Lyft (LYFT.O) shares rose 0.6% after the company forecast 15% growth in total bookings by 2027, announced after the close of trading on Thursday. Declining stocks outnumbered advancing stocks on the New York Stock Exchange (NYSE) by a 2.72-to-1 ratio. On the Nasdaq, 1,177 stocks advanced and 3,064 declined, giving decliners a 2.6-to-1 ratio. The S&P 500 posted 17 new 52-week highs and five new lows, while the Nasdaq Composite posted 34 new highs and 149 new lows. Total volume of shares traded on U.S. exchanges was about 10.75 billion, compared with an average of 12.7 billion over the past 20 trading days. Lower expectations for quick Fed action weighed on stocks, which ended lower. The MSCI World Share Index (.MIWO00000PUS) was down 0.3% after hitting a record high of 797.48. The yield on two-year notes, a proxy for interest rate expectations, rose nearly 17 basis points to 4.8868% after six straight days of declines. The rise in yields comes as bond prices have fallen. Rate changes had been expected in September, especially after the European Central Bank cut its deposit rate to 3.75% from a record 4% on Thursday, in line with expectations. The Bank of Canada on Wednesday became the first G7 bank to cut its key rate, following Sweden's Riksbank and the Swiss National Bank. The employment report also changed the dynamics of eurozone rate expectations, with traders now forecasting a 55 basis point cut this year, up from 58 bps before the data. The European Stoxx 600 (.STOXX), which has gained almost 10% since the start of the year, fell 0.2%. The euro zone bond market also showed weakness, with German 10-year yields up 8 basis points to 2.618%. In currency markets, the U.S. dollar rose 0.8% against a basket of major currencies, reversing a week of losses ahead of the employment data. The euro fell 0.8% to $1.0802 after a small gain the previous day. Brent crude futures fell 0.6% to $79.36 a barrel. The stronger dollar weighed on spot gold, which fell 3.6% to $2,290.59 an ounce.

News are provided by InstaForex

Read more: https://ifxpr.com/3Xe5Vpq

Wall Street stocks ended slightly lower on Friday amid turbulence after strong U.S. jobs data confirmed the resilience of the economy but also raised concerns that the Federal Reserve may keep interest rates high longer than many investors had expected. The U.S. Labor Department said it added about 272,000 jobs in May, well above analysts' forecasts of 185,000. The unemployment rate rose to 4%. The S&P 500 (.SPX) fell sharply after the report, while Treasury yields rose as traders revised down their expectations for a rate cut in September. The index then rebounded and briefly hit a new intraday record as investors viewed the data as confirmation of a healthy economy. Utilities (.SPLRCU), materials (.SPLRCM) and communications (.SPLRCL) were the biggest losers. Financials (.SPSY) and technology (.SPLRCT) were the best performers. For the week, the S&P 500 rose 1.32%, the Nasdaq gained 2.38% and the Dow Jones gained 0.29%. "This shows that a rate cut is not coming anytime soon. Rising bond yields are putting significant pressure on risk assets, including small-caps," said Sandy Villere, a portfolio manager at Villere & Co in New Orleans. "It's all about interest rates. They may stay higher longer than expected, and investors will have to adjust to the new environment," he added. Markets reacted to the employment data by changing expectations for the timing of the Fed's rate cut. After the data was released, traders speculated that the Fed's rate cut from the current level of 5.25% to 5.5% may not begin until November. According to Fedwatch LSEG, the probability of the Fed cutting rates by 25 basis points in September has fallen to 56% from about 70% the day before. The Dow Jones Industrial Average (.DJI) fell 87.18 points, or 0.22%, to 38,798.99, the S&P 500 (.SPX) lost 5.97 points, or 0.11%, to 5,346.99, and the Nasdaq Composite (.IXIC) fell 39.99 points, or 0.23%, to 17,133.13. GameStop (GME.N) shares fell 39% in volatile trading that coincided with popular blogger Roaring Kitty's first livestream in three years. The company announced a possible stock offering and a cut in quarterly sales. Other names popular with retail investors, such as AMC Entertainment (AMC.N) and Koss Corp (KOSS.O), also suffered significant losses, falling 15.1% and 17.4%, respectively. Nvidia (NVDA.O) shares extended their losses from the previous session, pushing their market cap back below the $3 trillion mark. Lyft (LYFT.O) shares rose 0.6% after the company forecast 15% growth in total bookings by 2027, announced after the close of trading on Thursday. Declining stocks outnumbered advancing stocks on the New York Stock Exchange (NYSE) by a 2.72-to-1 ratio. On the Nasdaq, 1,177 stocks advanced and 3,064 declined, giving decliners a 2.6-to-1 ratio. The S&P 500 posted 17 new 52-week highs and five new lows, while the Nasdaq Composite posted 34 new highs and 149 new lows. Total volume of shares traded on U.S. exchanges was about 10.75 billion, compared with an average of 12.7 billion over the past 20 trading days. Lower expectations for quick Fed action weighed on stocks, which ended lower. The MSCI World Share Index (.MIWO00000PUS) was down 0.3% after hitting a record high of 797.48. The yield on two-year notes, a proxy for interest rate expectations, rose nearly 17 basis points to 4.8868% after six straight days of declines. The rise in yields comes as bond prices have fallen. Rate changes had been expected in September, especially after the European Central Bank cut its deposit rate to 3.75% from a record 4% on Thursday, in line with expectations. The Bank of Canada on Wednesday became the first G7 bank to cut its key rate, following Sweden's Riksbank and the Swiss National Bank. The employment report also changed the dynamics of eurozone rate expectations, with traders now forecasting a 55 basis point cut this year, up from 58 bps before the data. The European Stoxx 600 (.STOXX), which has gained almost 10% since the start of the year, fell 0.2%. The euro zone bond market also showed weakness, with German 10-year yields up 8 basis points to 2.618%. In currency markets, the U.S. dollar rose 0.8% against a basket of major currencies, reversing a week of losses ahead of the employment data. The euro fell 0.8% to $1.0802 after a small gain the previous day. Brent crude futures fell 0.6% to $79.36 a barrel. The stronger dollar weighed on spot gold, which fell 3.6% to $2,290.59 an ounce.

News are provided by InstaForex

Read more: https://ifxpr.com/3Xe5Vpq

- IFX Bella

- Posts: 435

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: S&P 500, Nasdaq hit new highs: What to expect from Fed meeting, CPI data

The S&P 500 and Nasdaq both hit new record closing highs on Monday, despite investor caution ahead of consumer price data and the Federal Reserve's policy announcement this week. Nvidia (NVDA.O) shares provided some support to the Nasdaq and S&P 500, rising 0.7% after a 10-for-one stock split. Some investors now believe the chipmaker could be added to the Dow. The May CPI report is due Wednesday, coinciding with the end of the Fed's two-day meeting. The central bank is expected to leave interest rates unchanged while issuing updated economic and policy forecasts. Investors will be watching closely for any hints of a possible rate cut down the road. "It's a big week for the market in terms of Fed commentary and statements," said Quincy Crosby, chief global strategist at LPL Financial in Charlotte, North Carolina. "Additionally, the CPI report is due Wednesday morning. Everything related to the economy and inflation is viewed through the prism of the Fed's actions by the market," he added. The Dow Jones Industrial Average (.DJI) rose 69.05 points, or 0.18%, to 38,868.04. The S&P 500 (.SPX) rose 13.8 points, or 0.26%, to 5,360.79, and the Nasdaq Composite (.IXIC) added 59.40 points, or 0.35%, to 17,192.53. Traders trimmed their expectations for a September rate cut after stronger-than-expected May employment data on Friday, leaving the chance of a cut at 50%. Apple (AAPL.O) shares fell 1.9% on the first day of its annual iPhone developer conference, with investors eagerly awaiting news on how the company will integrate artificial intelligence into its products. Among the day's best performers were Southwest Airlines (LUV.N), which jumped 7% after activist investor Elliott Investment Management acquired a $1.9 billion stake in the company. Diamond Offshore Drilling (DO.N) rose 10.9% after oilfield services company Noble (NE.N) announced it was buying a rival for $1.59 billion. Noble also rose 6.1%. Advancing stocks outnumbered declining stocks 1.06-to-1 on the New York Stock Exchange, while gainers were outnumbered 1.01-to-1 on the Nasdaq. The S&P 500 posted 19 new 52-week highs and five new lows, while the Nasdaq Composite posted 56 new highs and 177 new lows. Trading volume on U.S. exchanges totaled 10.39 billion shares, below the 20-day average of 12.80 billion. MSCI's global share index rose on Monday, despite investor expectations for key U.S. inflation data and an upcoming central bank meeting. The euro, however, slipped after French President Emmanuel Macron announced an early election. U.S. Treasury yields rose as investors digested Friday's labor market data and looked ahead to consumer price data and a Federal Reserve statement this week. Eyes were also focused on the Bank of Japan's possible decisions. Adding to the uncertainty was political instability in the euro zone's second-largest economy. Far-right gains in the European Parliament elections on Sunday prompted Macron to call a national election. The euro hit a one-month low against the dollar, while European stocks also suffered. "The uncertainty is coming from multiple sources. "The European elections over the weekend added volatility to the markets," said Chad Oviatt, director of investment management at Huntington National Bank. The STOXX 600 index, which covers pan-European stocks, closed down 0.27%. France's blue-chip CAC 40 index fell 1.4%, hitting a more than three-month low. However, the MSCI Global Equity Index (.MIWD00000PUS) turned from bearish to bullish territory by the end of the day, and Wall Street partially recouped its gains. As a result, the global index rose 0.75 points, or 0.09%, to 794.99. Huntington National Bank's Oviatt said investors are eagerly awaiting the release of U.S. consumer price index (CPI) inflation data on Wednesday morning, ahead of the Federal Reserve's policy decision Wednesday afternoon. Adding to the uncertainty about the impact of economic data on the Fed's interest rate policy was Friday's jobs report, which showed the U.S. economy added significantly more jobs in May than expected and annual wage growth accelerated again. "Everyone seems to be hoping for a rate cut, but so far that hasn't been the case. "So everyone is looking to the CPI data on Wednesday morning, hoping that will give us more information and commentary from the Fed in the afternoon to clarify the situation," said Jim Barnes, director of bonds at Bryn Mawr Trust in Berwyn, Pennsylvania. U.S. Treasury yields, which move inversely to prices, rose Monday, reflecting expectations for higher, longer-term U.S. rates. The benchmark 10-year Treasury yield rose 4.1 basis points to 4.469%, up from 4.428% late Friday. The 30-year yield also rose, up 4.8 basis points to 4.5958%. The 2-year yield, which typically responds to changes in interest rate expectations, rose 1.5 basis points to 4.8846% from 4.87% late Friday. In the foreign exchange market, the euro fell to its lowest since May 9 against the U.S. dollar, down 0.37% to $1.076. Earlier, the euro hit a near two-year low against sterling. The dollar index, which measures the greenback against a basket of currencies including the euro and the Japanese yen, rose 0.08% to 105.14. Against the Japanese yen, the dollar strengthened 0.21% to 157.03. The Bank of Japan (BOJ) is holding a two-day monetary policy meeting this week and may offer new guidance on tapering its massive bond purchases. In commodities, oil prices hit a one-week high on hopes for a pickup in fuel demand this summer. However, a stronger dollar and fading expectations for a U.S. rate cut capped gains. U.S. crude rose 2.93% to $77.74 a barrel, while Brent crude rose 2.52% to $81.63 a barrel. Gold prices pared their losses after their biggest drop in 3.5 years in the previous session, as investors awaited inflation data and a policy statement from the Federal Reserve. Spot gold rose 0.72% to $2,309.15 an ounce.

News are provided by InstaForex

Read more: https://ifxpr.com/3xegmPg

The S&P 500 and Nasdaq both hit new record closing highs on Monday, despite investor caution ahead of consumer price data and the Federal Reserve's policy announcement this week. Nvidia (NVDA.O) shares provided some support to the Nasdaq and S&P 500, rising 0.7% after a 10-for-one stock split. Some investors now believe the chipmaker could be added to the Dow. The May CPI report is due Wednesday, coinciding with the end of the Fed's two-day meeting. The central bank is expected to leave interest rates unchanged while issuing updated economic and policy forecasts. Investors will be watching closely for any hints of a possible rate cut down the road. "It's a big week for the market in terms of Fed commentary and statements," said Quincy Crosby, chief global strategist at LPL Financial in Charlotte, North Carolina. "Additionally, the CPI report is due Wednesday morning. Everything related to the economy and inflation is viewed through the prism of the Fed's actions by the market," he added. The Dow Jones Industrial Average (.DJI) rose 69.05 points, or 0.18%, to 38,868.04. The S&P 500 (.SPX) rose 13.8 points, or 0.26%, to 5,360.79, and the Nasdaq Composite (.IXIC) added 59.40 points, or 0.35%, to 17,192.53. Traders trimmed their expectations for a September rate cut after stronger-than-expected May employment data on Friday, leaving the chance of a cut at 50%. Apple (AAPL.O) shares fell 1.9% on the first day of its annual iPhone developer conference, with investors eagerly awaiting news on how the company will integrate artificial intelligence into its products. Among the day's best performers were Southwest Airlines (LUV.N), which jumped 7% after activist investor Elliott Investment Management acquired a $1.9 billion stake in the company. Diamond Offshore Drilling (DO.N) rose 10.9% after oilfield services company Noble (NE.N) announced it was buying a rival for $1.59 billion. Noble also rose 6.1%. Advancing stocks outnumbered declining stocks 1.06-to-1 on the New York Stock Exchange, while gainers were outnumbered 1.01-to-1 on the Nasdaq. The S&P 500 posted 19 new 52-week highs and five new lows, while the Nasdaq Composite posted 56 new highs and 177 new lows. Trading volume on U.S. exchanges totaled 10.39 billion shares, below the 20-day average of 12.80 billion. MSCI's global share index rose on Monday, despite investor expectations for key U.S. inflation data and an upcoming central bank meeting. The euro, however, slipped after French President Emmanuel Macron announced an early election. U.S. Treasury yields rose as investors digested Friday's labor market data and looked ahead to consumer price data and a Federal Reserve statement this week. Eyes were also focused on the Bank of Japan's possible decisions. Adding to the uncertainty was political instability in the euro zone's second-largest economy. Far-right gains in the European Parliament elections on Sunday prompted Macron to call a national election. The euro hit a one-month low against the dollar, while European stocks also suffered. "The uncertainty is coming from multiple sources. "The European elections over the weekend added volatility to the markets," said Chad Oviatt, director of investment management at Huntington National Bank. The STOXX 600 index, which covers pan-European stocks, closed down 0.27%. France's blue-chip CAC 40 index fell 1.4%, hitting a more than three-month low. However, the MSCI Global Equity Index (.MIWD00000PUS) turned from bearish to bullish territory by the end of the day, and Wall Street partially recouped its gains. As a result, the global index rose 0.75 points, or 0.09%, to 794.99. Huntington National Bank's Oviatt said investors are eagerly awaiting the release of U.S. consumer price index (CPI) inflation data on Wednesday morning, ahead of the Federal Reserve's policy decision Wednesday afternoon. Adding to the uncertainty about the impact of economic data on the Fed's interest rate policy was Friday's jobs report, which showed the U.S. economy added significantly more jobs in May than expected and annual wage growth accelerated again. "Everyone seems to be hoping for a rate cut, but so far that hasn't been the case. "So everyone is looking to the CPI data on Wednesday morning, hoping that will give us more information and commentary from the Fed in the afternoon to clarify the situation," said Jim Barnes, director of bonds at Bryn Mawr Trust in Berwyn, Pennsylvania. U.S. Treasury yields, which move inversely to prices, rose Monday, reflecting expectations for higher, longer-term U.S. rates. The benchmark 10-year Treasury yield rose 4.1 basis points to 4.469%, up from 4.428% late Friday. The 30-year yield also rose, up 4.8 basis points to 4.5958%. The 2-year yield, which typically responds to changes in interest rate expectations, rose 1.5 basis points to 4.8846% from 4.87% late Friday. In the foreign exchange market, the euro fell to its lowest since May 9 against the U.S. dollar, down 0.37% to $1.076. Earlier, the euro hit a near two-year low against sterling. The dollar index, which measures the greenback against a basket of currencies including the euro and the Japanese yen, rose 0.08% to 105.14. Against the Japanese yen, the dollar strengthened 0.21% to 157.03. The Bank of Japan (BOJ) is holding a two-day monetary policy meeting this week and may offer new guidance on tapering its massive bond purchases. In commodities, oil prices hit a one-week high on hopes for a pickup in fuel demand this summer. However, a stronger dollar and fading expectations for a U.S. rate cut capped gains. U.S. crude rose 2.93% to $77.74 a barrel, while Brent crude rose 2.52% to $81.63 a barrel. Gold prices pared their losses after their biggest drop in 3.5 years in the previous session, as investors awaited inflation data and a policy statement from the Federal Reserve. Spot gold rose 0.72% to $2,309.15 an ounce.

News are provided by InstaForex

Read more: https://ifxpr.com/3xegmPg

- IFX Bella

- Posts: 435

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: Tech Leads Wall Street to Records, Nasdaq, S&P 500 High

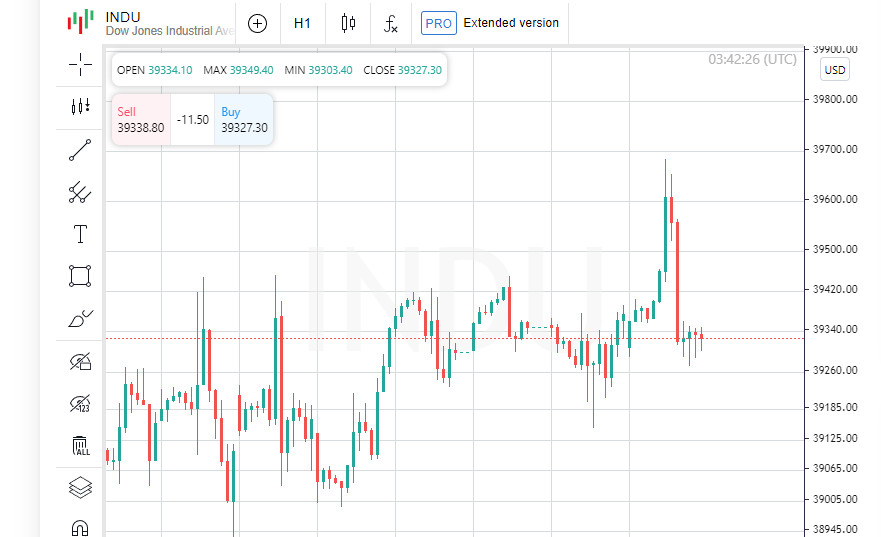

The Nasdaq and S&P 500 posted their fourth straight record closing high on Thursday, while Treasury yields fell to their lowest since early April. Investors reacted to lower-than-expected inflation data and a modest rate-cutting outlook from the Federal Reserve. The dollar strengthened against major currencies as the Fed's hawkish stance and the prospect of trade tensions between Europe and China sent European stocks sharply lower. The Dow Jones Industrial Average ended the day slightly lower. The Labor Department reported that producer prices fell 0.2% in May from the previous month, though they rose 2.2% year-on-year, 20 basis points above the Fed's 2% inflation target. Separately, initial jobless claims hit a 10-month high. The data came after a weaker-than-expected consumer price index report on Wednesday and a revision to the Fed's forecasts, which now call for only one rate cut this year instead of three. "After a solid rally, markets are taking a bit of a break from yesterday's big news, and that's a good thing," said Ryan Detrick, chief market strategist at Carson Group in Omaha, Neb. "We call it the calm after the storm — consolidating the gains we saw in the first half of June." Despite the Fed's hawkish rhetoric, expectations are growing that the central bank will cut rates for the first time as soon as September. According to CME's FedWatch tool, financial markets are pricing in a 60.5% chance of the Fed cutting its target rate by 25 basis points in September. "The Fed may sound hawkish, but they are dependent on economic data," Detrick said. "With today's positive PPI data, the market is thinking the Fed could ease if inflation continues to decline." The Dow Jones Industrial Average (.DJI) fell 65.17 points, or 0.17%, to 38,647.04. The S&P 500 (.SPX) rose 12.71 points, or 0.23%, to 5,433.74, and the Nasdaq Composite (.IXIC) added 59.12 points, or 0.34%, to 17,667.56. The S&P 500 and Nasdaq hit record closing highs for the fourth straight session on Thursday, driven by a continued rally in tech stocks. The number of Americans filing new jobless claims last week, while another report showed an unexpected decline in producer prices in May, bolstering hopes for an early Fed rate cut. The Federal Reserve on Wednesday forecast only one rate cut this year, down from three quarter-percentage-point cuts in March. The S&P 500 tech sector (.SPLRCT) jumped 1.4% and the semiconductor index (.SOX) rose 1.5%, both hitting record closing highs. Broadcom (AVGO.O) shares soared 12.3% after raising its revenue forecast for chips used in artificial intelligence technology. The company also announced a 10-for-1 forward stock split. Nvidia (NVDA.O) rose 3.5%, while Apple (AAPL.O) rose 0.5%. Adobe (ADBE.O) shares rose more than 14% in after-hours trading after the software maker beat Wall Street's second-quarter revenue expectations. However, the stock was down 0.2% in the main session. New data released Wednesday showed that the consumer price index was unchanged in May for the first time in nearly two years, raising concerns among some investors that the economy could be slowing too much. The economically sensitive industrial sector (.SPLRCI) fell 0.6%, while the Russell 2000 small-cap index (.RUT) fell 0.9%. Tesla (TSLA.O) shares rose 2.9% after shareholders approved Elon Musk's $56 billion pay package. Trading volume on U.S. exchanges was 10.14 billion shares, below the 20-day average of 12.49 billion. European shares ended wider lower, with the auto sector particularly hard hit as investors worried about Beijing's retaliatory measures to the European Union's new tariffs on electric vehicles from China. The pan-European STOXX 600 index (.STOXX) fell 1.31%, while MSCI's global share index (.MIWD00000PUS) lost 0.27%. Emerging market shares rose 0.64%. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) rose 0.67%, while Japan's Nikkei (.N225) fell 0.40%. U.S. 10-year Treasury yields fell on weak economic data. Benchmark 10-year notes rose 13/32, sending yields down to 4.2442% from 4.295% late Wednesday. 30-year notes rose 27/32, sending yields down to 4.4% from 4.45% late Wednesday. The dollar index (.DXY) rose 0.53%, while the euro fell 0.64% to $1.0738. The Japanese yen weakened 0.22% against the greenback to hit $157.09 per dollar, while sterling was last at $1.2761, down 0.27% on the day. Oil prices edged up amid choppy trading, with supply growth and a delayed Fed rate cut offset by economic data. The price of U.S. crude oil rose 0.15% to $78.62 per barrel, while the price of Brent rose 0.18%, stopping at $82.75 per barrel. Gold prices fell amid a stronger dollar after the release of the PPI report, which was weaker than expected. Spot gold lost 0.8%, reaching $2,303.15 per ounce.

News are provided by InstaForex

Read more: https://ifxpr.com/3xjqu9s

The Nasdaq and S&P 500 posted their fourth straight record closing high on Thursday, while Treasury yields fell to their lowest since early April. Investors reacted to lower-than-expected inflation data and a modest rate-cutting outlook from the Federal Reserve. The dollar strengthened against major currencies as the Fed's hawkish stance and the prospect of trade tensions between Europe and China sent European stocks sharply lower. The Dow Jones Industrial Average ended the day slightly lower. The Labor Department reported that producer prices fell 0.2% in May from the previous month, though they rose 2.2% year-on-year, 20 basis points above the Fed's 2% inflation target. Separately, initial jobless claims hit a 10-month high. The data came after a weaker-than-expected consumer price index report on Wednesday and a revision to the Fed's forecasts, which now call for only one rate cut this year instead of three. "After a solid rally, markets are taking a bit of a break from yesterday's big news, and that's a good thing," said Ryan Detrick, chief market strategist at Carson Group in Omaha, Neb. "We call it the calm after the storm — consolidating the gains we saw in the first half of June." Despite the Fed's hawkish rhetoric, expectations are growing that the central bank will cut rates for the first time as soon as September. According to CME's FedWatch tool, financial markets are pricing in a 60.5% chance of the Fed cutting its target rate by 25 basis points in September. "The Fed may sound hawkish, but they are dependent on economic data," Detrick said. "With today's positive PPI data, the market is thinking the Fed could ease if inflation continues to decline." The Dow Jones Industrial Average (.DJI) fell 65.17 points, or 0.17%, to 38,647.04. The S&P 500 (.SPX) rose 12.71 points, or 0.23%, to 5,433.74, and the Nasdaq Composite (.IXIC) added 59.12 points, or 0.34%, to 17,667.56. The S&P 500 and Nasdaq hit record closing highs for the fourth straight session on Thursday, driven by a continued rally in tech stocks. The number of Americans filing new jobless claims last week, while another report showed an unexpected decline in producer prices in May, bolstering hopes for an early Fed rate cut. The Federal Reserve on Wednesday forecast only one rate cut this year, down from three quarter-percentage-point cuts in March. The S&P 500 tech sector (.SPLRCT) jumped 1.4% and the semiconductor index (.SOX) rose 1.5%, both hitting record closing highs. Broadcom (AVGO.O) shares soared 12.3% after raising its revenue forecast for chips used in artificial intelligence technology. The company also announced a 10-for-1 forward stock split. Nvidia (NVDA.O) rose 3.5%, while Apple (AAPL.O) rose 0.5%. Adobe (ADBE.O) shares rose more than 14% in after-hours trading after the software maker beat Wall Street's second-quarter revenue expectations. However, the stock was down 0.2% in the main session. New data released Wednesday showed that the consumer price index was unchanged in May for the first time in nearly two years, raising concerns among some investors that the economy could be slowing too much. The economically sensitive industrial sector (.SPLRCI) fell 0.6%, while the Russell 2000 small-cap index (.RUT) fell 0.9%. Tesla (TSLA.O) shares rose 2.9% after shareholders approved Elon Musk's $56 billion pay package. Trading volume on U.S. exchanges was 10.14 billion shares, below the 20-day average of 12.49 billion. European shares ended wider lower, with the auto sector particularly hard hit as investors worried about Beijing's retaliatory measures to the European Union's new tariffs on electric vehicles from China. The pan-European STOXX 600 index (.STOXX) fell 1.31%, while MSCI's global share index (.MIWD00000PUS) lost 0.27%. Emerging market shares rose 0.64%. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) rose 0.67%, while Japan's Nikkei (.N225) fell 0.40%. U.S. 10-year Treasury yields fell on weak economic data. Benchmark 10-year notes rose 13/32, sending yields down to 4.2442% from 4.295% late Wednesday. 30-year notes rose 27/32, sending yields down to 4.4% from 4.45% late Wednesday. The dollar index (.DXY) rose 0.53%, while the euro fell 0.64% to $1.0738. The Japanese yen weakened 0.22% against the greenback to hit $157.09 per dollar, while sterling was last at $1.2761, down 0.27% on the day. Oil prices edged up amid choppy trading, with supply growth and a delayed Fed rate cut offset by economic data. The price of U.S. crude oil rose 0.15% to $78.62 per barrel, while the price of Brent rose 0.18%, stopping at $82.75 per barrel. Gold prices fell amid a stronger dollar after the release of the PPI report, which was weaker than expected. Spot gold lost 0.8%, reaching $2,303.15 per ounce.

News are provided by InstaForex

Read more: https://ifxpr.com/3xjqu9s

- IFX Bella

- Posts: 435

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: As the West Changes Investing Course, the East Reacts with Indexes Rising

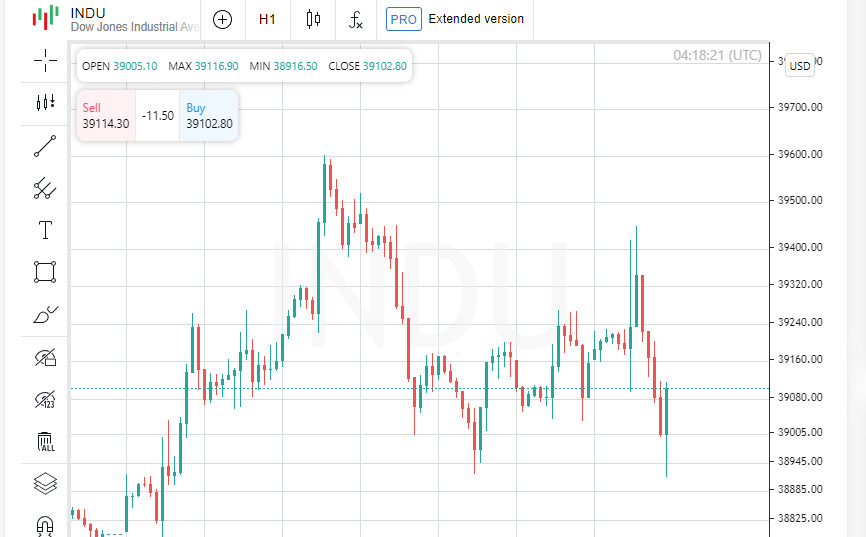

The Dow hit a one-month high on Monday, while the Nasdaq fell more than 1% as investors switched from artificial intelligence stocks to laggards on expectations that the Federal Reserve will cut interest rates this year. The S&P 500 and Nasdaq ended lower as investors shifted away from tech stocks, whose overextended gains have fueled this year's rally. However, nine of the 11 major S&P 500 industries rose. Shares of Nvidia (NVDA.O) have fallen 6.68% in three sessions as observers noted profit-taking after last week's meteoric rise made the company the world's most valuable. Nvidia's decline triggered a sell-off in the tech sector, leading to significant losses. On Monday, the S&P 500 (.SPX) was down 0.3%, the Nasdaq (.IXIC) was down more than 1%, and the SOX semiconductor index (.SOX) lost more than 3%. Other chipmakers, including Taiwan Semiconductor Manufacturing, Broadcom (AVGO.O), Marvell Technology (MRVL.O) and Qualcomm (QCOM.O), fell 3.53% to 5.7%, leading the SOX index to fall 3.02%. "The market is selling some winners and buying some laggards," said Jack Janasiewicz, chief strategist at Natixis Investment Managers. "This is due to expectations of soft inflation data coming out on Friday." Tech (.SPLRCT) and consumer discretionary were the only sectors among the 11 S&P 500 indexes to decline, while energy led the gains, rising 2.73%. "There's a rotation into value sectors like financials, energy and utilities. Energy is also benefiting from a small jump in oil prices," said Ed Clissold, chief U.S. strategist at Ned Davis Research. Oil prices rose Monday, supporting gains in energy and oilfield services stocks. The Dow Jones Industrial Average (.DJI) jumped to snap a five-day winning streak. The Russell 2000 small-cap index (.RUT) also hit a one-week high, signaling broader gains in the market. With the exception of Nvidia and other chipmakers, "the rest of the market is positive, expecting a soft landing," said Carl Ludvigson, managing director at Bel Air Investment Advisors. Investors are focused this week on Friday's PCE price index report, the Fed's preferred measure of inflation, which is expected to show modest price pressures. Investors still expect two rate cuts this year, pricing in a 61% chance of a 25 basis point cut in September, according to FedWatch LSEG data. The Fed's latest forecast calls for one rate cut in December. San Francisco Fed President Mary Daly has said she doesn't think rates need to be cut until policymakers are confident that inflation is approaching 2%. The S&P 500 (.SPX) lost 15.73 points, or 0.29%, to end at 5,448.89. The Nasdaq Composite (.IXIC) fell 190.19 points, or 1.09%, to 17,499.17. The Dow rose 257.99 points, or 0.66%, to 39,408.32. Other big stories this week include durable goods data, weekly jobless claims, final first-quarter GDP data and a year-over-year rebound in the Russell Index. There will also be some quarterly earnings reports. President Joe Biden and his Republican rival Donald Trump will debate in Atlanta on Thursday, which could impact the outcome of the November election, which polls show is neck-and-neck. Meta Platforms (META.O) shares rose after a report that the Facebook parent is discussing integrating its generative AI model into Apple's (AAPL.O) new iPhone AI system. Apple shares also rose. RXO (RXO.N) announced plans to buy United Parcel Service (UPS.N) and launch a new unit, Coyote Logistics, for $1.025 billion.

News are provided by InstaForex

Read more: https://ifxpr.com/45GrfpZ

The Dow hit a one-month high on Monday, while the Nasdaq fell more than 1% as investors switched from artificial intelligence stocks to laggards on expectations that the Federal Reserve will cut interest rates this year. The S&P 500 and Nasdaq ended lower as investors shifted away from tech stocks, whose overextended gains have fueled this year's rally. However, nine of the 11 major S&P 500 industries rose. Shares of Nvidia (NVDA.O) have fallen 6.68% in three sessions as observers noted profit-taking after last week's meteoric rise made the company the world's most valuable. Nvidia's decline triggered a sell-off in the tech sector, leading to significant losses. On Monday, the S&P 500 (.SPX) was down 0.3%, the Nasdaq (.IXIC) was down more than 1%, and the SOX semiconductor index (.SOX) lost more than 3%. Other chipmakers, including Taiwan Semiconductor Manufacturing, Broadcom (AVGO.O), Marvell Technology (MRVL.O) and Qualcomm (QCOM.O), fell 3.53% to 5.7%, leading the SOX index to fall 3.02%. "The market is selling some winners and buying some laggards," said Jack Janasiewicz, chief strategist at Natixis Investment Managers. "This is due to expectations of soft inflation data coming out on Friday." Tech (.SPLRCT) and consumer discretionary were the only sectors among the 11 S&P 500 indexes to decline, while energy led the gains, rising 2.73%. "There's a rotation into value sectors like financials, energy and utilities. Energy is also benefiting from a small jump in oil prices," said Ed Clissold, chief U.S. strategist at Ned Davis Research. Oil prices rose Monday, supporting gains in energy and oilfield services stocks. The Dow Jones Industrial Average (.DJI) jumped to snap a five-day winning streak. The Russell 2000 small-cap index (.RUT) also hit a one-week high, signaling broader gains in the market. With the exception of Nvidia and other chipmakers, "the rest of the market is positive, expecting a soft landing," said Carl Ludvigson, managing director at Bel Air Investment Advisors. Investors are focused this week on Friday's PCE price index report, the Fed's preferred measure of inflation, which is expected to show modest price pressures. Investors still expect two rate cuts this year, pricing in a 61% chance of a 25 basis point cut in September, according to FedWatch LSEG data. The Fed's latest forecast calls for one rate cut in December. San Francisco Fed President Mary Daly has said she doesn't think rates need to be cut until policymakers are confident that inflation is approaching 2%. The S&P 500 (.SPX) lost 15.73 points, or 0.29%, to end at 5,448.89. The Nasdaq Composite (.IXIC) fell 190.19 points, or 1.09%, to 17,499.17. The Dow rose 257.99 points, or 0.66%, to 39,408.32. Other big stories this week include durable goods data, weekly jobless claims, final first-quarter GDP data and a year-over-year rebound in the Russell Index. There will also be some quarterly earnings reports. President Joe Biden and his Republican rival Donald Trump will debate in Atlanta on Thursday, which could impact the outcome of the November election, which polls show is neck-and-neck. Meta Platforms (META.O) shares rose after a report that the Facebook parent is discussing integrating its generative AI model into Apple's (AAPL.O) new iPhone AI system. Apple shares also rose. RXO (RXO.N) announced plans to buy United Parcel Service (UPS.N) and launch a new unit, Coyote Logistics, for $1.025 billion.

News are provided by InstaForex

Read more: https://ifxpr.com/45GrfpZ

- IFX Bella

- Posts: 435

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: Presidential Debate, Inflation Tumbling Wall Street: What's Next?

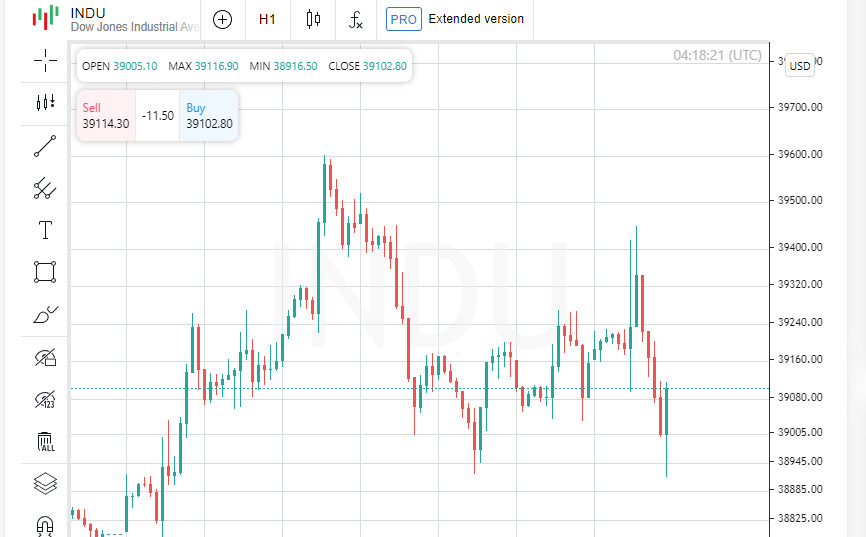

US stocks closed lower on Friday after morning gains proved short-lived. Investors analyzed fresh inflation data and weighed political uncertainty following the US presidential debate. Nike Shares Slip on Biggest One-Day Drop in 20 Years on Downbeat Outlook "I don't think inflation will change much because the Fed is committed to the 2% target and has been very disciplined," said Ann Miletti, head of active capital at Allspring. Data showed that monthly U.S. inflation remained flat in May, an encouraging sign after sharp price increases earlier in the year that raised doubts about the effectiveness of the Fed's policies. The Commerce Department report also showed a modest increase in consumer spending last month, adding to optimism that the Fed will be able to achieve a soft landing for the economy. The probability of a rate cut in September rose to 66% after the release of the personal consumption expenditures price index, according to LSEG FedWatch. Despite the Fed's forecast for only one rate cut this year, traders continue to bet on two cuts, hoping for further inflation relief. The first debate on Thursday between U.S. President Joe Biden and his Republican opponent Donald Trump also weighed on the stock market, said Thomas Martin, senior portfolio manager at Globalt Investments, highlighting the incumbent's unconvincing performance. "People are trying to figure out what's going to happen with the presidential election. "The uncertainty has only increased since the debate," he said. Treasury yields pared their morning losses and ended the day higher, adding to pressure on big-name stocks. San Francisco Fed President Mary Daly noted the slowdown in inflation, calling it "good news" that policy is working. Fed Governor Michelle Bowman said the central bank will hold its course because it has not yet reached its inflation target. The S&P 500 energy (.SPNY) and real estate (.SPLRCR) indexes rose 0.42% and 0.62%, respectively, while utilities (.SPLRCU) and telecom (.SPLRCL) fell 1.08% and 1.63%. Nike (NKE.N) shares fell 19.98% after forecasting a big decline in fiscal 2025 revenue, weighing on the broader consumer discretionary sector (.SPLRCD). The Dow Jones Industrial Average (.DJI) fell 41.12 points, or 0.11%, to 39,122.94. The S&P 500 (.SPX) lost 22.57 points, or 0.41%, to end at 5,460.30, while the Nasdaq Composite (.IXIC) fell 126.08 points, or 0.71%, to 17,732.60. Volume picked up late in the session as FTSE Russell completed a rebalance of its indices. It was the second-highest daily volume this year. The S&P 500 and Nasdaq posted quarterly gains of 3.9% and 8.3%, respectively. Meanwhile, the Dow (.DJI) fell 1.7%, highlighting the differences between the more tech-heavy indexes and the rest of the market. A standout among individual stocks was optical networking equipment maker Infinera (INFN.O), which jumped 15.78% after Nokia (NOKIA.HE) announced plans to acquire the company for $2.3 billion. Advancing stocks outnumbered declining stocks 1.29-to-1 on the New York Stock Exchange, with 271 new highs and 75 new lows. The S&P 500 posted 16 new 52-week highs and one new low, while the Nasdaq Composite posted 58 new highs and 139 new lows. Upcoming economic reports and Federal Reserve Chairman Jerome Powell's testimony to Congress could lift U.S. government bonds out of their current narrow trading range. The yield on the 10-year U.S. Treasury note, which moves inversely to their prices, has risen to a range between 4.20% and 4.35% since mid-June as the market reacted to data showing slowing inflation and signs of weakening economic growth across a range of indicators. The 10-year yield was 4.33% on Friday. Economic data have so far failed to dispel doubts about the depth of the Fed's interest rate cuts this year, keeping Treasury yields in their range. However, U.S. employment data next week, as well as new inflation data and a speech by Jerome Powell, could change that outlook. U.S. monthly inflation, as measured by the personal consumption expenditures (PCE) price index, was unchanged in May, a report released Friday. That confirms the trend of slowing inflation and robust economic growth that has stabilized bond market swings and supported stocks in recent weeks. However, federal funds futures showed that traders expect rates to be cut by just under 50 basis points over the course of the year. The market reaction to the upcoming employment data next Friday could be exacerbated by tight liquidity during a week when many U.S. bond traders will be off work for the July 4 holiday, said Hugh Nicola, head of fixed income at GenTrust. "The market is looking for more big events," he added. Other big events this month include consumer price data scheduled for July 11. Jerome Powell is also scheduled to deliver his semiannual monetary policy testimony before the Senate Banking Committee on July 9, according to the office of Senate Chairman Sen. Sherrod Brown. If tradition continues, Powell will testify the following day before the House Financial Services Committee.

News are provided by InstaForex

Read more: https://ifxpr.com/3W2XLPO

US stocks closed lower on Friday after morning gains proved short-lived. Investors analyzed fresh inflation data and weighed political uncertainty following the US presidential debate. Nike Shares Slip on Biggest One-Day Drop in 20 Years on Downbeat Outlook "I don't think inflation will change much because the Fed is committed to the 2% target and has been very disciplined," said Ann Miletti, head of active capital at Allspring. Data showed that monthly U.S. inflation remained flat in May, an encouraging sign after sharp price increases earlier in the year that raised doubts about the effectiveness of the Fed's policies. The Commerce Department report also showed a modest increase in consumer spending last month, adding to optimism that the Fed will be able to achieve a soft landing for the economy. The probability of a rate cut in September rose to 66% after the release of the personal consumption expenditures price index, according to LSEG FedWatch. Despite the Fed's forecast for only one rate cut this year, traders continue to bet on two cuts, hoping for further inflation relief. The first debate on Thursday between U.S. President Joe Biden and his Republican opponent Donald Trump also weighed on the stock market, said Thomas Martin, senior portfolio manager at Globalt Investments, highlighting the incumbent's unconvincing performance. "People are trying to figure out what's going to happen with the presidential election. "The uncertainty has only increased since the debate," he said. Treasury yields pared their morning losses and ended the day higher, adding to pressure on big-name stocks. San Francisco Fed President Mary Daly noted the slowdown in inflation, calling it "good news" that policy is working. Fed Governor Michelle Bowman said the central bank will hold its course because it has not yet reached its inflation target. The S&P 500 energy (.SPNY) and real estate (.SPLRCR) indexes rose 0.42% and 0.62%, respectively, while utilities (.SPLRCU) and telecom (.SPLRCL) fell 1.08% and 1.63%. Nike (NKE.N) shares fell 19.98% after forecasting a big decline in fiscal 2025 revenue, weighing on the broader consumer discretionary sector (.SPLRCD). The Dow Jones Industrial Average (.DJI) fell 41.12 points, or 0.11%, to 39,122.94. The S&P 500 (.SPX) lost 22.57 points, or 0.41%, to end at 5,460.30, while the Nasdaq Composite (.IXIC) fell 126.08 points, or 0.71%, to 17,732.60. Volume picked up late in the session as FTSE Russell completed a rebalance of its indices. It was the second-highest daily volume this year. The S&P 500 and Nasdaq posted quarterly gains of 3.9% and 8.3%, respectively. Meanwhile, the Dow (.DJI) fell 1.7%, highlighting the differences between the more tech-heavy indexes and the rest of the market. A standout among individual stocks was optical networking equipment maker Infinera (INFN.O), which jumped 15.78% after Nokia (NOKIA.HE) announced plans to acquire the company for $2.3 billion. Advancing stocks outnumbered declining stocks 1.29-to-1 on the New York Stock Exchange, with 271 new highs and 75 new lows. The S&P 500 posted 16 new 52-week highs and one new low, while the Nasdaq Composite posted 58 new highs and 139 new lows. Upcoming economic reports and Federal Reserve Chairman Jerome Powell's testimony to Congress could lift U.S. government bonds out of their current narrow trading range. The yield on the 10-year U.S. Treasury note, which moves inversely to their prices, has risen to a range between 4.20% and 4.35% since mid-June as the market reacted to data showing slowing inflation and signs of weakening economic growth across a range of indicators. The 10-year yield was 4.33% on Friday. Economic data have so far failed to dispel doubts about the depth of the Fed's interest rate cuts this year, keeping Treasury yields in their range. However, U.S. employment data next week, as well as new inflation data and a speech by Jerome Powell, could change that outlook. U.S. monthly inflation, as measured by the personal consumption expenditures (PCE) price index, was unchanged in May, a report released Friday. That confirms the trend of slowing inflation and robust economic growth that has stabilized bond market swings and supported stocks in recent weeks. However, federal funds futures showed that traders expect rates to be cut by just under 50 basis points over the course of the year. The market reaction to the upcoming employment data next Friday could be exacerbated by tight liquidity during a week when many U.S. bond traders will be off work for the July 4 holiday, said Hugh Nicola, head of fixed income at GenTrust. "The market is looking for more big events," he added. Other big events this month include consumer price data scheduled for July 11. Jerome Powell is also scheduled to deliver his semiannual monetary policy testimony before the Senate Banking Committee on July 9, according to the office of Senate Chairman Sen. Sherrod Brown. If tradition continues, Powell will testify the following day before the House Financial Services Committee.

News are provided by InstaForex

Read more: https://ifxpr.com/3W2XLPO

- IFX Bella

- Posts: 435

- Joined: Sat Dec 08, 2012 12:39 am

Re: Forex News from InstaForex

Forex Analysis & Reviews: European stocks on the rise: What to expect from interest rates and UK election?

[img]https://forex-images.ifxdb.com/userfiles/20240705/analytics66879ce6173bc_source!.jpg

[/img]

European stocks rose on Thursday, as hopes for a US interest rate cut were fuelled by weak economic data. London markets also showed positive momentum as voting began in the UK general election, where polls predicted a historic victory for the Labour Party. The pan-European STOXX 600 index (.STOXX) rose 0.6%, hitting a more than one-week high. The UK's FTSE 100 index (.FTSE) rose 0.8% as investors waited to see how much of a majority the Labour Party could secure. "The UK election result, which many expect to go in Labour's favour, will not have a significant impact on markets unless there is a big surprise, as they are already pricing that scenario in," said Bas van Geffen, senior macro strategist at Rabobank. French shares (.FCHI) rose for a second day in a row, up 0.8%, as opponents of France's National Rally (RN) struggle to keep the far-right party out of power. A poll on Thursday showed that France's National Rally is unlikely to win an outright majority in the second round of parliamentary elections on Sunday. The European lenders sub-index (.SX7E), which includes French banks Societe Generale (SOGN.PA) and BNP Paribas (BNPP.PA), rose 1.3% on the news, leading the sector. Germany's industrial orders unexpectedly fell in May, while a separate report showed inflation in Switzerland eased last month. This has reduced market expectations that the central bank will cut interest rates again this year. Meanwhile, European Central Bank officials were largely confident of further inflation cuts, although some were hesitant about the previous rate cut due to a host of headwinds, as confirmed in the meeting reports. Among individual stocks, shares in Britain's Smith & Nephew (SN.L) rose 6.8% after activist investor Cevian Capital said it had acquired a 5% stake in the medical equipment maker. France's Pluxee (PLX.PA) fell 9.2% after reporting weaker-than-expected third-quarter sales in Europe on Wednesday. Sweden's Ericsson (ERICb.ST) fell 1.2% after announcing it would write down an SEK11.4 billion ($1.09 billion) impairment charge for the second quarter of 2024. Trading activity was thin due to a bank holiday in the US. The pound held its ground and UK stocks were set to rise on Friday after the centre-left Labour Party's landslide victory in the general election boosted investor confidence after a period of market volatility. As of 06:00 GMT on Friday, Keir Starmer's Labour Party had won 405 of the 650 seats in parliament, giving it a large majority, with results in several seats still pending. Conservative Prime Minister Rishi Sunak conceded defeat. Sterling strengthened slightly after exit polls were largely confirmed, and was last trading at $1.2767. Sterling was little changed against the euro at 84.75 pence. The pound began to strengthen after Sunak unexpectedly called a snap election at the end of May. Sterling has been the biggest gainer against the dollar this year, up 0.3%. Reflecting this sense of confidence ahead of the election, the premium investors demand for the added risk of holding UK gilts over Germany's top-rated 10-year bonds has remained steady this year at around 160 basis points, well below the 230 basis points seen during the 2022 mini-budget crisis. UK stock indices (.FTSE) have hit record highs this year, driven by a slowly growing but relatively stable economy and slowing inflation. The UK has seen the highest inflation and interest rates in the developed world over the past couple of years. Yields on 10-year UK government bonds have risen to around 4.2% this year as investors have sold debt on the belief that lower UK interest rates will take longer than previously expected. The Bank of England is expected to cut interest rates at either its August or September meetings. Analysts believe investors will react quickly not only to the outcome of Thursday's election but also to future monetary policy. High inflation and interest rates are having a significant impact on the UK economy. Bond yields reflect market expectations for future interest rates, and the rise to 4.2% suggests investors are anticipating a longer period of high borrowing costs. Economists and analysts are closely monitoring the Bank of England's decisions, expecting a possible rate cut in the coming months. These decisions will be critical to the future economic developments in the country, influencing sentiment in both domestic and foreign investors.

News are provided by InstaForex

Read more: https://ifxpr.com/4crAHjf

[img]https://forex-images.ifxdb.com/userfiles/20240705/analytics66879ce6173bc_source!.jpg

[/img]