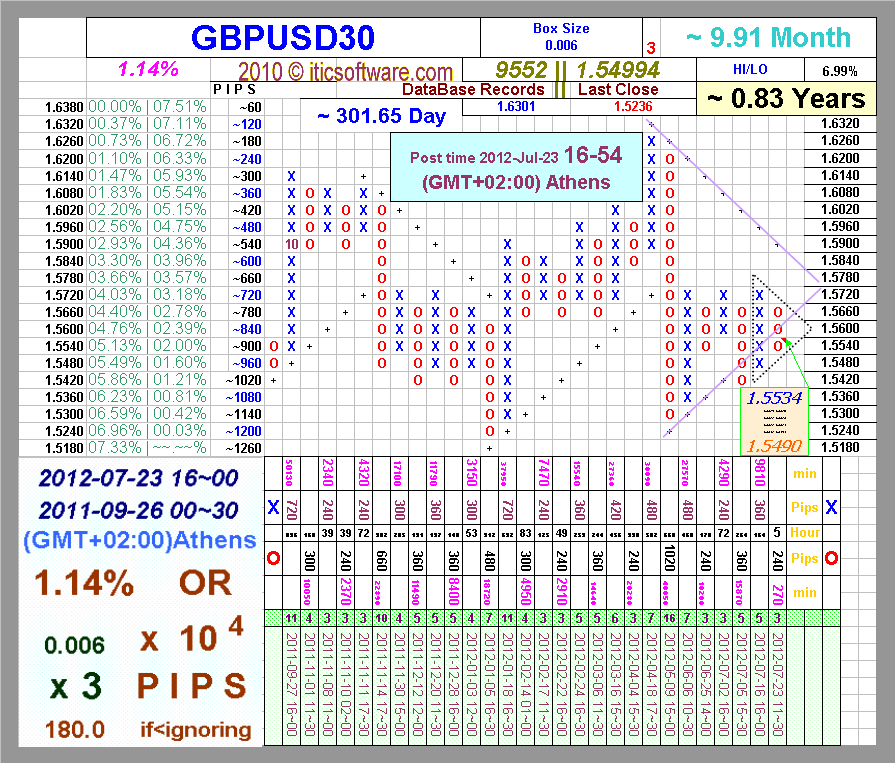

...Crude Oil Maintains The Upside Bias.OPEC decision was so helpful for crude pushing it up to the top of the range that is expected to remain among it $80-$85, as the commodity is trading now around $84.66. But how long the upside momentum will last as the Greek elections at the door and no one knows how results will come. In fact, central bankers seem to be more mature than the market speculated before, as they stand ready to stabilize financial markets in a coordinated action to provide liquidity if the Greek elections on Sunday cause a mess in the market....[by oilngold]

Learn more! ↓↓↓

- Code: Select all

https://docs.google.com/spreadsheet/pub?key=0AhxKzvQ2GlM8dDBqYWl6XzlEbFZDWFVob0FMbG9nbGc&output=html

See also:

~~~>docs.google.com/open?id=0B9cvIxidsTjvQ2VmWU5xUk96alE

^^^ORvvv

~~~>img717.imageshack.us/img717/6808/12jun17.pdf

^^^ORvvv

A d d i t i o n a l l y ↑↑↑