Forex Analysis & Reviews: EUR/USD: trading tips for beginners for European session on May 16

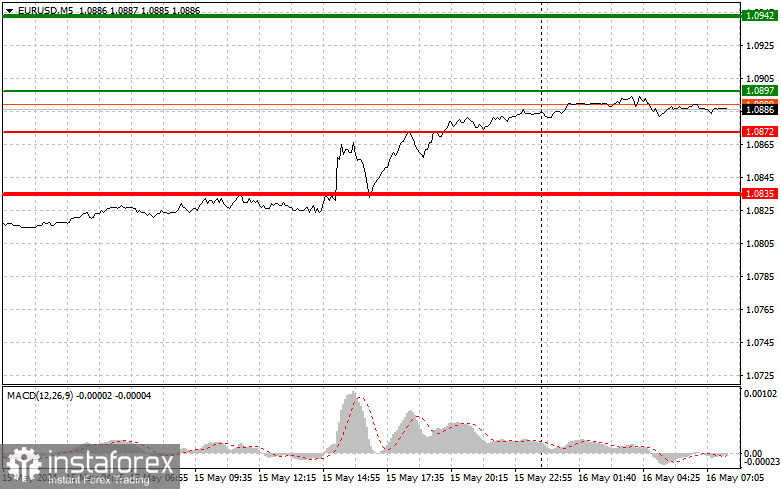

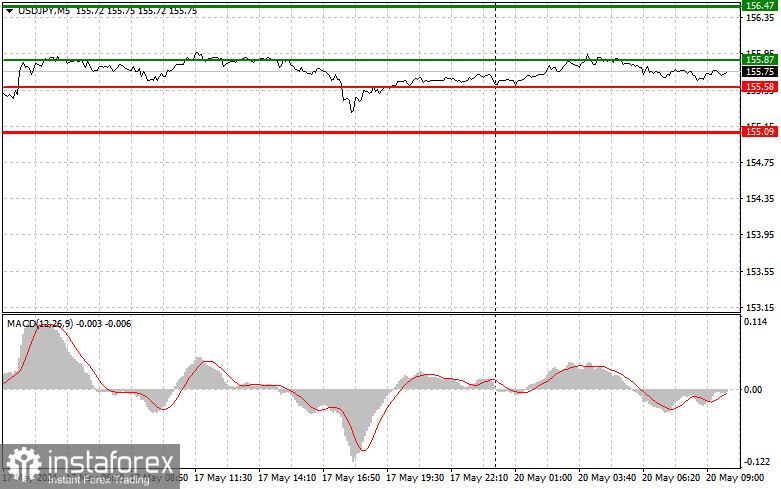

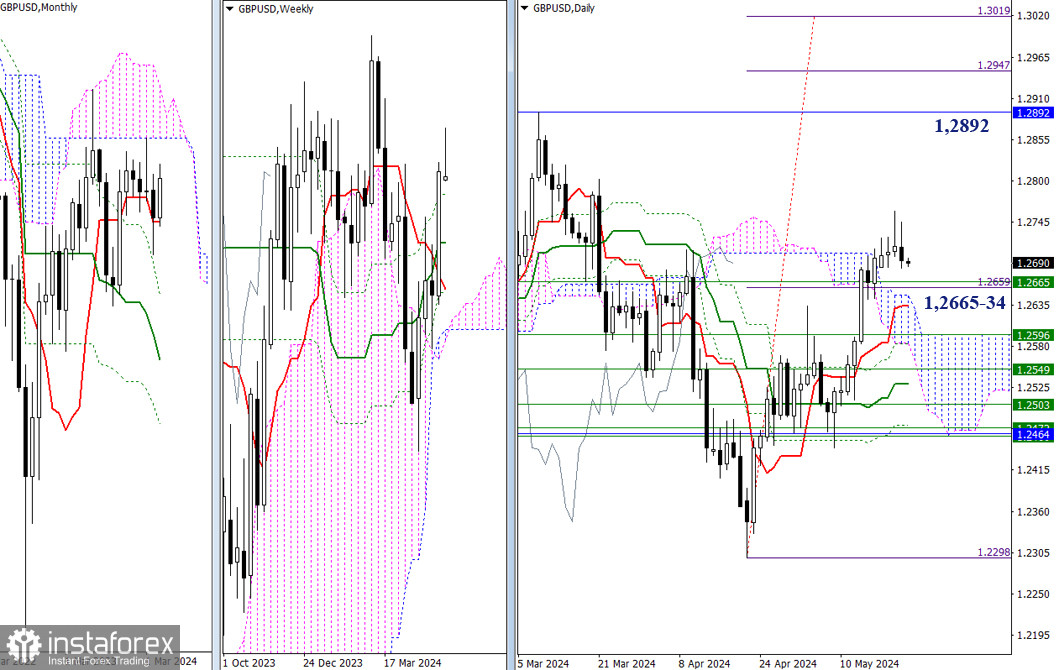

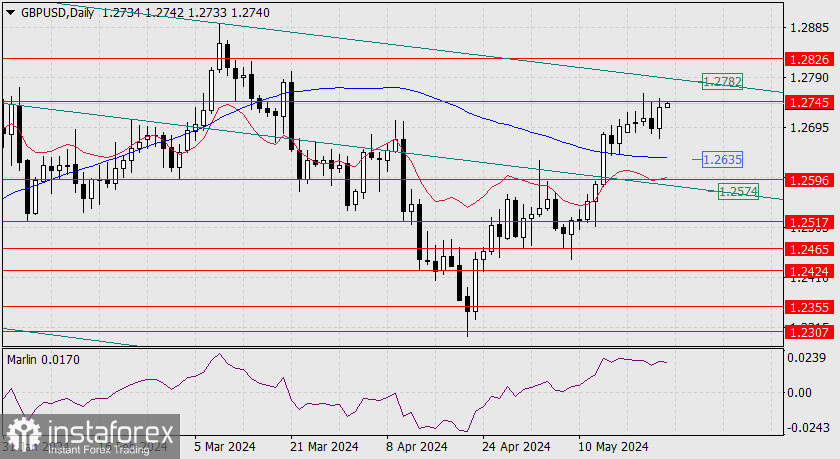

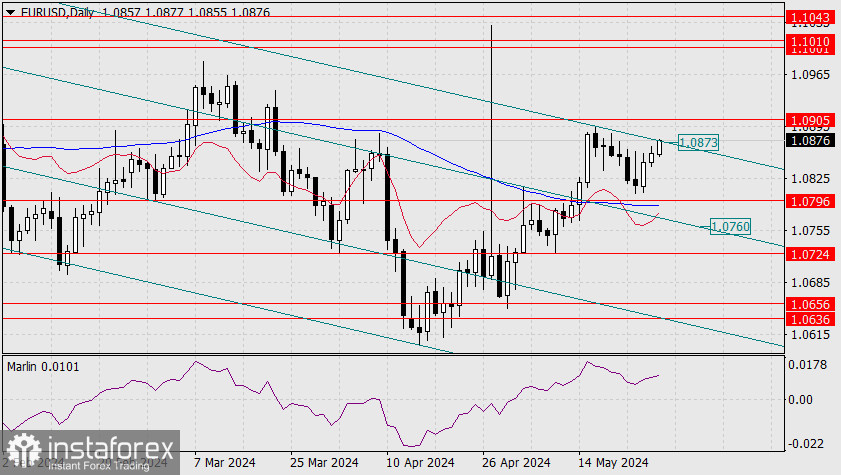

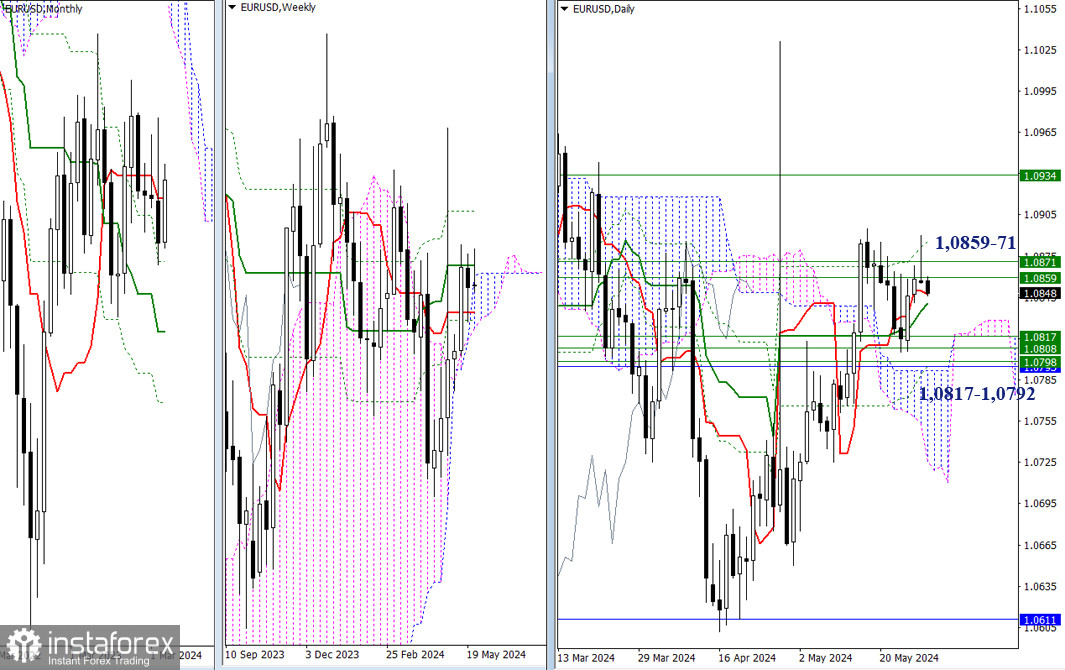

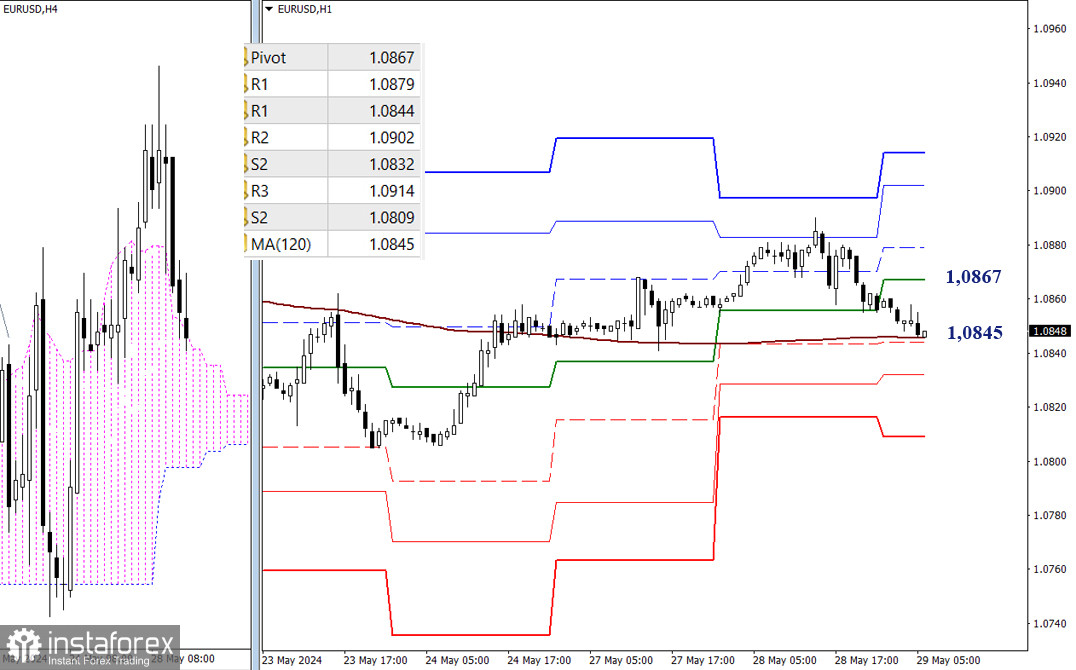

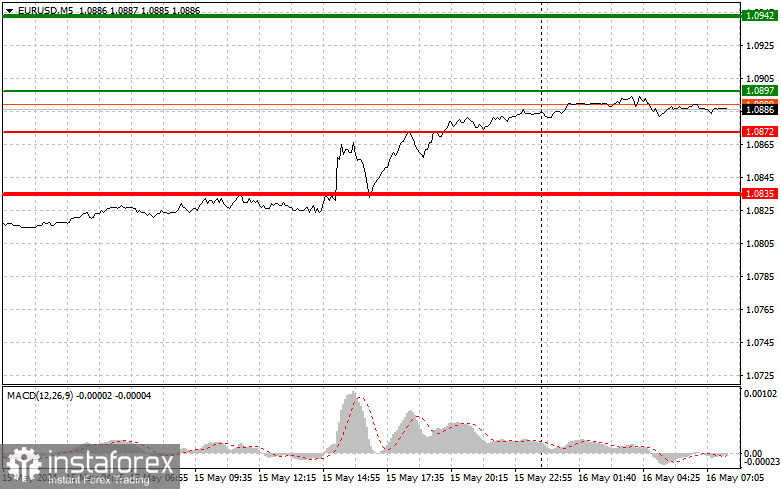

The price test of 1.0837 occurred at a time when the MACD indicator was just starting to move up from the zero mark, which confirmed the entry point to buy the euro. As a result, the EUR/USD pair rose to the area of the target level at 1.0882, so traders could earn approximately 50 pips of profit. There was no market reaction to reports on the Consumer Price Index in France, Eurozone GDP, employment, and industrial production. However, the US inflation data turned the market around, giving euro buyers a very strong impetus. Today, the uptrend may persist, but this requires good forecasts from the European Commission and a decent report on the financial stability of the Eurozone. There are no other reports, so if the market withstands weak data and pressure from sellers, then obviously, the euro may continue to rise in the afternoon. It is better to act according to the trend and look for buy signals. As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and 2.

Buy signals Scenario No 1. Today, you can buy the euro when the price reaches 1.0897 plotted by the green line on the chart, aiming for growth to the level of 1.0942. At the level of 1.0942, I plan to exit the market and also sell the euro in the opposite direction, counting on a movement of 30-35 pips from the entry point. You can count on the euro to rise today within the framework of an emerging uptrend, as well as after good news on the Eurozone. Before buying, make sure that the MACD indicator is above the zero mark and is just starting to rise from it. Scenario No 2. I am also going to buy the euro today in case of two consecutive tests of the price of 1.0872 at the time when the MACD indicator is in the oversold area. This will limit the downward potential of the instrument and lead to an upward reversal of the market. We can expect growth to the opposite levels of 1.0897 and 1.0942. Sell signals Scenario No 1. I plan to sell the euro after EUR/USD reaches the level of 1.0872 plotted by the red line on the chart. The target will be the level of 1.0835, where I am going to exit the market and buy immediately in the opposite direction (expecting a movement of 20-25 pips in the upward direction from the level). Pressure on EUR/USD will increase if it fails to consolidate near the daily high and weak Eurozone data. Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decline from it. Scenario No 2. I am also going to sell the euro today in case of two consecutive price tests of 1.0897 at the time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal of the market. We can expect a decline to the opposite level of 1.0872 and 1.0835.

Analysis are provided by InstaForex.

Read more:

https://ifxpr.com/3UFuLM9