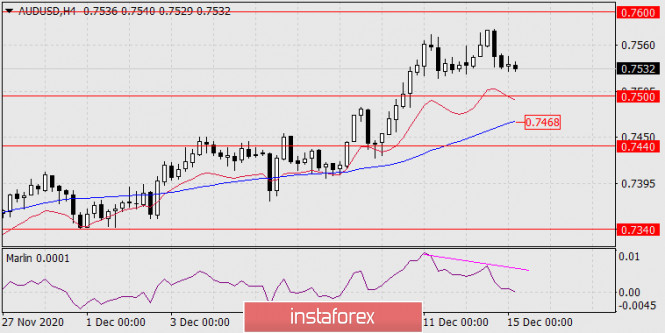

AUD / USD

The Australian dollar does not share the great optimism of European currencies and went up by only 27 points yesterday, remaining in the range of Monday until this morning. Even on today's GDP data for the 3rd quarter that showed growth of 3.3% against expectations of 2.5%, the "Aussie" did not react and the price is in no hurry to overcome the target level at the resistance of 0.7380.

Yesterday's RBA meeting was cautiously negative as the regulator does not expect the economy to recover until the end of next year. It is very possible that this definition includes a version of a hard Brexit. The double divergence of the price with the oscillator on the daily scale remains. We are waiting for a reversal in the target range of 0.7222 / 52 in the area of the Kruzenshtern line and the price level of the minimum on November 12.

Based on the four-hour chart, the price stopped at the Kruzenshtern line, which strengthened the level of 0.7380. The Marlin oscillator is held in the downward trend zone. Commodities and metals were cheaper yesterday and today keeping the Australian dollar from rising during a period of uncertainty in Europe. We are waiting for a slow decline in the Australian currency to 0.7340 with the overcoming of the level, the fall may accelerate.

Analysis are provided byInstaForex.